(Photo by JOE RAEDLE / GETTY IMAGES NORTH AMERICA / Getty Images via AFP)

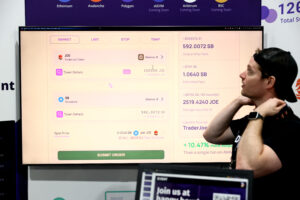

DeFi ecosystems report US$ 10.5 billion losses in 2021

Decentralized Finance or DeFi is becoming increasingly popular as a fast get rich scheme to many investors. Unfortunately, many of these investors have very little or knowledge of how DeFi ecosystems work.

According to a new report by Elliptic, a firm that tracks movements of funds on the digital ledgers that underpin cryptocurrencies, growth in the use of DeFi over the past two years has been staggering. In fact, the total capital locked in DeFi services has grown by over 1,700% to $247 billion in the past year alone. While the figures are promising signs for investors, the reality is, the losses are also high.

Elliptic’s report shows that the same openness and innovation that makes DeFi so powerful also brings with it new risks. As the underlying technology is still in its early days, hackers have been able to compromise it to steal users’ funds. At the same time, the deep pools of liquidity have allowed criminals to launder the proceeds of crimes such as ransomware and fraud.

This is part of a broader trend in the exploitation of decentralized technologies for illicit purposes, which Elliptic refers to as DeCrime. The report highlighted that DeFi users and investors have suffered more than $12 billion in losses due to theft and fraud. These losses are accelerating, with losses totaling $10.5 billion in 2021 to date, up from $1.5 billion in 2020.

(Photo by JOE RAEDLE / GETTY IMAGES NORTH AMERICA / Getty Images via AFP)

For Gunnar Jaerv, co-founder and COO of First Digital Trust (FDT), a Hong Kong-based trust and custodian, it’s no surprise that the need for crypto regulations has increased given that DeFi crime has risen quite significantly in the past year.

With a TVL of $104 billion in DeFi, this space has grown to be more lucrative and attractive to not just investors but criminals as well. Crypto regulations are inevitable and necessary to help protect investors.

“We have seen through natural selection that as the crypto industry matures, it is the companies that comply with security regulations that thrive. For those who refuse to comply, they are not only putting themselves at risk but their consumers at risk too. Crypto companies can minimize data leaks by implementing proper security infrastructures such as network firewalls and vulnerability scanning,” explained Gunnar.

Meanwhile, Antoni Trenchev, Co-Founder of Nexo, the leading regulated financial institution for digital assets, believes the noise around DeCrime growing is not 100% on point. He felt that it’s being measured mostly based on how much funds have been stolen. While the rise is concerning, Anotoni pointed out that the scaling of the decentralized finance industry isn’t being taken into account. Proportionally to how much money is now in DeFi, DeCrime hasn’t actually risen as drastically as suggested.

“Since October 2020, the total value locked in DeFi has grown 40 times to over $250 billion. Simultaneously, the funds funneled away through illicit activity in late 2020 amounted to roughly $1.5 billion, while this year, it increased to a little over $10 billion. The roughly 10x DeCrime increase is about four times smaller than the growth of DeFi’s TVL, so it may not necessarily be that this subset of crime is on the rise but that the losses are simply larger because there are far more funds locked in DeFi to steal,” said Antoni.

Antoni also reiterated that the solution wouldn’t be to abstain from DeFi, though. He felt that the opposite needs to happen, which is to keep innovating to create a safer space.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM