Recurring payment headaches? Software aspirin for pain-free billing

The phrase “the best thing since sliced bread” may not be culturally relevant everywhere, but its meaning is well-accepted.

New ideas that purport to change businesses and organizations in the form of the latest app to download, or service to sign up to, are widespread. In fact, you’d be hard-pressed not to find a piece of software-as-a-service (SaaS) that didn’t claim to make organizations more efficient, save time, increase communication rates, and so on.

While the barriers that a typical startup has to surmount are many and various, overcoming them is necessary to bring something new to the market, in order to earn that sliced-bread comparison.

The best software-based idea in the world will need, amongst other attributes:

- effective coding on platforms relevant to the intended application

- a user interface that ensures high acceptance rates

- secure back end with necessary third-party integrations

Of course, talented software developers may be capable of delivering these and more. But a successful business will also require:

- attractive and effective marketing

- general business acumen

- great investor relations

- positive staff management

- vision for the future

- and so on, ad infinitum

And it’s in these peripheral, yet essential, areas, that developers often require help. It’s a rare software specialist who’s polymath enough to be able to cover all bases.

Let’s imagine a new product coming to market. It’s a great offering: well imagined and crafted, useful, a boon to industry, an enabling product that will make a real difference to any enterprise lucky enough to deploy it.

It’s also well marketed and the predictions of demand are good, after a thorough round of user-testing and extensive trial beta deployments.

However, there’s a fly in the ointment: the marketing division (our imaginary product is being produced by a startup, so the “marketing division” comprises one person!) has found out that realizing the potential demand for this new SaaS is dependent on the right pricing structure. Specifically:

- outright purchase options in addition to a monthly subscription model

- three tiers of subscription, bronze, silver & gold

- a free trial period with no credit card sign-up initially

- self-service billing and bill management

- automatic rebilling, reminders and receipts

- a range of offers that change over time

- customer-specific billing/offers

- integration with existing accounting systems that took an inordinate amount of bedding-in time

To add further layers of complication, it’s become apparent that it would be a good idea if there was integration with at least two payment gateways in order to ensure failover capability, and also it’s deemed that this newly-founded company should gain PCI compliance in order to keep customers’ payment details in-house (for rebilling and the like). Of course, there’s a hefty bill for the latter, in terms of necessary infrastructure improvements.

It’s when faced with these hills to climb that it’s probably worth examining that phrase again: “the best thing since sliced bread.” If sliced bread is the epitome of all that’s desirable, what enabled it to attain that status? The answer: mechanization.

Clearly, in the software world, mechanization per se isn’t really applicable. But its digital equivalent is: automation, or employing methods that would allow the product to be accessed, trialed, and paid for in a variety of ways, with all financial stats feeding into existing accounts packages.

In coding terms, the time costs of producing complex billing subroutines are high. While none of the underlying machine language requirements quoted are particularly difficult, the specialist area of billing requires a level of precision that’s exacerbated by our interconnectivity: one slip-up in handling credit card details can lead to, at best, a negative PR storm, or at worst, a wholesale calamity in which masses of customer data are lost through mistake or malicious data breach.

Therefore, in order to ensure that desired billing strategies can be safely and easily deployed in a way that ensures the highest security levels, companies are looking to billing specialists: these are companies who know the intricacies of financial transactions on a global basis, and can offer payment solutions to fit most (or even all), models.

Here are three payment solution providers whom we consider worthwhile researching:

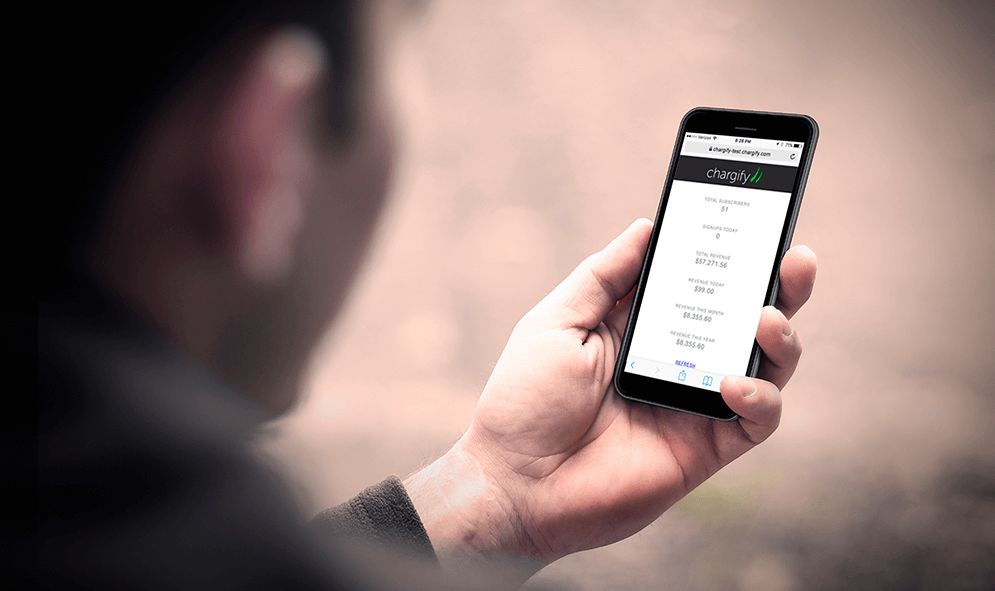

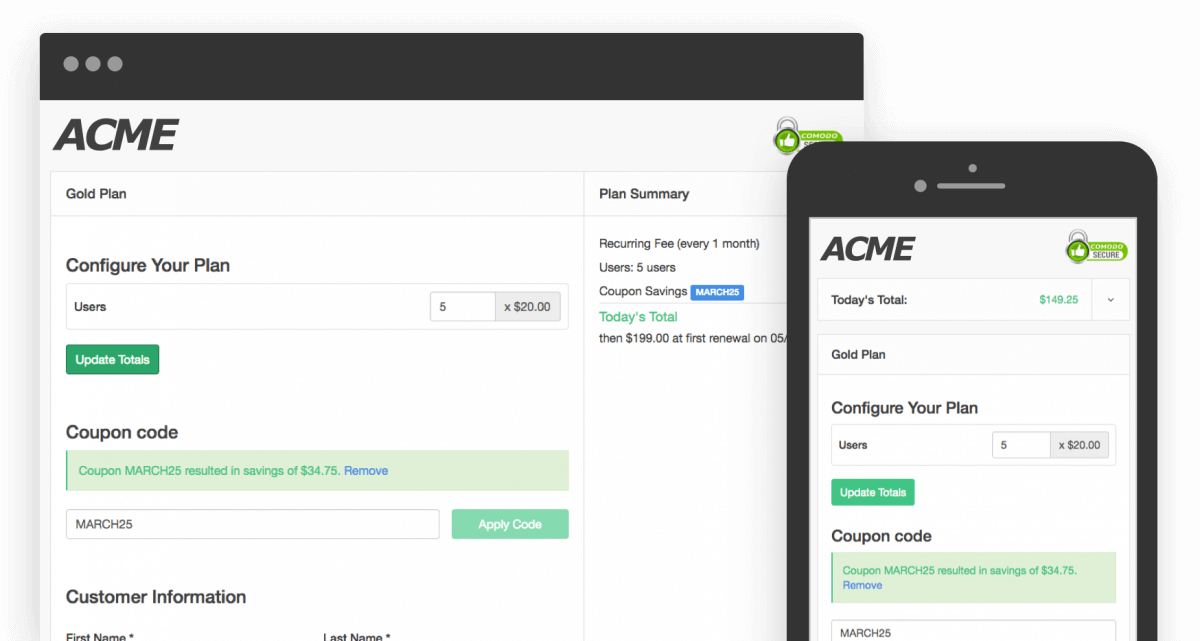

CHARGIFY

Chargify refers to the complexity associated with building and scaling recurring revenue as the billing bottleneck. Their solution aims to end the bottleneck by providing businesses with the speed and agility to accelerate growth.

Chargify’s headline-grabbing statistic is that they support over 100k unique billing configurations out-of-the-box without custom code.

While this figure speaks to the massive number of different recurring billing scenarios, the concept encapsulates what the company calls Dynamic Billing…the need for businesses to constantly evolve, customize, and optimize their offers.

By using Chargify’s billing engine, you can make revenue collections as granular as desired, down to a single customer’s billing being personalized to them. They make this type of capability available to businesses of all sizes from startups to enterprise-level organizations.

Beyond billing, Chargify manages the entire subscriber lifecycle from sign up to customer service to retention to reporting. Their analytics suite provides business leaders the visibility they need to speed up decision making and operate more efficiently.

Chargify is Level 1 PCI compliant and backs their product with various service-level agreements and highly acclaimed customer success and support teams to ensure companies move faster to maximize their results.

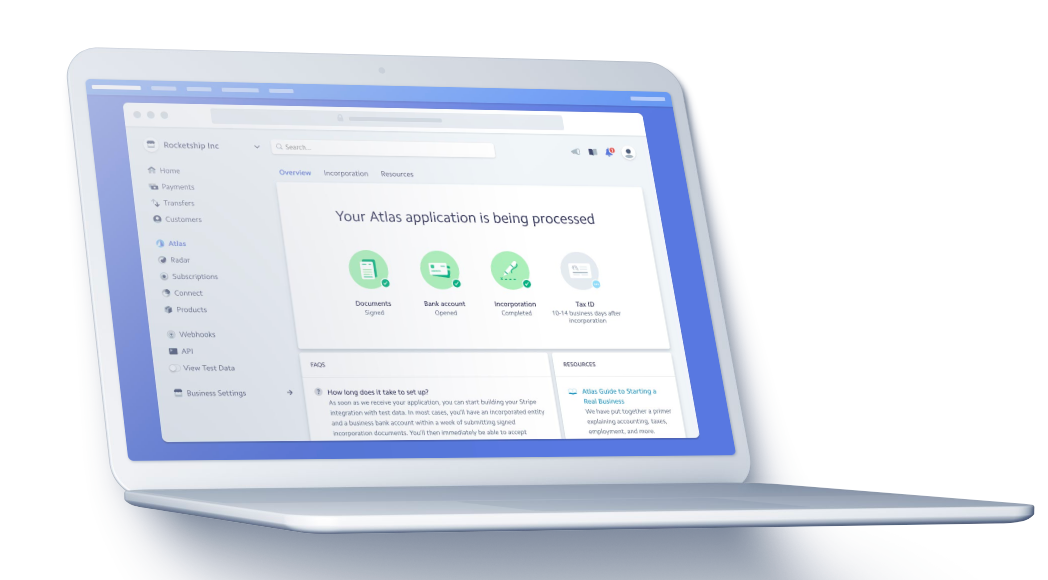

STRIPE

Stripe’s founders, Irish brothers John and Patrick Collinson are two of the world’s youngest self-made billionaires at 27 and 29 years old respectively.

The company’s attractiveness to investors CapitalG, Elon Musk and General Catalyst Partners, among others, stems from the company’s robust approach to attracting startups and established products alike to the platform. Their customers include Skype, Act Blue, Missguided, Made, and Dice.fm, and it has 25 offices across the world.

In addition to payment solutions, Stripe Atlas makes most aspects of starting a new internet business easier, including company incorporation, banking and there’s a range of courses on tap for the budding entrepreneur.

Stripe offer SDKs for Android and iOS, enabling different companies just launching apps to make seamless use of the company’s payment facilities, which encompass one-off payments and subscriptions. The company’s Radar uses machine learning algorithms to help protect from fraud and allows customers to review flagged payments.

For subscription-based billing, Stripe offers metered billing, per-seat pricing models, add-ons and options for quick customer attraction, and allows multiple subscriptions per customer.

Stripe is, of course, fully PCI compliant, and can protect payment details taken in 140 currencies (plus cryptocurrencies!), ensuring that e-commerce is a fully global playground for its clients.

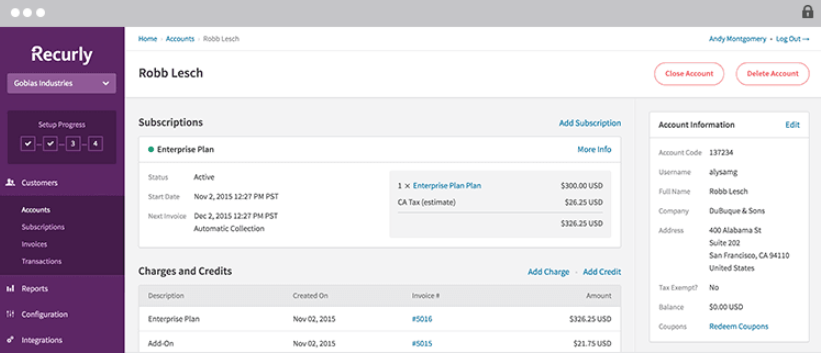

RECURLY

Recurly was founded in 2009 and is headquartered in San Francisco, USA.

The company offers integration with a range of payment gateways, depending on where the organization wishing to bill is located, and a business’s customers can pay in one of 19 currencies.

As one might expect, Recurly is fully PCI compliant, and will in fact only transfer held credit card data to another supplier of payment solutions if that supplier is itself PCI compliant – it’s reassuring to see the company’s concern for end-users’ payment details.

Recurly charges their customers a monthly fee depending on the level of plan signed up for, plus a percentage of each transaction. This makes their solutions suitable even for the smallest of startups, who need to be supplied with transparent pricing in order to plan financially, month to month.

Small companies need to be aware, of course, that merchant gateways are essentially bank clearinghouses, and so any monies moving through them are also subject to charges.

Payment pages can either be customer-hosted, or Recurly offers a range of options that allow organizations to adapt and personalize the payment pages supplied as part of the chosen plan.

The company claims that customer churn for its users can be reduced significantly with over 60 common payment errors being automatically corrected without any need for contact with the end-user.

Recurly states that its customers recover an average of seven percent of revenue each month from transactions thus ‘repaired’, which might have been previously lost.

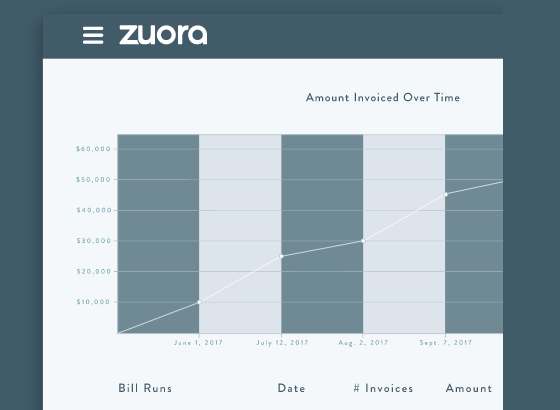

ZUORA

Zuora was founded ten years ago by Taiwanese-born, Brooklyn NYC resident Tien Tzuo. Back in 2007, the subscription model for payments was in its infancy, and the company’s history shadows the rise of the subscription economy.

In a podcast, Tzuo refers to one of their customers, the machinery giant, Caterpillar. As well as a well-publicised move into clothing ranges and footwear, the company now offers customers subscriptions to earth moving services!

“That’s really the core of the subscription economy – to stop thinking about your business as shipping product, but as a lifetime relationship with a customer.”

Zuora’s claim is that there are nine keys to billing success:

– Price. Adjust dynamically.

– Acquire. Use promotions, flexible pricing, and multiple channels.

– Subscriptions. Ensure revenue streams.

– Collection, via manual and automated methods, as required.

– Nurture. Keep customers happy and engaged.

– Account. Examine financial data in existing accountancy packages.

– Measure. Gather relevant data to reach better decisions.

– Iteration. Try new things.

– Scale. Grow!

By taking each of these steps, alongside Zuora’s cloud-based systems, companies can respond to the latest changes in customer demand – both for products and services customers currently offered but also respond to changes in the way that customers want to behave.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM