Jack Ma, Chairman of Alibaba Group, speaks during the Computing Conference in Yunqi Town of Hangzhou, Zhejiang province, China. Source: Reuters

Alibaba enlists brick-and-mortar businesses into quest for retail dominance

ALIBABA is pulling brick-and-mortar into its massive e-commerce environment as it seeks to dominate all aspects of the retail industry through an app-based system.

According to reporting by Reuters, Alibaba’s supply chain app is making it easier for store owners to restock inventories. The app is part of a multi-billion dollar plan by one of China’s leading tech giants to cast its wide net over the country’s consumers, a plan that includes tech-infused shopping experiences, e-commerce platforms and the integration of traditional players.

Alibaba is pushing its influence – first established through its Tmall and Taobao apps which have upended the Chinese retail market – by bringing onboard supermarkets, malls and millions of local shops. Its Ling Shou Tong supply chain app has recruited 2,000 evangelists to convince retailers to come onboard. These evangelists have been trained and incentivized by Alibaba, but their results have been mixed.

“First, awareness of the technology is too low and the replacement cycle for goods is too long. Also, the logistics aren’t good enough yet,” said Yu Wenze, a 21-year-old “chengshi paidang” as they are known.

“We have to commit to next-day delivery if the shop ordered before 4pm, but in most cases, we can’t do it.”

Furthermore, there is always the question of data – who owns it, and are Alibaba’s shoppers all right with having their data being poured into this separate system? Alibaba doesn’t have a reputation as a protector of data and little experience with managing and integrating data into its infrastructure.

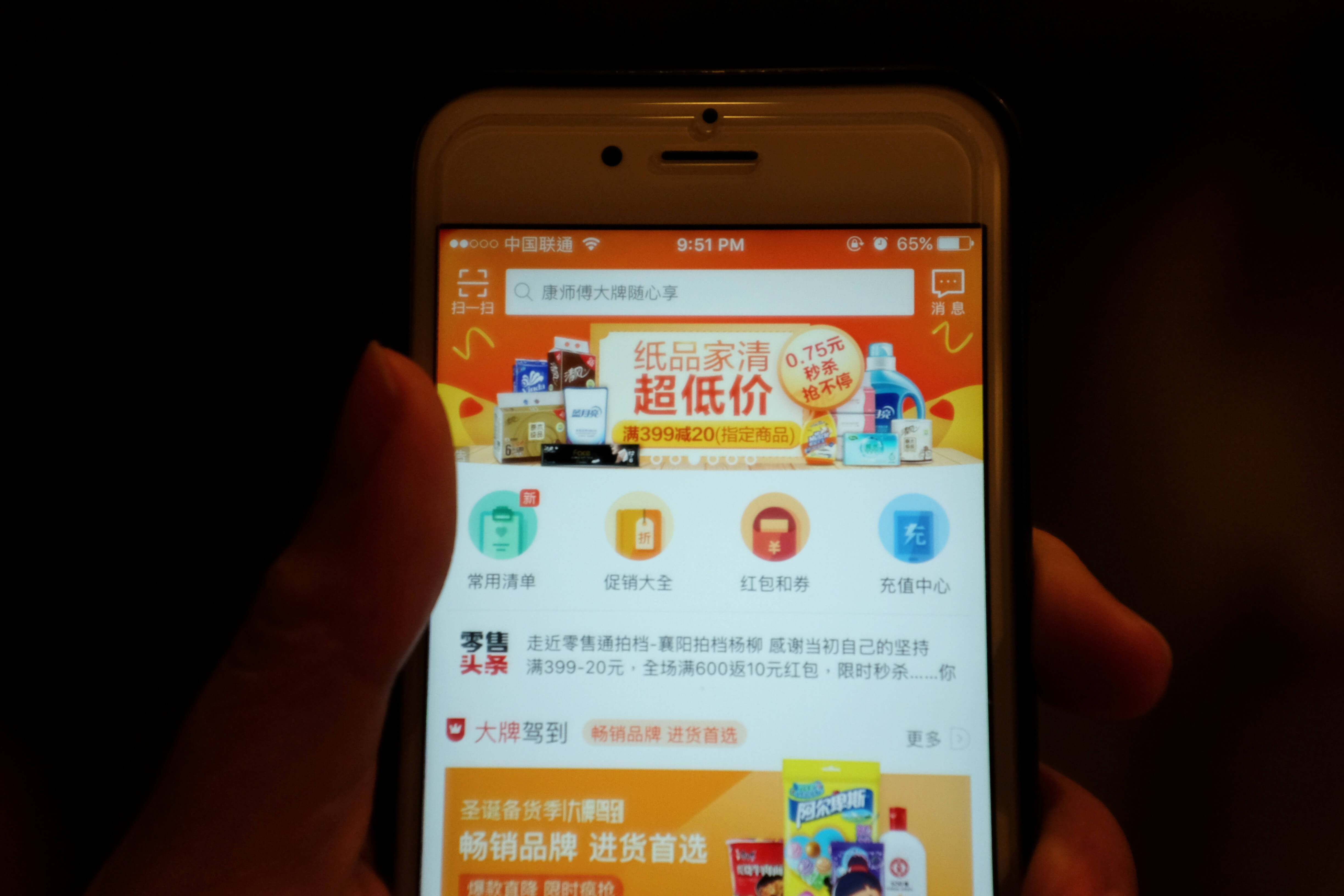

Alibaba’s Ling Shou Tong supply chain app is seen on a smartphone in this illustration picture. Source: Reuters

“They need that personal information in order to create more targeted offline stores, and all of that will require additional data to be shared across different locations,” said Jason Ding, partner at Bain & Company’s Beijing office, to Reuters.

“There are a lot of new rules that need to be defined if they want to strike the right balance.”

Alibaba wants to track the shopping habits and capture the attention of every Chinese consumer, a challenge in a country where 85 percent of all transactions are still made in person in stores. However, Alibaba has already onboarded 600,000 mom-and-pop retailers into its app ecosystem, and recently spent US$2.9 billion on a stake in Sun Art Retail Group Ltd., the country’s largest grocery chain.

Alibaba isn’t – and never has been – afraid to spend some money to dominate any market, and they’re already throwing big bucks at the problem.

“We’re working to make the net in the sky and the net on the ground,” CEO Daniel Zhang said last month after the acquisition, according to Reuters. “We will cover all consumers seamlessly.”

Chinese data giants are supplying information to traditional stores in China. Source: Shutterstock

Alibaba acquisition of Sun Art may be familiar – it closely mirrors US e-retailer Amazon Inc.’s recent move to buy out organic grocer Whole Foods Market Inc., which rocked markets and provided a glimpse into the future where retail becomes digital first. Alibaba could not have picked a better example to follow: Amazon’s influence spreads across industries and it has played a major role in reshaping the US retail landscape.

That being said, Alibaba will have to contend with a fragmented market split between mega-cities and rural ones, and has to hold a variety of stores from malls to small shops within a net through its mobile apps, payments platform, logistics infrastructure and inventory management tools. It’s proving to be expensive to maintain all of these things together at the same time, but it’ll likely be important if Alibaba wants to maintain its growth margins and defend against encroaching rivals.

Aside from acquiring stakes in Sun Art, Alibaba has invested heavily in big box retailers Suning Commerce Group Co. Ltd., Lianhua Supermarket Holdings Co. Ltd. and Intime Retail Group Co. Ltd.

“It definitely needs to be a priority for Alibaba,” said Ding.

READ MORE

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry