Are usability and cloud the big innovations in the accounting space?

Significant way-points usually punctuate the progress of a business from a startup to a flourishing concern. The first one might be the first staff hire, followed by the opening of a second branch, then perhaps the move upstream in your chosen niche to take on bigger competitors.

These stages are often marked by periods of stress, where the systems and processes (those embedded in silicon and otherwise) prove to be insufficient. Here’s where business owners throw up their hands and begin casting about to find a solution in the different platforms and solutions that operate in their vertical, looking for a way that the application of a little technology might solve their latest impasse.

If you read the marketing materials of most solutions in the financial space (those that will help organizations with activities like invoicing, bank reconciliation, purchase and ledger, and so forth), then you’ll be aware that every product can solve every problem you currently have, plus a few more besides you didn’t know you had!

What many vendors and resellers will try to do is to get the business owner or head of the organization to buy into a large ecosystem that will, likely, do far more than what’s necessary. The reason for this is invariably that there’s ‘room to grow’, and the system’s capabilities can be brought online as and when required.

What’s unfortunate is that these large, overarching systems often come with significant overheads:

– Having to teach staff how to use new systems.

– Necessity to make changes to infrastructure and working methods to accommodate the proposed platform.

– The need to open new bank accounts or sign up to other financial services.

The best solutions to the problems that business owners have are usually ones that are suitable to their size and existing working methods. Below, we focus on three vendors capable of supplying a software platform that’s suitable for growing businesses – neither startups nor large multinationals, but organizations with maybe a few dozen employees, not yet ready to commit wholesale to the SAPs, Salesforces, and NetSuites of this world.

That’s not to say that the larger players (Oracle, IBM, et al.) only supply huge global firms – several have viable products on offer suitable for the smaller fish. We’re not featuring those products specifically here, however.

Instead, we’re looking at next-gen suppliers of financial software for growing businesses that tick those three key boxes:

– They each offer a user interface already familiar to staff.

– They’re solutions that fit into existing tech systems, so you continue to get ROI on your existing setup.

– They don’t require a sudden change in finance providers or services.

Each of the companies below has cloud-based solutions that we’re examining, not because cloud solutions are endgame the way technology is headed, but rather, cloud platforms by their nature must be open and inter-operable to be useful. In technical terms, cloud solutions tend to be accessible via APIs as a matter of course, rather than existing in an online island. That means your investment in your existing systems (Office 365, SharePoint, SQL Server, etc.) will continue to pay off.

Wiise

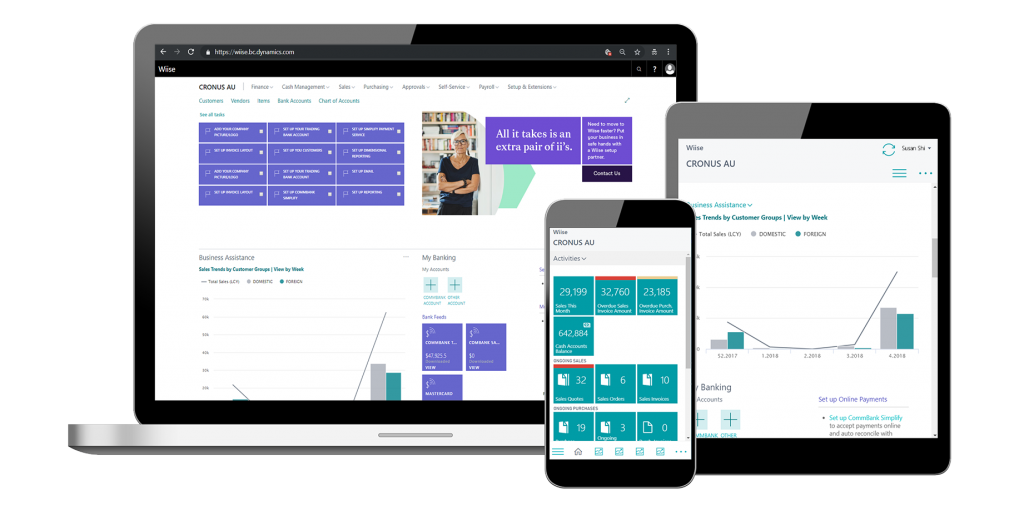

Wiise’s offerings are 100 percent cloud-native, unlike some of its competitors where existing apps have been virtually crow-barred onto a cloud platform, usually with mixed results. Built on the solid familiarity of Microsoft tech, Wiise brings together your finances, operations, payroll, people and processes in one hub to help streamline your workday.

Wiise relaunched in 2018 with one sole purpose. Give businesses the ability to access Enterprise technology at a fraction of the price so they can save time on processes and on cost.

Integrating seamlessly with Office 365, Wiise streamlines not just your accounts administration. Repetitive and common business processes that usually involve switching apps, logging into several platforms, and copying information from paper into spreadsheets, are all dealt with from familiar surroundings, like your Outlook.

Source: Wiise

Wiise solves problems like seemingly simple tasks taking up a disproportionate amount of time: responding to a new request for a quote, a new order hitting your inbox, or creating a PO. The platform is also predictive, so can prompt the user to trigger multiple PO creation when stock levels fall, for example, all at the simple click of a mouse.

Removing tedious administration tasks is changing the way finance managers and business owners are working. Plus Wiise’s overarching nature means the underlying code can forecast trends in sales, or bad debt, and helps you make decisions about the best course of action.

Created by KPMG, built on Microsoft and supported by Commonwealth Bank, Wiise is an integrated solution designed to help you see your business clearly. To read more about Wiise, clever business software, click here.

XERO

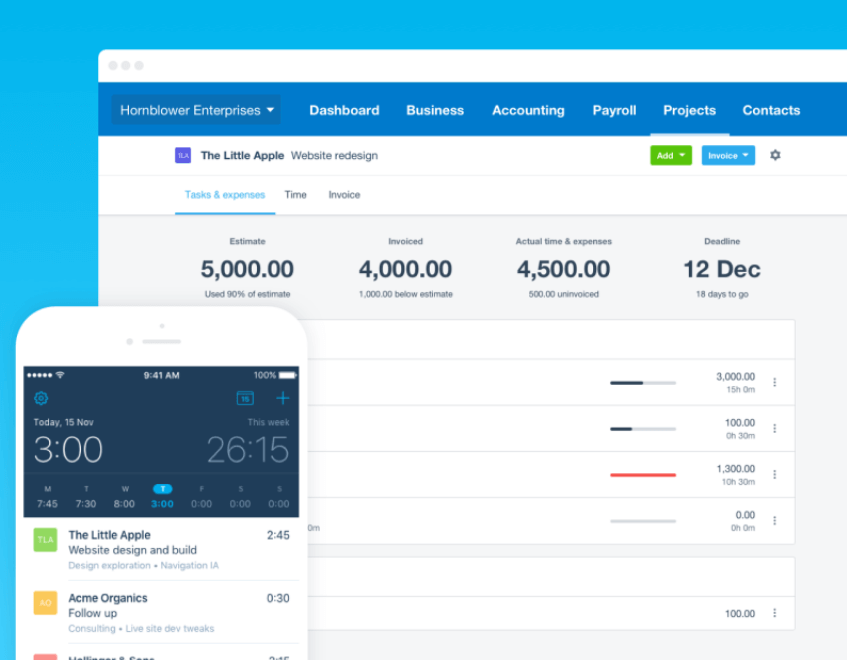

Kiwi company Xero launched its online-only product in 2006 and used its native country as a test-bed – with no small measure of success – before expanding out to launch in Australia and the UK two years later. The company now sells extensively in the US and Canada, as well as into the APAC market.

As one of the first online-only accounting packages aimed at small businesses, Xero made significant ground in the market space as it emerged and gained a great deal of investment from early on in its history.

Source: Xero

Through several acquisitions more recently, Xero’s offering has expanded to include a payroll integration feature specifically for the Australian market and has also added time management features, similarly as the result of buying up a specialist company.

A simple, and easy-to-use interface was designed primarily for business owners, rather than accountants or book-keepers, and the ethos of business-first and ease of use is maintained. As well as an attractive desktop GUI, there are also dedicated iOS and Android apps, which can achieve the main features of their larger-screened cousins.

Xero integrates with over 700 other systems (including payment providers like PayPal and Stripe), and bank reconciliation is baked in: in Australia, participating institutions include the ‘big four’, NAB, CBA, Westpac, and ANZ.

QUICKBOOKS

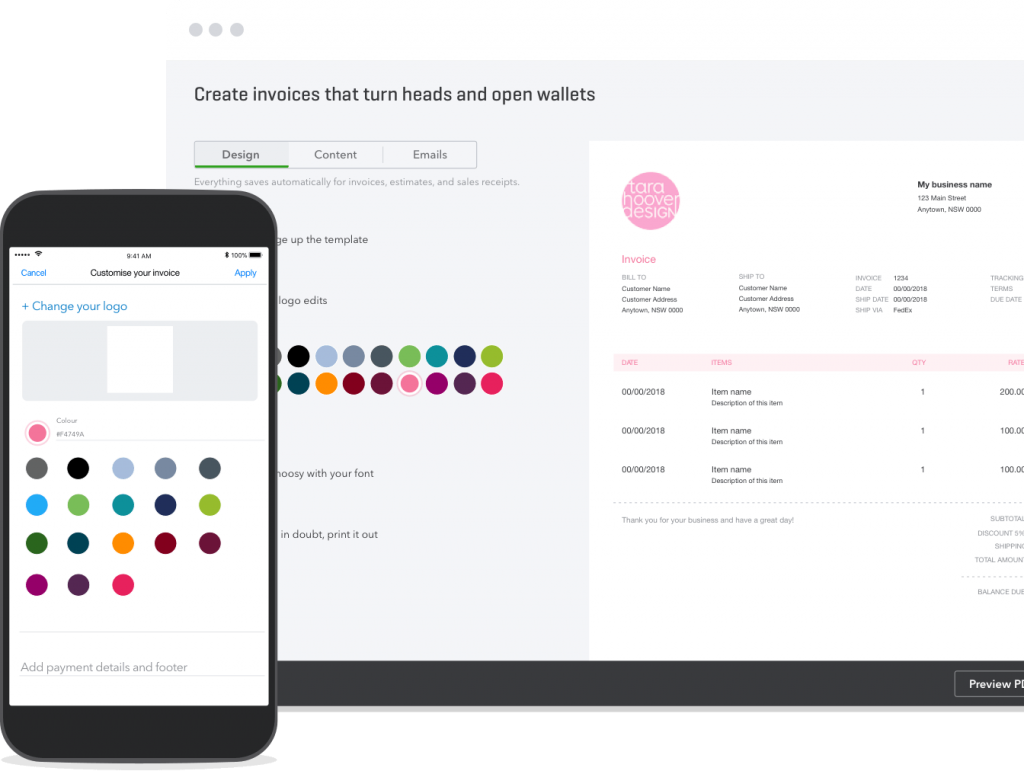

Intuit’s Quickbooks is the de facto accountancy application in its native US, a product released by the company after the success of Quicken, a package designed for individual financial management. The company offers at least two bare-metal deployment models, plus Quickbooks Online, an internet platform that is a serious player in the financial SaaS space. Quickbooks Online was “a complete rewrite” of the original Quickbooks, the company said at the time of its launch.

The Online platform is aimed at small to medium enterprises and exists in discrete versions for the US, UK, and Australia, with versions tuned to the various details of tax and regulatory issues particular to each geography. Pricing starts at just a few dollars for sole traders, and scales up, with additional features added (like mileage tracking) in the more expensive tiers.

Source: Quickbooks

The company claims that nearly 70 percent of users of Quickbooks (the locally installed version) migrate to Quickbooks Online in just a few minutes.

To keep tabs on finances on the go, there are mobile apps, and the SaaS model means that web access is always available. If you’re a Quicken user and need the benefits of a use-anywhere model, QuickBooks Online is probably your next logical step.

RECKON

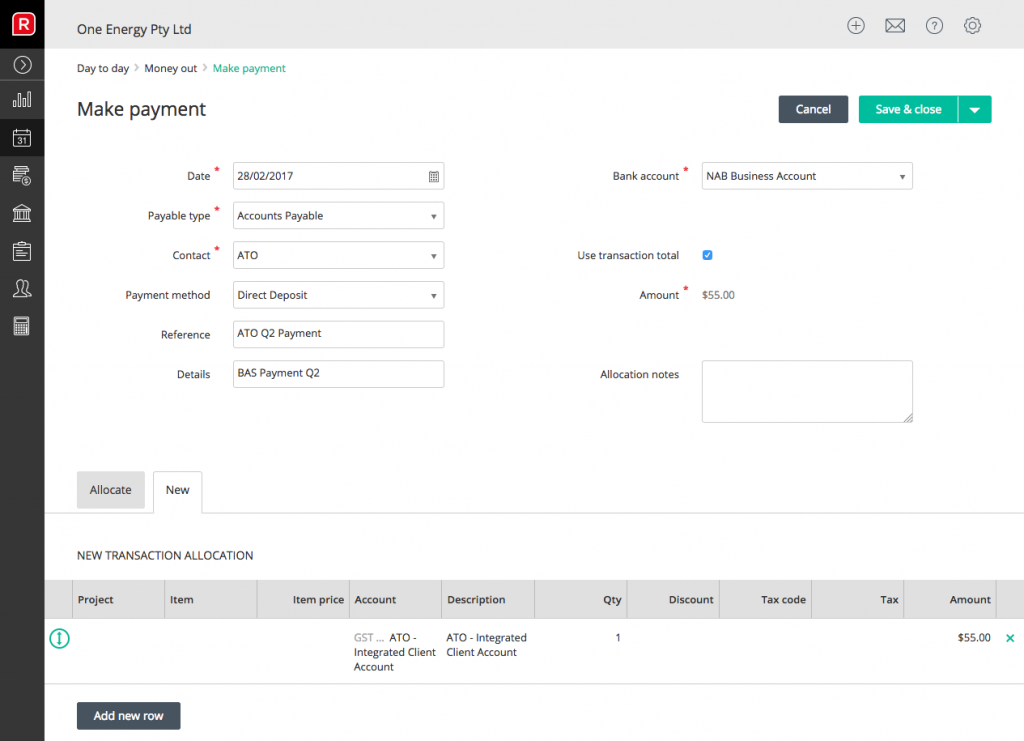

The Australian partner of Intuit launched its own Reckon One in 2015, a fully online accounting package designed for small businesses. The company also offers on-premise products for medium to large enterprises, but these are not available in the same cloud-based SaaS form that many have come to expect.

For many years, reckon were resellers of Intuit’s products in Australia, and the business-first mentality of that company has clearly rubbed off, with users given a dashboard (like a control center) from which the principal financial activities of a business can be controlled.

Source: Reckon

As you’d expect, there are areas for expenses, purchase orders, bank reconciliation, payroll, inventory management, plus there are (in the Australian version) tax return routines specific to the geography.

Reckon’s product suites are eminently suitable for growing businesses, as, for instance, it offers a POS raft of software (including Reckon One POS), e-commerce functionality and even software for book-keepers and accountancy firms.

The general manager of the Reckon business group said at the time of Reckon One’s launch: “We don’t want to put you in a box. No business is the same. We need to make sure we are offering you solutions, so you have the choice to enhance your business journey.”

Reckon’s broad and detailed product range (over a dozen discrete packages for business finance) is a testament to a company that supports businesses in the way that it demands, rather than adopting the one-size-fits-all approach.

*Some of the companies featured on this editorial are commercial partners of Tech Wire Asia

READ MORE

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry