Insurance could get a big boost from technologies that could reduce paper dependence and increase speed. Source: Shutterstock

Prudential wants to work with fintech startups to take insurance digital

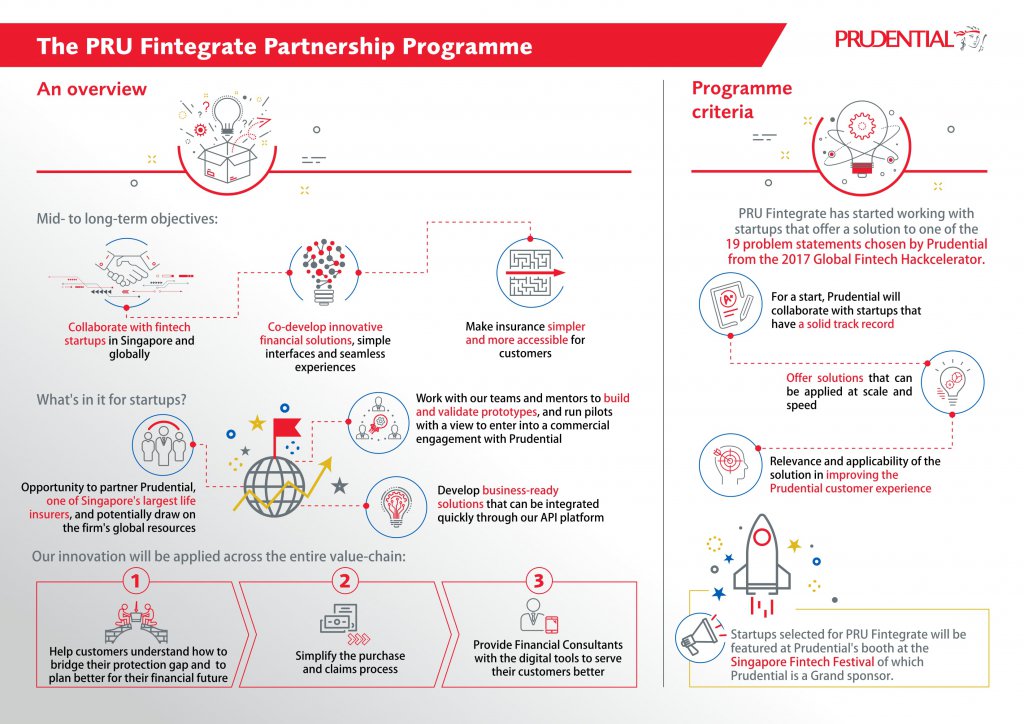

PRUDENTIAL SINGAPORE today launched a partnership program aimed at attracting global fintech startups who will work with the insurer to develop digital solutions for their customers.

The PRU Fintegrate Partnership program will focus on improving aspect of customer experience through the use innovative solutions gleaned from existing players in the market. According to a statement from the company, Prudential will onboard startups with “a solid track record”, and work with them to produce “innovative financial solutions, simple interfaces and seamless experiences”.

“Insurance has to become more integral to the customer’s life,” said Namrata Jolly, the head of customer & digital at Prudential Assurance, in a phone interview with Tech Wire Asia.

“The idea came from several discussions we were having within Prudential about our digital strategy and the best way to go about implementing our roadmap. Not all innovation comes from within. ”

Prudential’s new incubator-like program will help them source fintech companies with solid track records to partner with. Source: PRU Fintegrate

Prudential will evaluate a startup’s track record based off of their ability to produce technologies that are able to scale quickly. According to Jolly, “There is huge value in collaborating with the fintech startups in our external ecosystem, and it’s a win-win for both parties.

“That’s really the genesis of the PRU Fintegrate programme. We want to leverage the strengths of different fintech startups which are extremely agile and creative to bring customer solutions to market quickly.”

Prudential was a part of Singapore’s 2017 Global Fintech Hackcelerator, where several insurance-related problem statements were discovered. Each of these statements was concerned with improving the industry’s response to customer engagement, financial inclusion, and advances or gaps in regulation technology. When asked about what was a key issue PRU Fintegrate is trying to solve, Jolly said that they’re taking a big picture view of the industry’s situation.

“We want to focus on the whole spectrum of the customer experience. We want to be able to bring value to the customer, from starting to help them understand their financial and insurance needs, to the process of onboarding that customer, and thereafter ensuring that they receive timely and thoughtful service,” she said.

![]()

Prudential is looking to build digital enhancements that could help customers do a variety of things in an efficient and cheap way, from bridging protection gaps, to planning for their financial future. Jolly said that a significant goal of the program was to build solutions that would help customers with planning their financial future in a way that is both comprehensive but specific to each individuals’ experience.

Namrata Jolly, head of customer and digital for Prudential Assurance. Source: Prudential

Unlike a traditional incubator however, PRU Fintegrate will totally embed these startups into their current business model, meaning that these enterprises will gain access to both the company’s significant customer base, as well as their proprietary APIs. Prudential is one of the biggest life insurers in Singapore, and a partnership with them could help startups create high-level products that can be built, validated and deployed across the region.

The program will work on rapidly deploying startups’ innovations through their Application Programming Interface (API) platform which will allow them to integrated quickly into Prudential’s existing frameworks.

Prudential brings something that startups don’t have: exposure. The company’s long experience and wide base of subject matter experts who “really understand the practical issues on the ground.” While startups may be agile and creative, without a clear understanding of the real issues that policy buyers face, their solutions might not be targeted or comprehensive enough.

“Our insurance subject matter experts understand the practical issues on the ground. When we try to scale these models and to bring them to market, it’s really important that they work alongside our fintech partners,” she said.

“We want to make their expertise and experience available to our partners so that the solutions we build are truly relevant to our customers.”

This is particularly evident in how the company is thinking about the shifting demographics of the people that Prudential is looking to insure. As today’s global population gets younger and younger, established insurers have been turning to new digital solutions and stronger branding tactics to attract millennials.

Insurtech startups will benefit from the experience of Prudential’s subject experts who are on the ground. Source: Shutterstock

It’s also no secret that big companies like Prudential have to fight off a raft of new startups offering cheaper policies through online channels. Some of these include Southeast Asian Policy Pal, and US-based Lemonade, which markets itself as an insurer “with a heart”.

A key issue that Prudential is looking to solve with PRU Fintegrate is the delivery of better experiences and engagements through the use of digital tools. These tools are directed not only at the average policy buyer, but also at the agents selling these policies. According to the chief executive of Prudential’s office in Singapore, Wilf Blackburn, the company has been working to build up the company’s digital infrastructure that could help agents deliver information more quickly and while on-the-go.

For instance, Financial Consultants are given various digital tools from chatbots to digital interfaces that will allow them to retrieve accurate information quickly.

Another innovation is the implementation of digital experience at various touchpoints, from the customer’s initial consultation, up to the claims process. Often many issues of delayed service or confusing jargon can impede customers’ ability to understand what exactly they’re buying. In their statement, Prudential identified these issues as integral to the sustainability of a positive brand. According to research by Futurecast, more than a third of millennial purchasers are more likely to buy from a brand they know and like.

Prudential currently runs a PRU For You online community platform that has been feeding them real-time feedback that has allowed them to tailor their offerings and respond to criticism. “Feedback from this channel was instrumental in the company’s decision to move into a claims-based pricing model for its private hospitalisation plan early in the year,” the company said.

READ MORE

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry