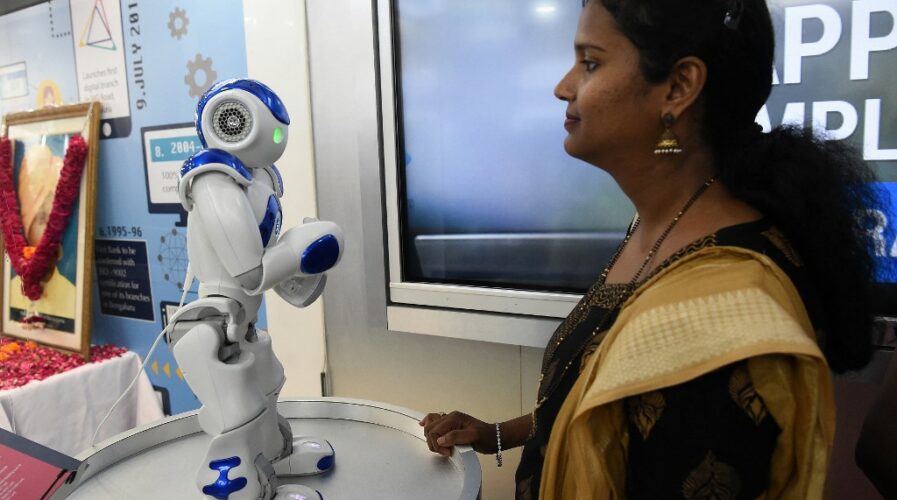

Talking robot “Bro” at a digital banking branch of Canara Bank in New Delhi, India. Source: AFP

83% of Indians trust robots more than humans in finance

2020 was an eye-opening year when it came to financial uncertainty, with the COVID-19 pandemic and the ensuing economic downturn causing people around the world to reexamine the role of money and the people handling it. With a changing dynamic both at home and in the workplace, the shifting financial landscape is causing consumers and business decision-makers in various countries including India to consider allowing robots to manage their personal finances.

The surge in social distancing, business closures, suspension of operations, and the generally changing relationship people had with money, physical or digital representations of monetary value, was adversely changed in 2020, in a new study by enterprise solutions provider Oracle and personal finance expert Farnoosh Torabi.

The study of more than 9,000 consumers and business leaders across 14 countries and found that the COVID-19 pandemic has increased financial anxiety, sadness, and fear among people around the world, reporting that among business leaders globally, financial anxiety and stress increased by 186%, and sadness grew by 116%, while consumer financial anxiety and stress doubled, and sadness increased by 70%.

The stressful financial climate has caused both consumers and business leaders to reevaluate who can be trusted to manage our finances. Included among those 14 countries in the Oracle study is India, where a surprisingly overwhelming share of respondents say they would trust a robot more than a human to manage finances.

Following the pandemic-associated effects of 2020, while 67% of global consumers and business leaders said they would lean towards robots in financial matters more now, a much higher percentage, 83% of Indian consumers and business leaders said they share this belief.

Enterprise decision-makers appear to be greatly shaken up on the subcontinent, with nearly every business leader in India (96%) stating that robots could improve their work processes in a number of ways, such as by detecting fraud (37%), creating invoices (32%), and conducting cost/benefit analysis (30%). In fact, Indian consumers and business leaders appear to favor trusting robots more when it comes to financial services compared to the global average in practically every category surveyed.

For instance, while just over half (56%) of business leaders worldwide believe robots will replace corporate finance professionals in the next five years, about two-thirds (67%) of Indian business leaders believe the same. And while 85% of business decision-makers want help from robots for finance tasks, a whopping 93% of Indian business leaders want assistance from robots for the same, including finance approvals (58%), budgeting and forecasting (49%), reporting (38%), and compliance and risk management (50%).

And it’s not just business leaders, Indian consumers are radically changing the way they view funds heading into 2021, ramping up the need for organizations to rethink how they utilize AI and other new technologies to manage and secure financial processes.

88% of Indian consumers say the pandemic has changed the way they buy goods and services, nearly every Indian consumer (93%) shares the feeling that the events of 2020 have changed attitudes about handling cash, with people now feeling anxious (33%), fearful (39%), and dirty (15%) when in contact with physical cash. Over half (52%) of Indian consumers now say that cash-only is a deal-breaker for doing business.

Businesses have been quick to respond to this change in behavior, with 69% of global business leaders having invested in digital payment capabilities, and 64% of global business leaders creating new forms of customer engagement or changed their business models in response to COVID-19.

But once again the shift is more pronounced in India, where a staggering 93% of Indian business leaders have invested in digital payment capabilities and 81% of Indian business leaders have altered their methods of doing business to adapt to changing consumer attitudes.

READ MORE

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry