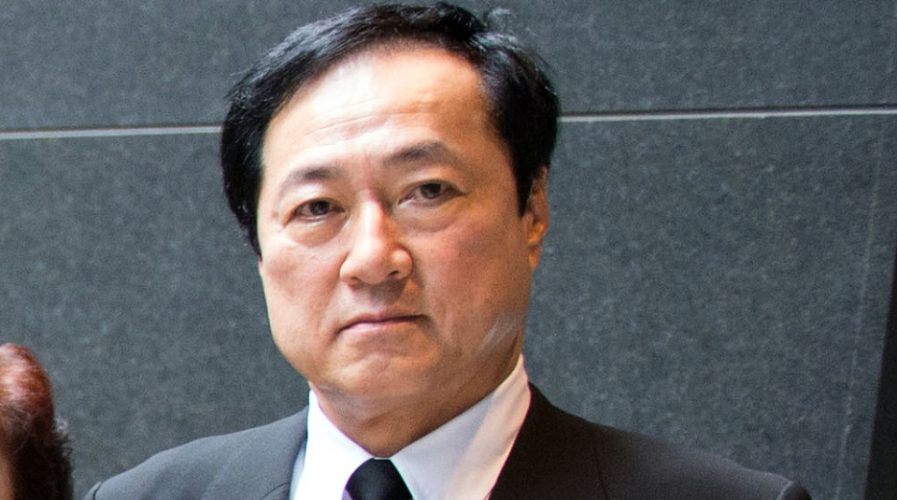

Yasuhiro Sat6o, CEO of Mizuho. Pic: Wikimedia Commons

Japan’s Mizuho joins Malaysia’s MayBank to expand Asia equities

AS part of its efforts to broaden its equities business, Mizuho Financial Group Inc. has partnered with Malayan Banking Bhd., its second alliance following one with U.K. firm Redburn Europe Ltd. earlier this year.

Now, the investment-banking branch of Malaysia’s biggest bank, MayBank Kim Eng, will equip Mizuho Securities Co. with research on Southeast Asian companies, and will also exchange execution services.

According to Bloomberg, the alliance will give the Japanese bank’s institutional clients access to the senior managers of SEA companies, and marks the first time they will have access to corporations in the region.

The companies said in a statement: “Mizuho Securities will channel orders placed by these clients to MayBank Kim Eng, which is known for its strong execution capabilities and access to ASEAN markets.”

SEE ALSO: Will a common currency be a viable option for economic growth in ASEAN+3?

MayBank Kim Eng continued: “ASEAN is one of the fastest growing regions in the world and the partnership will benefit Mizuho’s institutional clients in Japan, as they will gain from MayBank Kim Eng’s deep and wide knowledge of the region, as well as access to the investment opportunities in the ASEAN markets.

“MayBank Kim Eng, on the other hand, will be able to leverage Mizuho’s strong franchise in the Japanese domestic market,” they added.

The agreement states that Mizuho will receive fees for acting as a middle-man on trading stock transactions, while MayBank will earn commissions by doing so for the Japanese bank’s clients.

Datuk John Chong, CEO of MayBank Kim Eng, said: “This partnership is a testament of MayBank Kim Eng’s strength in ASEAN, our deep understanding of the region and access to its vast potential.”

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM