Southeast Asia’s digital economy is expected to grow up to US$240 billion in value, by 2025, effectively tripling in size, according to a new study. Source: Shutterstock.com

SE Asia digital economy to reach $240b in valuation

IN any discussion about the growth of Asia’s digital economy, China usually becomes the main focus.

However, the recent exponential growth of Southeast Asia in the internet economy is giving analysts and observers something else to ponder.

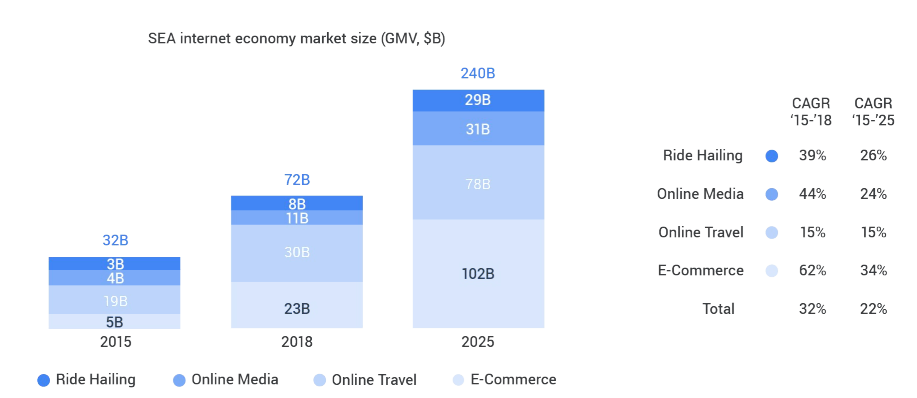

The region’s digital economy is expected to grow up to US$240 billion in value, by 2025, effectively tripling in size.

A new study conducted by Google and Singapore’s Temasek, predicts that the region’s 350 million mobile internet users spanning across six countries have boosted its internet economy to the value of US$72 billion, up from US$50 billion in 2017.

This new “inflection point,” as the study calls it, has made Google and Temasek raise their initial estimation of growth which was US$200 billion in the next seven years to US$240 billion.

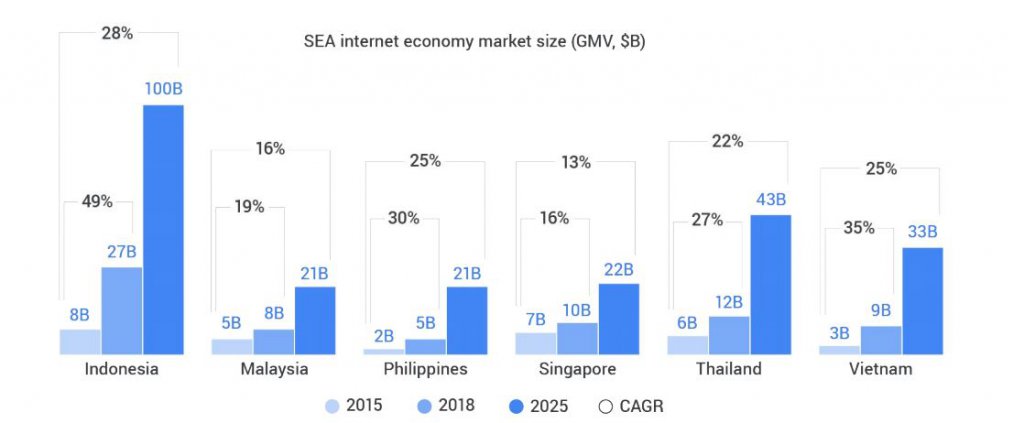

Indonesia largest ($27B) and fastest growing (49% CAGR),

will be a $100B internet economy by 2025. Source: Google-Temasek

At the moment, the region’s most populous country, Indonesia is leading the charge as the most prominent player at US$27 billion and is estimated to reach US$100 billion marks by 2025.

In that same timeframe, Thailand’s digital economy is projected to triple from current US$12 billion to US$43 billion and Vietnam from US$9 billion to US$33 billion.

The study focused on four sectors within the digital economy and found that the online travel industry will be responsible for the most significant chunk of the estimated US$72 billion in revenue.

E-commerce will account for US$23 billion, followed by online media, and ride-hailing services with US$11 billion and US$8 billion respectively.

Booming e-Commerce sector, Online Media accelerating. Source: Google-Temasek

However, by 2025, e-commerce is expected to be the biggest revenue generator. The industry is projected to bring in US$102 billion, propelled mainly by the three biggest players in the region — Lazada, Shopee, and Tokopedia.

Fueled by online advertising, gaming, and the emergence of on-demand music and video subscription, online media is tipped to become a US$31 billion industry while ride-hailing is will be worth US$29 billion.

Ride-hailing was particularly given particular focus by the study due to the unique situation in the region, where earlier this year, leading vendor Grab acquired its competitor, Uber’s business.

Grab, and its other rival that emerged out of Indonesia Go-Jeck have seen their market expand monumentally from, according to the report.

Over eight million rides are taken by users in 2018, compared to only 1.5 million per day in 2015. The active users utilizing the hailing services itself ballooned from eight million in 2015 to a whopping 35 million in 2018.

Food delivery services, which is a part of e-hailing services see faster growth in revenue as both Grab, and Go-Jek sought to expand into this untapped market.

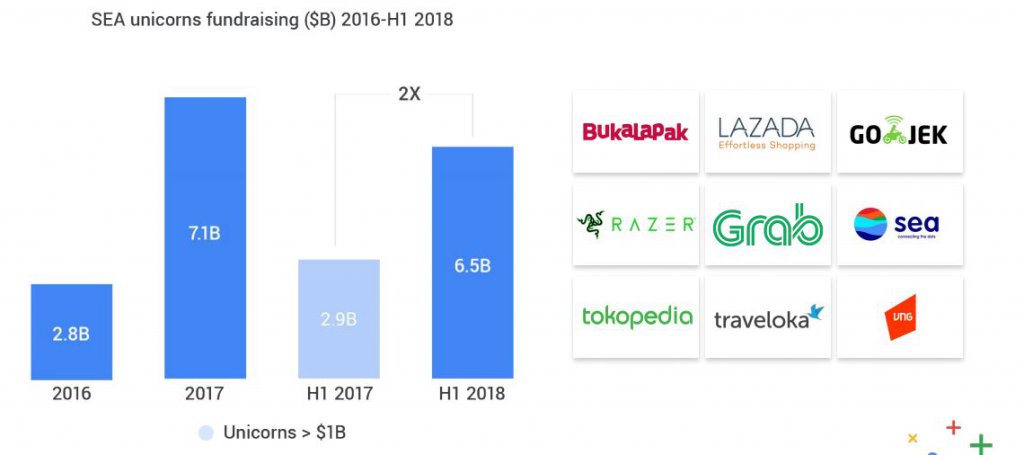

With regards to funding, 2018 is a record year fundraising in the region for the digital economy.

US$9.1 billion was raised in the first half of 2018 alone. To put it in perspective, in all of 2017 saw a total investment of US$9.4 billion.

Since 2015, a total of US$24 billion investment flowed to the region.

Most of the funding (US$ 16 billion since 2016) went to the regions nine unicorn companies – Bukalapak, Go-Jek, Grab, Lazada, Razer, Sea Group, Traveloka, Tokopedia, and VNG.

It is also worth noting that Grab is the region’s first decacorn (company with US$10 billion-plus valuation), and took the lion’s share of the investments (US$6 billion).

Most funding went to SEA’s nine unicorns ($16B since 2016);

Grab 1st decacorn ($10B+ valuation), less than 20 globally. Source: Google-Temasek

The rest of the players in the digital economy did not do all that bad and had certainly benefited from the investors’ confidence in the region.

More than 2000 tech companies in the region secured funds, with companies valued less than US$1 billion collectively raised almost US$7 billion in the last three years.

Singapore and Indonesia emerged as investors favorite destination as companies headquartered in these countries attracted the vast majority of the funding in the tune of US$16 billion and US$6 billion since 2015.

The other countries raised a combined total of US$2 billion.

In the previous iteration of the study, Google -Temasek identified six distinct areas that will pose a challenge to sustain growth in the digital economy.

These areas were: internet infrastructure, ability to secure funding, building consumer trust, developing logistics to handle e-commerce, ability to attain talent, and viable digital payment solutions.

This year’s report, however, declared that the availability of venture capital investments has turned from being

a challenge for the Southeast Asian internet economy ecosystem to being one of its core strengths.

Considerable progress has also been made in the other five area of challenge, the reports said, and one such development is the creation of 100,000 new professional jobs, which is expected to double by 2025.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM