People crowd an Apple store in Beijing, China. Source: Shutterstock

Alipay, WeChat among top 50 most relevant brands in China

IN a country of 1.2 billion people, it can be hard to stand out as unique, but many consumer brands – especially local technology-led brands – have found exceptional ways to deliver value to an increasingly affluent and savvy Chinese market.

The Chinese crave experiences that say something unique about them, which they can share with their friends and followers. Consumers are also showing a greater desire to try, test and taste products that demonstrate their individuality.

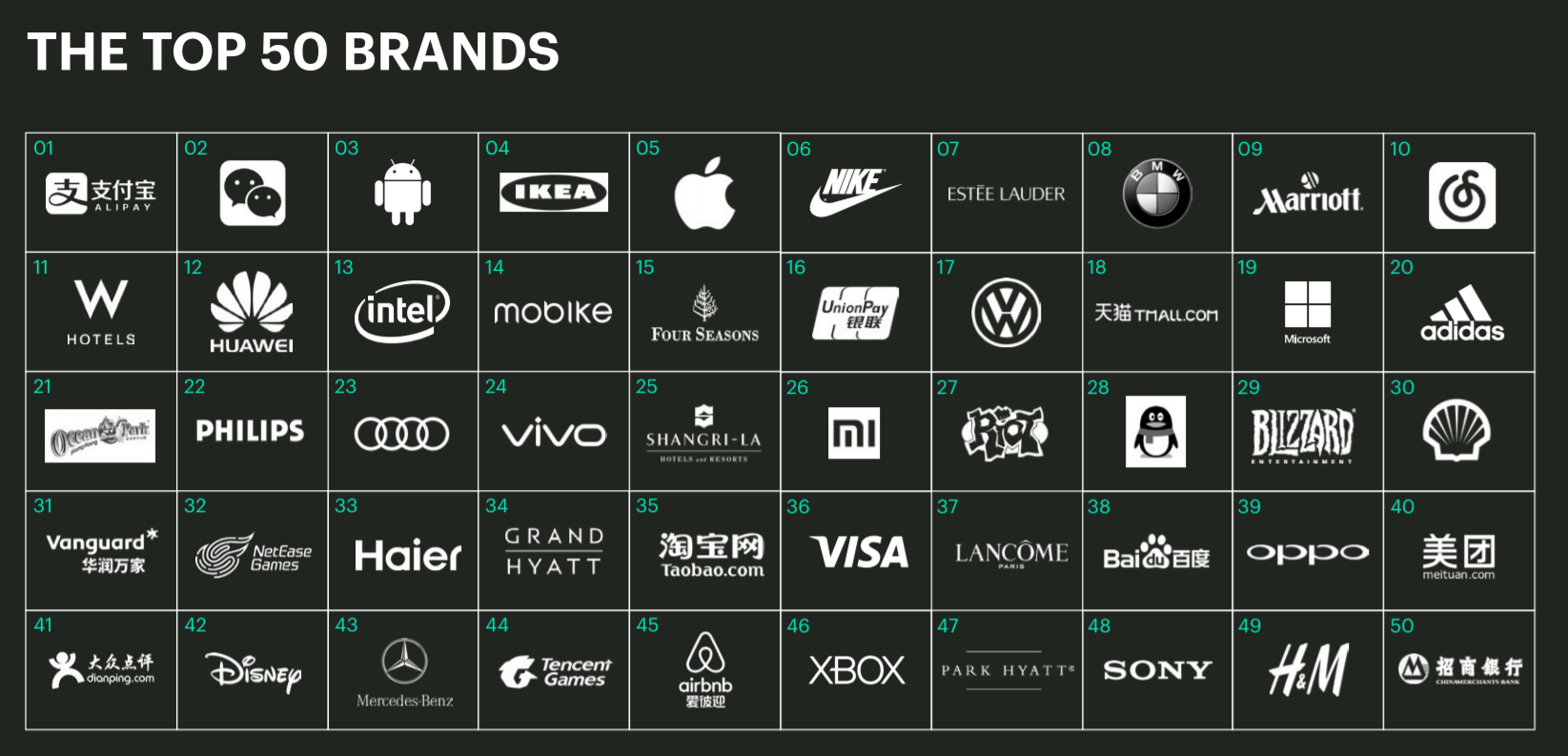

In the recently released Prophet Brand Relevance Index on the year’s 50 most relevant consumer brands in China, local tech brands Alipay and WeChat emerged top.

The index, built to help businesses measure their relevance, was developed from carefully collated responses from 13,500 consumers and 235 brands in 30 industries.

The brands were chosen based on their performance in four categories: customer obsession, ruthlessly pragmatic, distinctively inspired and pervasively innovative. Those that made it on the index are deemed as brands that are making a difference to consumers’ lives and creating experiences that customers simply cannot live without.

A snapshot of the 50 brands that made in on the Prophet Brand Relevance Index 2017. Source: Prophet

Unsurprisingly, Alipay is number one, pipping China Merchants Bank and Union pay – who come later in the index – to the post. Dominating all four principles of relevance, Alipay performed exceptionally well on being ruthlessly pragmatic. The app is constantly innovating to take the stress out of customers lives.

“WeChat and Alipay make my everyday life a lot easier. I don’t have to worry about taking out a wallet, so that’s one less thing to lose,” said Antoine Champs, a languages student at Beijing Normal University.

The online payment platform allows its 450 million users to easily make payments in China and abroad. Alipay’s dominance in the well-populated world of mobile payment platforms is set to increase along with demand for on-the-go payments, which is quickly becoming a necessity for foreign businesses to attract Chinese consumers.

Alipay and WeChat dominate the top 10 of the most relevant brands to Chinese consumers, according to a report by global consultancy Prophet. pic.twitter.com/ZNb9Ps9mcg

— ShanghaiEye (@ShanghaiEye) November 9, 2016

“Global brands continue to be rated as more innovative and inspiring, whereas Chinese brands are highly regarded as understanding consumers better, well-priced, pragmatic and convenient,” a partner of the survey creators (Prophet), Jacqueline Alexis Thng, said.

“However, with more affluent and savvy consumers and a growing middle class, focusing on innovation and being inspiring to lift hearts and minds are ways to build stronger brands in China.”

The explosive growth of China’s middle class has brought sweeping economic change and social transformation to the country. With China’s urban consumers set to reach 75 percent by 2022, brands are having to step up their game to ensure they provide experiences that will allow the consumer to show off their status.

Brands that craft a stage for consumers’ public consumption have become highly relevant in China.

The want of trying news things, tasting new food and ultimately gaining experiences that say, “this is what I own” and “this is how I live”, have increased as China has opened up its markets. Therefore, Prophet’s index has hosted companies like BMW and Marriott in the top 10 brands for two years running.

Tmall and Dianping also feature in the top 50. The two are known for enabling consumers to improve their lifestyles through unrivaled shopping and dining experiences. These brands are able to make emotional connections, earn trust and often exist to fulfill larger purposes, like bringing of families together and creating memories.

Technology-led brands, which account for more than 50 percent of the index, have proved to push the status quo, which is a factor held in higher regard by Chinese consumers than any other market. This said, it is more important than ever for brands to go beyond just delivering a product, but empowering consumers to do more.

Desirability, functionality and value has seen Mobike, a bike sharing provider, rank number one in the travel category and 14th overall.

Mobike has encouraged China to get active, cut pollution and create unique experiences through journeys taken and new areas explored on the bikes. The smart lock systems, fitted to the bikes, relieve the rider of tricky location constraints.

Mobike ranks #14 in @ProphetBrand Brand Relevance Index for setting #Mobikers free from the "hassles of daily commutes" #MobikeMovement https://t.co/rLYMhe7Nji pic.twitter.com/N7bukEEhSS

— Mobike (@Mobike) October 24, 2017

The unique experience seekers vary in demographics. Whilst young Chinese millennials are following trends from social media platforms, Generation X and above (30+) are using newfound status in China’s economy to flaunt their money with little persuasion or influence needed.

The brands featured in the index are a healthy mix of Western and Eastern companies, however, the front-runners, Alipay and WeChat, are Chinese companies who are penetrating Western markets at an astounding rate.

China has created a rich-laboratory for commerce in the new on-demand service economy. In doing so, a healthier and happier China has emerged, one which is setting the precedent for brand expansion across the globe.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM