FedEx Express promises “attractive” international shipping rates for APAC

FedEx Express, a subsidiary of global transportation giant FedEx Corp., launched the FedEx® International Connect Plus (FICP) yesterday. It promises express international, day-definite, e-commerce shipping service that combines competitive speed with “attractive” prices in the Asia Pacific, Middle East, and Africa (AMEA) regions.

The FICP will be serving e-tailers across ten markets including Australia, Hong Kong, India, Japan, mainland China, Malaysia, Singapore, South Korea, Taiwan, and Thailand.

According to a statement by FedEx Express, online sellers can now provide customers with an international shipping solution with “prices that offer value-for-money”, while ensuring shipments will be delivered within 1 to 5 business days.

e-Commerce market booming across APAC

Whilst improvements in cross-border trade have dramatically improved over the past decade, the Covid-19 pandemic has caused much disruption to supply chains everywhere.

There are, however, some upsides to a world ravaged by the Covid-19 pandemic — the substantial rise of e-Commerce in almost all regions and countries being one of them. Digital retail sales in the Asia-Pacific reached nearly USD $2.9 trillion in 2021, as mainland China and India continue to lead e-commerce sales across the region.

This growth has led e-commerce sellers to adapt and meet consumer expectations in a post-pandemic, digital-first era to reimagine their physical assets and make significant upgrades to their current logistics networks.

Can FedEx Express satisfy consumers?

The FICP offers facilities like tracking, update notifications to receivers, and flexibility to change delivery options. According to the company, online sellers can experience greater savings at competitive day-definite transits, whilst customers can get value for money by choosing pricing options for their specific delivery needs.

Aside from home deliveries, the FICP service also enables e-tailers to give their customers the flexibility to pick up their packages from hundreds of available pick-up locations nearby, as well as the option to change delivery dates and locations.

Furthermore, both online and offline shipping automation solutions are available for e-tailers. With its parcel tracking capabilities, both sellers and customers will be able to have greater visibility of their packages as they move along throughout the journey to their doorstep.

According to FedEx, building a robust e-commerce ecosystem is a top priority. They believe their FCIP can help businesses meet the higher expectations of consumers for reliable and economical delivery services.

“By providing businesses with a broader range of shipping solutions, we help them accelerate their cross-border e-commerce offerings and connect to more online shoppers across the Intra-AMEA markets”, said Kawal Preet, president of the Asia Pacific, Middle East, and Africa (AMEA) region at FedEx Express.

Logistical challenges and increasing consumer expectations

Due to the distance and logistical as well as customs hurdles involved in international deliveries, shipping fees can run very high, especially to and from APAC and the rest of the world. As such, businesses, especially SMEs, are increasingly looking for more diversified, cost-effective solutions to meet consumers’ ever-changing needs, especially in cross-border, trade-heavy Asia-Pacific.

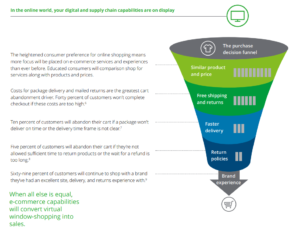

According to Deloitte, consumers today prioritize not just products but a holistic, end-to-end shopping experience. Shipping costs and delivery options are two of the most significant drivers of cart abandonment – about 40% of consumers won’t complete checkout if the delivery costs are too high. Another 10% will abandon their cart if a package cannot be delivered on time or if the delivery time is unclear.

The heightened consumer preference for online shopping means more focus will be placed on e-commerce services and experiences than ever before. (IMG/ Deloitte)

This, then, may alienate a substantial portion of the 4.3 billion consumers in the Asia Pacific, most of whom are in emerging Asian markets that suffer from weaker currencies. Nevertheless, the number of consumer trade from APAC and elsewhere is still increasing.

Furthermore, with the easing of trade restrictions and implementation of new regulatory initiatives in the region such as the ASEAN Customs Transit System and the Regional Comprehensive Economic Partnership, trade cooperation will see continued uptake and further strengthen inter-Asia trade.

FedEx Express — a strong competitor for the rest?

FedEx’s newest offering comes on the heels of their competitor, UPS, which expanded domestic services in Malaysia early this year.

From as early as 2016, the other US delivery giant DHL started up its e-Commerce arm to boost local last-mile delivery services. They are currently operating in a few SEA markets such as Thailand and Malaysia.

Whilst DHL and UPS have targeted local markets here, it remains to be seen if FedEx Express will expand its presence by going for local, last-mile logistics in e-Commerce heavy markets such as China and Southeast Asia.

In the supply chain, air freight is often considered the fastest mode of travel. However, these moves by DHL and UPS appear to be on the back of increased interest and uptake of road, instead of air freight in Southeast Asia.

More businesses are now seeing road freight as a more convenient route as well, thanks to new capabilities and features provided in the road freight industry.

Nevertheless, this development from FedEx may hint at more exciting times ahead in the logistics industry across the Asia Pacific.

With new players such as FedEx coming on board, competition is heating up for not just international brands, but for local and regional logistics SMEs as well.

All these, of course, will augur well for not just their e-merchant clients, but for customers looking for affordability and choice when selecting a delivery service for their online purchases.

Seizing new opportunities in a changing supply changing landscape will be key to SME survival, and these include digitized solutions that can help accelerate growth or ways to help small businesses pivot towards a different, lucrative vertical.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM