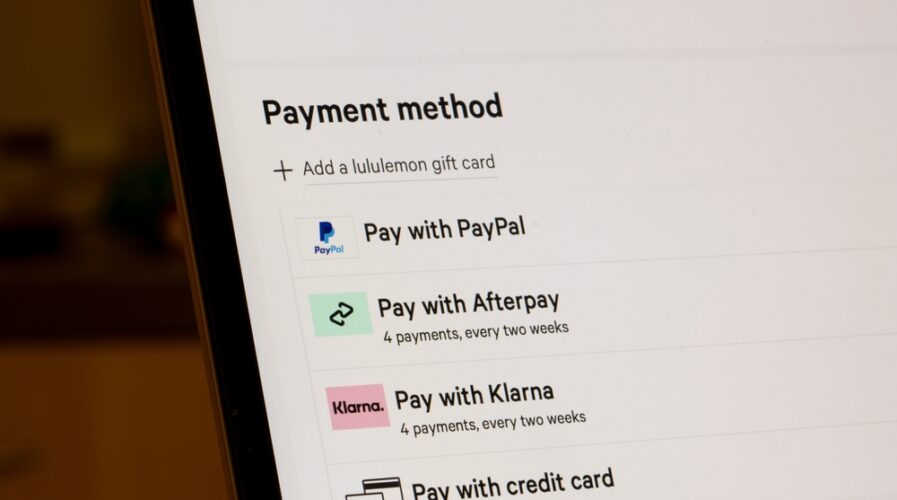

Global buy now pay later users may soon reach a billion mark, Juniper Research shows.(IMG/Shutterstock)

Does buy now pay later prey on the vulnerable?

Buy now pay later (BNPL) is a trend that’s been taking the world by storm in recent times — and the Asia Pacific isn’t exempt.

The concept of BNPL is simple — it allows the consumer to defer payments into installments that can be repaid over anywhere from one to 12 months, depending on the provider.

It is hardly a novel or new concept. Banks offer this with credit cards, and large retailers that sell expensive items (e.g. furniture) often offer installment plans as well.

Before banks, small retailers have been using this for regular customers they trust to be able to “pay later” for purchases.

Traditional banks vs buy now pay later

Although both services offer installment payment schemes, one difference is that both target different (debt) markets.

Credit cards provided by banks are marketed to those who can demonstrate (or seem capable of demonstrating) responsible debt repayment. Credit card owners also enjoy perks such as rebates, cashback, or points that can be redeemed for items.

This decision is informed by their creditworthiness (via their credit score), where they are able to show stable income generation and the ability to repay, which banks determine through risk assessment.

The risk assessment process is designed to gauge the probability of the bank’s financial loss resulting from a borrower’s failure to repay a loan or debt. The lower one’s risk of failure to repay a debt, the higher their odds of getting a loan or credit card approved.

BNPL, however, starts “from scratch” and a customer’s eligibility isn’t based on their credit score. As such, BNPL providers will build their own customer’s “credit score” based on their usage of the BNPL service, as well as their purchasing behavior and other behaviors within the provider’s ecosystem.

Buy now pay later customers can include those who are eligible for credit cards but they primarily target the underbanked or unbanked. Asia, in particular, is a particularly lucrative market due to the high amount of unbanked and underbanked consumers.

Differences in service accessibility

Traditional banking facilities such as credit cards or loans are strictly regulated by the financial authorities of the countries they operate in, which means they can be held responsible to an extent.

This allows banks to tap into the appropriate segments of the consumer debt market, in a somewhat more responsible manner.

As the ability of customers to use these facilities is predicated on their creditworthiness, they are notoriously difficult to access for the unbanked and underbanked.

They include college students; fresh graduates who have started a new job; those with unstable incomes (e.g. gig workers), lower-income earners, MSME owners, and others.

This makes buy now pay later services particularly attractive to those who wish to make purchases, especially high-value ones, but lack the cash or the credit facilities to do so.

Read the fine print

Banks are required to be upfront about fees related to installment plans. However, BNPL services regularly tout 0% installment fees, which may appear very attractive at first.

However, there is a caveat — failure to repay these installments will come with fees for late payment.

As BNPL providers are often not treated as financial institutions, they do not need to abide by financial laws and regulations that their banking counterparts are subjected to.

This may lead to abuse, as many BNPL platforms may or already charge exorbitantly for late repayment. Thus, the unaware customer may end up paying more in the end as compared to using a credit card — if they can’t repay in time.

Although BNPL doesn’t require a credit score, some providers may report missed payments to credit report agencies, which may affect one’s credit score.

The reverse, however, is not true — even if you are a good paymaster for your monthly installments. It has yet to be shown that BNPL platforms will report good payment history to boost one’s credit score.

The consumerism ecosystem

Unlike credit services by banks, buy now pay later services are exclusively and specifically embedded within retail ecosystems. Conversely, banks operate and market their services in a more independent manner, although virtually all still do partner with specific merchants to offer attractive promotions.

This may sound innocent enough on the surface, but one ought to consider that these services are deeply enmeshed in a culture of rampant consumerism. And especially given how the pandemic has forced many to be online more often, it may spell trouble for the consumer.

In fact, just being on an e-Commerce platform itself may be too tempting to avoid, say, impulse purchases, or commitment to purchases that the customer may not be adequately capable of paying off.

This rampant consumerist culture — an ecosystem, if you will — is strongly supported by sales techniques such as regular promotions.

Examples include Black Friday, seasonal/holiday sales, Payday sales, and particularly in Asia, the popular double-double sales (e.g. 10.10, 11.11, etc.).

The predator’s toolset?

The promotion of (excessive) consumerism is one part of the predatory nature of the consumer retail industry, be it online or offline. The other is that marketing — and the psychology behind it — are neither regulated nor controlled in any way.

Taken on its own, conventional predatory marketing has traditionally been gatekept by hindrances to payment, or geographical limitations (think non-online payments or in-store promotions far from your residence).

Virtually all online retail platforms utilize data analytics and AI to understand their customers better. The goal is to provide targeted and personalized recommendations to customers in order to compel them to make purchases on their sites.

BNPL providers do the same thing, and most consumers do not realize how their data is being captured and used.

So this may make it even more difficult for customers to resist the onslaught of aggressive digital marketing, including push notifications, and monthly promotions as the products recommended to them naturally appeal greatly to them. Coupled with frictionless payments such as BNPL, the decision to commit to purchases will be far more likely.

Is buy now pay later a debt trap?

The pandemic has greatly affected the financial capabilities of many an individual, especially the young, the lower-wage earners, or the financially illiterate.

That, together with the aggressive and sometimes irresponsible way retailers promote their products, the targets of BNPL may find themselves in a more precarious financial situation.

The lack of online payment friction, aggressive and unregulated marketing tactics, personalized recommendations, the ease and convenience of shopping online are all engineered to increase sales.

And now, the ability to access purchases once previously out of reach, as well as increased BNPL service uptake by merchants works in tandem to enhance and ease the process of converting window shoppers into paying customers.

And when your customer base includes those who traditionally cannot afford bigger or more purchases for whatever reason, the temptation to indulge in purchases is likely to be more difficult to resist.

Where they previously were not part of the consumer debt market, they are now exposed to this form of debt — something which particularly vulnerable segments should be protected from.

So while buy now pay later may be able to enable the purchase of essential items for those who cannot afford them, it also comes with the risks of expenditures that they may not be able to pay off — a debt trap they cannot get out of when fees escalate.

Of course, some segments will deem these consumers “financially irresponsible”.

But are these purchases truly, fully a result of irresponsible financial management?

Or are the vulnerable caught in the buy now pay later debt trap victims of intelligently-engineered practices by predators armed with data and consumer psychology?

The debate remains.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM