IoT is a great way for manufacturers to improve efficiency. Source: Shutterstock

Strong demand pushes IoT spending forecast past $1 trillion mark

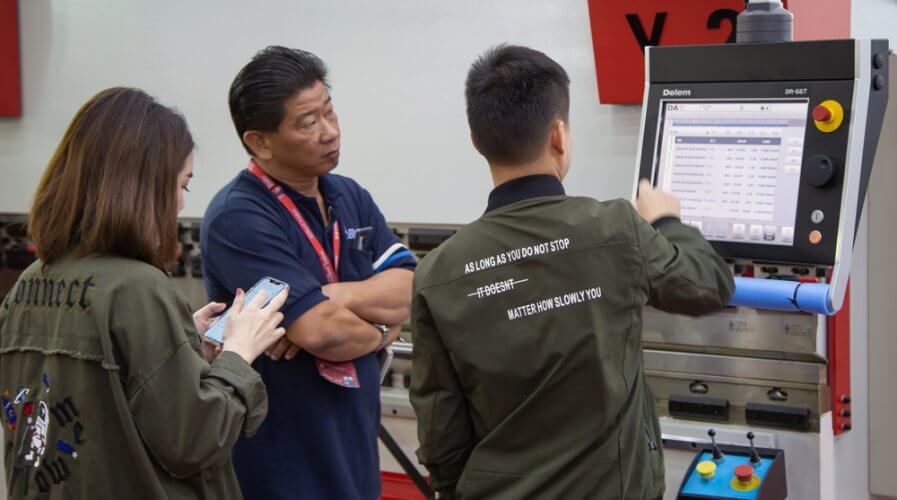

OVER the past decade, technology specialists, especially in the manufacturing field, have stood firmly by the forecast that the internet of things (IoT) will change the world of business and commerce.

As we move into 2020, more business leaders believe in that vision and are making investments accordingly.

According to a new forecast by IDC, worldwide spending on IoT is forecast to pass the US$1.0 trillion mark in 2022, reaching $1.1 trillion in 2023, indicating that the compound annual growth rate (CAGR) for IoT spending over the 2019-2023 forecast period will be 12.6 percent.

Obviously, the biggest spenders on IoT include discrete manufacturers and process manufacturers. Transportation providers, however, are a new entrant to the list of big spenders according to the IDC forecast.

What’s interesting is that the analysis reveals that companies are spending on IoT services and IoT hardware in equal measure.

IDC’s forecast shows that IoT services (traditional IT and installation services as well as ongoing services such as content as a service) will be the largest technology category through the end of the forecast after overtaking hardware spending, which is primarily dominated by module/sensor purchases, this year. Together, these two categories account for roughly two-thirds of all IoT spending.

However, as businesses get the sensors and devices in place, IoT services will obviously get the lion’s share of the IoT budget as companies need to make sense of the data they capture and harness it to create meaningful insights and help the overall project deliver on ROI expectations.

According to IDC’s spending guide, software that helps with IoT applications and analytics will see a five-year CAGR of 15.3 percent.

IoT: Well begun is only half done

“While organizations are investing in hardware, software, and services to support their IoT initiatives, their next challenge is finding solutions that help them to manage, process, and analyze the data being generated from all these connected things,” said IDC’s Group VP of IoT, 5G, and Mobility Carrie MacGillivray.

This is something that companies with a headstart in IoT implementations have been grappling with over the past year or so.

Truth be told, there are many obstacles to overcome — from data privacy and regulatory compliance to data security and overall network security, and linking up the data to the right systems within the company to deliver the promised operational and strategic benefits.

In the APAC where many companies are charging ahead with IoT find that the biggest concerns arise when evaluating the security of the devices and broader corporate network as a result of introducing the devices.

“Companies are finding that their proof-of-concept projects are revealing wider issues around security and infrastructure that must be addressed in order for them to deploy commercial-scale IoT systems,” IDC ANZ Research Manager Monica Collier said recently.

“To move past the barriers inhibiting production scale IoT, organizations have to solve the broader security and upgrade issues.”

Singapore, on the other hand, being one of the most progressive nations in this region, is working on creating guidelines for IoT cybersecurity for SMEs, large enterprises, as well as government agencies.

Other countries in the APAC, such as Malaysia and Hong Kong too are working on building cybersecurity measures to support IoT development at home.

Overall, although there are some concerns around harnessing the true potential of IoT, there are many vendors and businesses in the APAC and around the world that are exploring the technology and are keen on wide-scale deployments to support their wider digital transformation efforts.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM