If cryptocurrencies can achieve scale and increase speed, they will challenge traditional banking structures. Source: Shutterstock

Can cryptocurrency scale and scare old money?

IF cryptocurrencies are ever going to enter the mainstream, they are going to have to speed up.

While the PayPal infrastructure processes around 200 transactions each second, and nearly 1700 transactions pass via Visa per second, Bitcoin averages just seven transactions per second. And the more widely-owned Ethereum manages around 20.

Clearly, there are issues here that need addressing if (and it is a big ‘if’) Bitcoin et al are to be more widely used. Like any system that has no overarching regulatory control, opinions vary, even on the issue of whether scalability is desirable!

Some in the cryptocurrency community would rather that the currencies (especially the original, Bitcoin) remain as almost ‘special occasion’ currencies, not used in general for everyday transactions. Others have proposed measures (see below) to make the currencies scalable.

In 2017, alternative payment methods (APMs) across the APAC region grew in use by 27 percent; now around a third of all transactions are thus conducted.

APMs include cryptocurrencies but largely comprise of so-called e-wallet transactions, such as AliPay, TenPay, PayPal, Qiwi and Yandex.Money.

While crypto transaction rates remain at less than one percent of this total, the similarities between ‘traditional’ APM use and cryptocurrencies’ use are unmistakable.

Both utilize apps on smartphones. Users can download a cryptocurrency wallet as easily as they might AliPay. Cryptocurrency wallets can be used wirelessly in stores (if accepted) and can be used as person-to-person payment methods.

In fact, person-to-person payments are – in the underlying schema of cryptocurrency – are exactly the same as consumer-to-business transactions. The egalitarian nature of Bitcoin, Ethereum and so forth ensures this.

Cryprocurreny’s additional strength – its lack of a central, controlling body – is also its main weakness, but here in the sense of its PR and marketing power. That is, getting it accepted across the globe as a medium of exchange.

With no one voice promoting its merits and (in time) convenience, Bitcoin and Ethereum (to name two) will struggle to gain traction down traditional channels. But social media and the Internet are, like cryptocurrencies, egalitarian platforms, and so any groundswell of opinion may well gain its own momentum.

This may already be happening – a report in the Japan Times recently stated that China’s authorities are considering relaxing their ban on Bitcoin trading in the country.

The Chinese position has and will continue to have, a notable effect on the value of Bitcoin, among others. The recent fluctuations in the Bitcoin exchange price have been put down to Chinese (and latterly, Japanese) moves.

While ICOs and cryptocurrency trading may be banned in China, it is estimated that around 60 percent of mining on Bitcoin is done by the Chinese.

What will it take, therefore to make cryptocurrencies able to scale so its paltry exchange processing speeds are increased effectively?

There are several methods proposed (and partly enacted) across a range of currencies. These hope to address the two main issues hampering faster transaction processing rates:

1. Placing transactions in a block

Average time to process a Bitcoin transaction is 13 minutes when the lowest possible transaction fees are offered (transaction fees are levied by miners to certify every transaction – this is Bitcoin mining).

Ethereum works slightly differently, but its transaction speeds make it similarly impractical for everyday use.

In order to reduce processing times, one employable method is to implement a bigger blockchain. This has already been done, with the effect of causing a split in the Bitcoin currency, with Bitcoin Cash now using an 8MB blockchain, and Bitcoin (the original flavor) remaining with a 1MB blockchain.

Splitting, or forking, in a cryptocurrency, is symptomatic of the egalitarian nature of the beast. Rather than go along with a majority view (or indeed, a loudly expressed minority view), it’s considered by many preferable to fork the currency than continue unhappily.

This, of course, encourages the naysayers of cryptocurrencies. Why invest time and money into cryptocurrency X adoption if, in twelve months, it’s likely to fork into three or four disparate currencies?

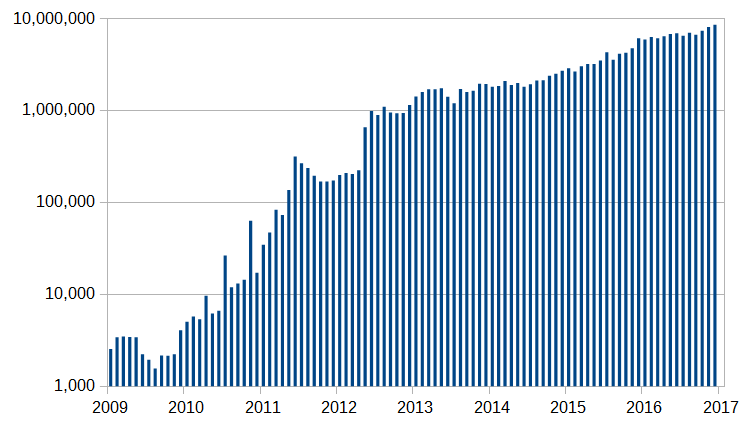

Number of successful Bitcoin transactions per day. Source: Wikipedia

2. Time to reach consensus

Cryptocurrencies work on the basis of consensus. When a miner has validated a transaction and added it to the blockchain, each node in the blockchain network has to do its own calculations to ensure the validity of the record. This takes time.

In Bitcoin, there are around seven thousand nodes. In Ethereum, over 200 thousand nodes. The more popular a currency becomes the more nodes and therefore the slower the transaction consensus.

There are several proposals which hope to improve the situations: Segwit sidechaining, the Lightning network, and the use of state channels, to name but three – the technical intricacies of these methods will not be covered here.

While all proposals could rectify the situation to some extent, the keystone of the problem is the same as the one that bedevils the blockchain size debate. That is, there is no widespread acceptance of one solution or another, so the risk of forking is quite real.

Conclusion

Some users of cryptocurrencies believe that forking is not necessarily a bad thing. But until a system can be implemented that in some way unifies forked, or split, cryptocurrencies into one usable whole (a wallet app “to rule them all”), then widespread use will not be viable.

Bitcoin was proposed shortly after the global banking collapse of 2008, the effects of which most people continue to feel. While the two events were not necessarily linked, the serendipity of cryptocurrency’s emergence could be seen as a possible sign that a similar banking crisis might be avoidable in the future.

While no global banking concerns would be able to devastate the world’s economy if cryptocurrencies became standard exchange media, Bitcoin et al bring their own issues.

Public trust in cryptocurrencies may take time to develop. In the meantime, if they can scale, competition with Tenpay, PayPal, Alipay and the rest is going to heat up.