Japan is bleeding from its young talent pool. Source: Shutterstock/Kobby Dagan

Tech’s deal boom might be over, and here’s why

IN the last five years, we’ve seen a flurry of mergers and acquisitions (M&A) take place in the technology space throughout Asia Pacific, with huge tech-focused funds such as Softbank and Tencent plugging money into every available opportunity, as well as established investors such as state-backed Temasek in Singapore, and internationally-known Vertex Ventures looking into the digital innovations that will likely drive the next five decades.

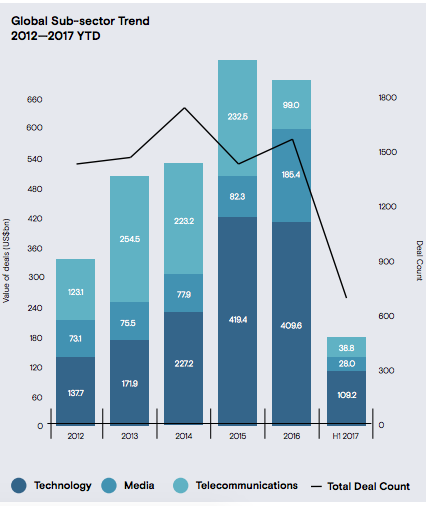

It’s everywhere for us to see, it’s in the water we’re drinking. Mergermarket’s Global Sector Overview for the Technology, Media and Telecommunications (TMT) industry reports in just the first half of 2017, the sector has seen various kinds of sub-fields sprout up, including advertising tech, education tech, medical tech and insurance tech. Software is expected to keep rising and has been the driver behind the rise of TMT stocks.

Software was responsible for 50 percent of TMT’s overall deal count in H1 2017 and accounts for over a third of the overall value of the industry.

Source: Mergermarket

Sounds great, right?

On the contrary, the numbers this year have been relatively lackluster. Though the overall value created by the TMT sector is high, the number of total deals is pretty small. Amazon’s takeover of Whole Foods accounted for US$13.5 billion, and on its own contributes almost eight percent of the totals for this year.

There’s been a huge fall in terms of the number of technology deals that have taken place recently. Though it’s true we’re only in the first half of the year, there’s already evidence 2017 will mark another fall in the number of technology M&As.

According to Mergermarket’s TMT Trend Report, in 2015, Asia Pacific recorded US$175.6 billion in technology-linked deals, which then fell to US$134.5 billion in 2016. In just the first half of this year, only US$52.9 billion worth of deals have taken place.

This half year, 20 percent fewer deals were made than in the first half of 2016, meaning TMT stocks dropped in value to fourth place.

“Global tech has seen a general slowdown in both the equities and M&A markets lately, and that’s not altogether surprising,” Elizabeth Lim, a senior analyst and research editor with Mergermarket, told Tech Wire Asia.

“A lot of the investments that have been taking place over the past couple of years have been based more or less on hype and anticipation, as tech is more of a growth sector as opposed to a value one like, say, financial services.”

SEE ALSO: Square’s success in fintech – what can we learn from it?

According to Lim, tech was experiencing a spotlight moment with investors for the last three years largely because of low-interest rates and huge hype. These new technologies aren’t superficial – they will definitely play a huge role in our future – but Lim said they’re largely in the nascent stage, with many still be researched and tweaked. She attributes the huge number of deals taking place to a sense of not wanting to be left out when the boat departs.

“The flurry of investment activity in these directions have been largely due to everyone wanting to get a piece of the pie in a kind of market share grab even before it’s really taken off,” she said, pointing to the hubbub around the ride-hailing industry and the co-working space world.

Technology deals have sharply fallen in the last two years. Source: Shutterstock/wavebreakmedia

She says the global technology M&A boom is still to come, and that we should be prepared for it to come, but also be aware of the conditions that have made it a possible reality for today. Right at this moment, we are living in a time of low-interest rates, making it cheap for investors to throw lots of money around.

But the good times must end and interest rates are beginning to rise, meaning investors are beginning to turn towards value industries, such as financial services and energy. Lim stressed technology’s time is still here, but it’s moving out of the sun for a spell.

SEE ALSO: Cream of the crop: World’s nine richest self-made billionaires in tech

“It’s more likely [the tech boom is] just on pause for now, until these technologies – which are currently very much still in the research and development stage – can reach a point where they are advanced enough for mass consumption,” she said.

Tech Stocks Disproportionately Driving Market Gains And Other News https://t.co/IjpVyIg5TT #ValueWalk pic.twitter.com/nHppE2KSVv

— 18d.Media (@18dMedia) August 6, 2017

She pointed to the potentials for artificial intelligence technologies embedded in Amazon’s Echo, and autonomous vehicles by Alphabet, Tesla and Uber, and noted for now, the technologies are quite young. Once the battle raging around the intellectual properties of these products has subsided and the defined players have emerged in each field, likely the boom times for tech will return.

SEE ALSO: How technology, on-demand food delivery platforms can drive China’s dining culture

“Once the technology has reached a point where it’s sophisticated enough to satisfy regulations in various regions and therefore be produced on a wider scale, then we could very well see another Tech boom in the distant future,” Lim said.

“We’ll probably see more competition in the near future in all of these fields, more legal battles, more regulatory scrutiny, and more stakes acquired, until all of it reaches a more sophisticated stage of development and therefore investment.”

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM