APAC travel bookers seek personalization. Source: Pexels

Personalization strikes a chord with APAC travel bookers

WITH online abandonment rates in Asia Pacific’s travel sector soaring, new data from marketing technology company Ve Global reveals how personalization can add greater potency to re-marketing campaigns in the ongoing struggle to turn online browsers into bookers.

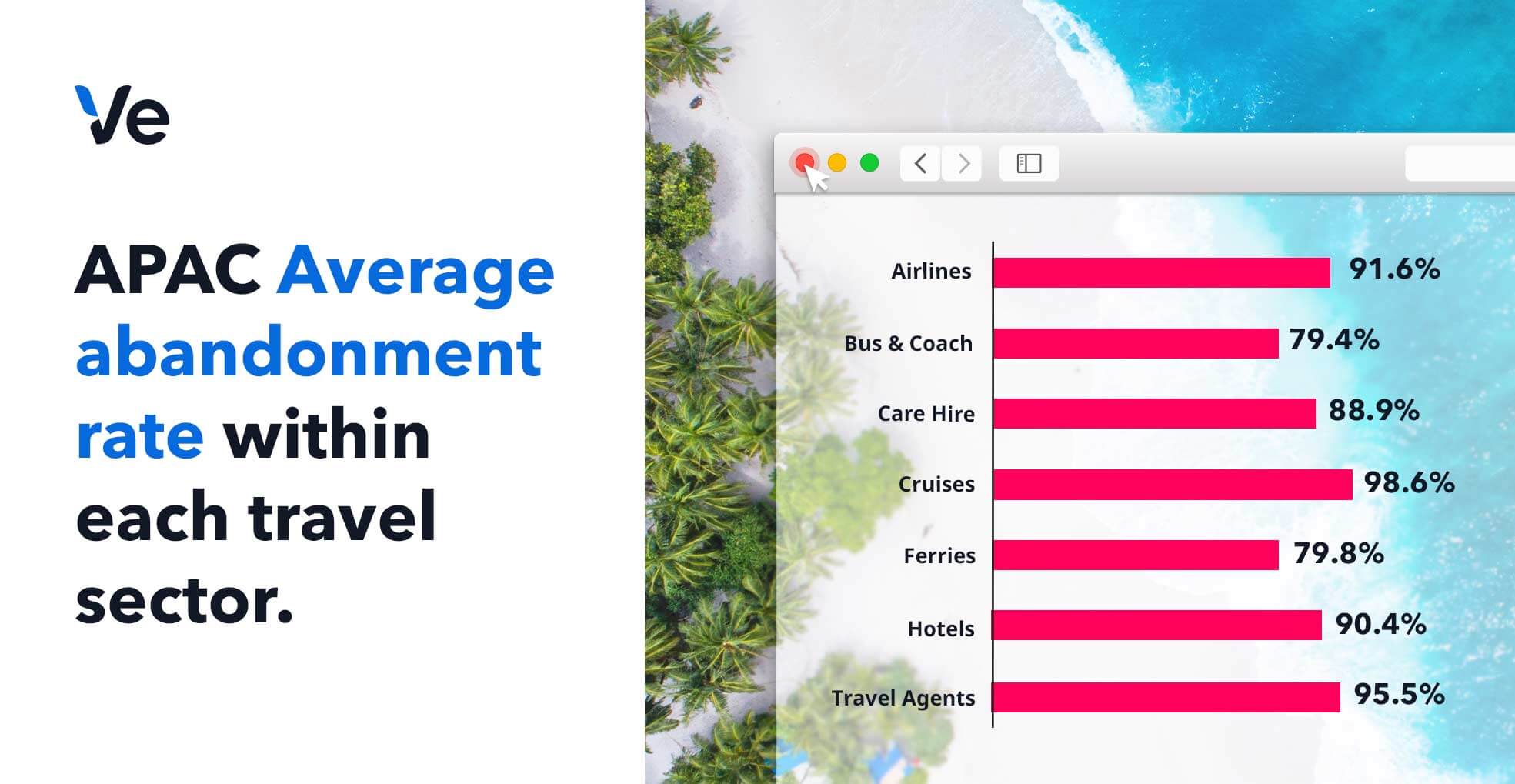

Basket abandonment continues to pose a major challenge in Asia Pacific (APAC) along with the rest of the world, leaving travel brands to question what they need to do to convert more online browsers into bookings.

Between January 2017 and April 2018, exclusive Ve data revealed that 92.6 percent of potential bookings in the region’s travel sector were abandoned before purchase. Despite having dropped 2.5 percent from the previous year and with rates below that of Europe and Latin America, online customer abandonment in the region remains a tenacious issue that the travel market needs to address.

An opportunity lies in re-marketing, which APAC customers are particularly receptive to. Re-marketing email open rates are high at 50.71 percent whilst one in 18 emails leads to a recovered booking, compared with just one in 23 in Europe.

As part of a wider Ve study into online customer journeys across the APAC travel sector, Jamie Pierre, Managing Director at Ve APAC, discusses how travel brands can reduce booking abandonment by deploying the following four effective re-marketing techniques:

Personalized messaging strikes a chord

It’s no secret that on a global scale, the desire from customers to receive personalized experiences is rising. For the travel industry, it can be harder to achieve highly effective end-to-end personalization due to less frequent purchasing and the influence of travel comparison websites which makes it difficult for brands to collect enough consumer data to segment and personalize effectively. Fortunately for APAC travel brands, basic forms of personalization have had a significant impact, with something as simple as including a customer’s first name in an email subject line found to significantly boost results.

Data from Ve, which carried out click analysis on over 12 million emails over a 4-month period, shows that in Asia this technique led to email re-marketing open rates of 65 percent, compared to an average of 44 percent for non-personalized subject lines. Perhaps even more significant is that conversion rates jumped from 9 percent to 23 percent, 9 percent higher than Europe and 14 percent more than the Americas.

With the lightest of personal touches resonating strongly with APAC customers, leading to more engagement and conversions, travel brands need to look carefully at all touch points along the consumer journey to a) identify their abandonment weak spots and b) understand what personalization opportunities exist, from discovery through to purchase.

Deploying a full-funnel approach through targeted display and video advertising, bespoke landing pages, and on-site engagement tools, could all pay dividends on a user’s path to purchase and in the fight against abandonment.

Customers becoming less receptive to discounts and offers

Naively, many travel brands believe discounts and promotions will trump greater personalization in wooing customers into making a booking. Offers can be a great way of enticing customers to book and often provide the final justification customers need to make a purchase. However, marketers should be wary. Not only could excessive discounting devalue product offering and brand image in the long term, it could also reduce the effectiveness of re-marketing efforts at the time.

In fact, Ve data shows that APAC customers in general are less receptive to email re-marketing communications that reference discounts, with open rates dropping by 10 percent on average as a consequence. Conversion rates also suffer, dropping from an average of 9 percent to 6 percent.

Whilst travel brands don’t need to bypass offers and discounts completely, they should be using them wisely by analyzing their own data to identify when within the customer journey offers are likely to be most effective. Otherwise, travel brands risk selling themselves short and not maximizing revenue opportunities from existing and prospective customers.

Channel personalization: Optimizing for APAC’s mobile-first market

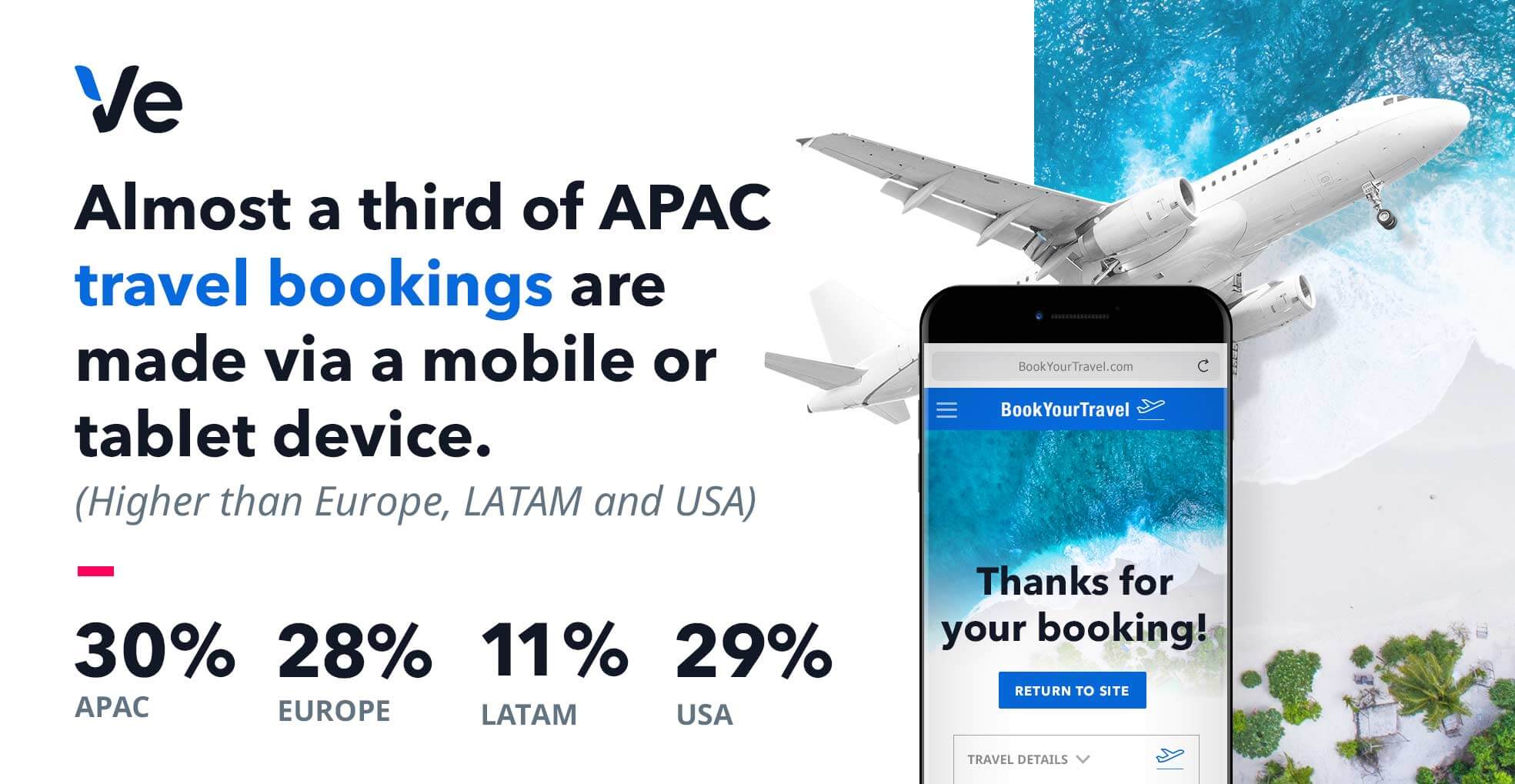

APAC customers lead the way for mobile travel bookings, as revealed in insights from Ve which found that 30 percent of all bookings are made on mobile and Tablet devices compared with 29 percent in the United States, 28 percent in Europe and just 13 percent in Latin America.

Unfortunately, every travel sub-sector in APAC suffers from significant abandonment rates which may be the direct result of a failure to optimize customer journeys for both mobile and Tablet devices. For example, data from IAB Singapore found that although APAC has firmly established itself as the front-runner in becoming a truly mobile-first region, half of all APAC consumers are not satisfied with their mobile shopping experience.

It’s clear that APAC consumers want better brand engagement in context to their personal usage and for that to happen, companies must optimize the online booking experience and any subsequent re-marketing effort to deliver on a consumer’s expectations.

This will require developing a superior hand-held experience as well as contextualized mobile-only campaigns, offers and exclusive promotions that appeal specifically to their growing mobile user base.

Mobile gets you closer to a consumer. But desktop isn’t dead, yet

Sure, the growth and pervasiveness of mobile needs to be addressed if travel companies are to remain competitive in the long-run but we haven’t yet entered a mobile-first era.

Let’s not forget that 70 percent of all travel bookings in APAC still take place on desktop, therefore brands can’t afford to focus efforts on mobile at the expense of other devices.

Ideally, travel companies should be building out a seamless cross-device experience that’s highly personalized but while any separation between devices is being bridged, travel companies should be optimizing the buying process for the desktop experience.

Start with the smallest of touches

With levels of basket abandonment still sitting so high across the travel sector, companies in APAC need to realize that even the smallest of improvements will have a considerable impact on conversions. Re-marketing in its broadest sense already has a range of benefits, but the trends in personalization, discounted offerings and mobile purchasing all represent a significant opportunity for APAC specifically.

Pierre’s team will be available at the Digital Travel APAC Summit in Singapore till April 19 if you have more questions.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM