A man with a mobile phone walks by the Samsung Electronics logos at its headquarters in Seoul. Source: AP

Samsung plans $19b investment to increase semiconductor manufacturing

KEEPING up with the global thirst for smartphone parts is proving to be a mammoth task, which is why Samsung Electronics Co. Ltd., as it announced on Tuesday, plans to sink at least KRW21.4 trillion (US$18.63 billion) to put itself ahead of its competitors.

Booming demand for memory chips propels Korean group to top of semiconductor pack https://t.co/Z87jdJtjjZ

— Thus Spake (@thus_spake) June 28, 2017

The second-largest manufacturer of semiconductors in the world wants to lead the global production of memory chips and next-generation smartphone displays. It intends to spend KRW1.4 trillion (US$1.22 billion) on a new NAND flash memory chip factory in Pyeongtaek as well as KRW6 trillion (US$5.23 billion) for a semiconductor facility in Hwaseong.

This year, with a new Apple handset on the horizon, chipmakers worldwide are ramping up their productivity and manufacturing capabilities to keep up with consumer demand. Every memory maker is expected to clock record profits for the 2017 financial year, with ever increasing demand and a persistent shortage driving up the prices of these chips.

SEE ALSO: Semiconductor industry gains second wind, thanks to IoT and smartphones

According to Reuters, industry sources and analysts note the shortage of NAND chips is particularly significant as more and more devices require high-end storage capabilities that can only be accommodated by these next-generation memory parts. Other sources note Samsung has an advantage over rivals Toshiba Corp. and SK Hynix Inc. as their technologies are far more advanced.

Samsung has consistently plugged annual investments of US$10 billion into their semiconductor research to drive more capable chip technologies and widen its competitive advantage.

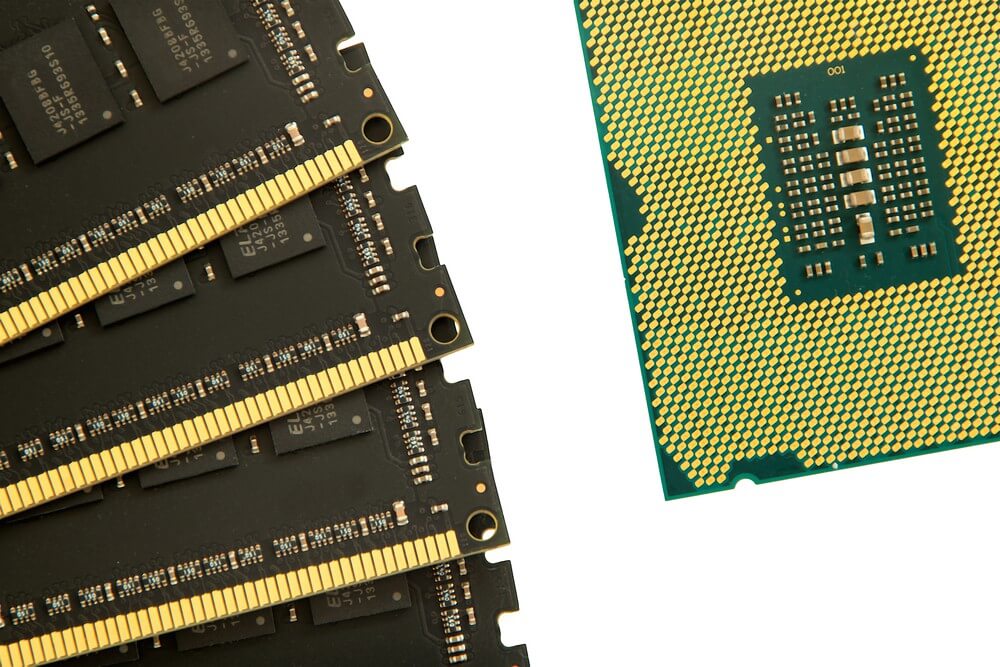

The NAND semiconductor is in high demand as more digital devices require greater internal storage capabilities. Source: Shutterstock/ThirdUnit

Recent years have seen semiconductor players invest tens of billions of dollars into NAND output, but that has done little to satisfy the outpouring of demand for these chips. Analysts say shortages will likely persist for the next year, driven by some companies over-ordering the chips to ensure their supplies don’t run dry.

It doesn’t look like the semiconductor market will cool off anytime soon, even as supply side players continue to labor to push output.

SEE ALSO: China’s Tsinghua Unigroup gets $22b to lead semiconductor growth

“I believe NAND market conditions will continue to favor suppliers until 2020,” HMC Investment analyst Greg Roh told Reuters.

There are some concerns the additional capacities manufacturers are building might lead to an oversupply of chips in early 2018, but analysts are largely siding with suppliers for now. The emergence of more complicated digital devices, the global pivot to big data infrastructures and new edge computing frameworks will necessitate greater internal storage capabilities, especially since the IoT industry is expanding its empire.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM