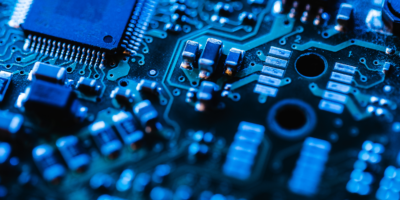

Semiconductor industry faces another snag with rising raw material prices. (Photo by JENS SCHLUETER / AFP)

Semiconductor industry faces another snag with rising raw material prices

- Players in the materials industry are struggling with how much cost burden they would be able to convince semiconductor customers to share with them.

- Showa Denko KK, which supplies essential chip fabrication materials to some of the world’s largest chip makers, said it is raising prices further to cope with a tough market.

- The situation is unlikely to significantly improve until at least 2023.

As we transition into the second half of the year, outlook over the global semiconductor industry remains somber for a myriad of reasons. Just a few weeks ago Tech Wire Asia (TWA) reported about the ‘lack of chips to make chips’ that is dragging down the sector at this point, extending the recovery period required to recover by another year. Now, the materials industry has come forward to share that they are struggling to keep costs under control and will be left with no choice but to raise prices further to their clients that include the world’s largest chip makers.

In a report by Bloomberg, Japanese chemicals supplier Showa Denko K.K. who’s key clients includes Taiwan Semiconductor Manufacturing Co and Infineon Technologies AG, said that the supply snarls caused by the pandemic, the surging energy cost due to Russia-Ukraine conflict and the yen’s dramatic weakening is making the situation harder for them.

On top of at least a dozen hikes done this year so far, Chief Financial Officer Hideki Somemiya told Bloomberg News in an interview that he expects to further raise prices this year. The company will also cut back unprofitable product lines. What’s worse, Somemiya said the situation is unlikely to significantly improve until at least 2023, echoing SEMI’s outlook shared by TWA recently.

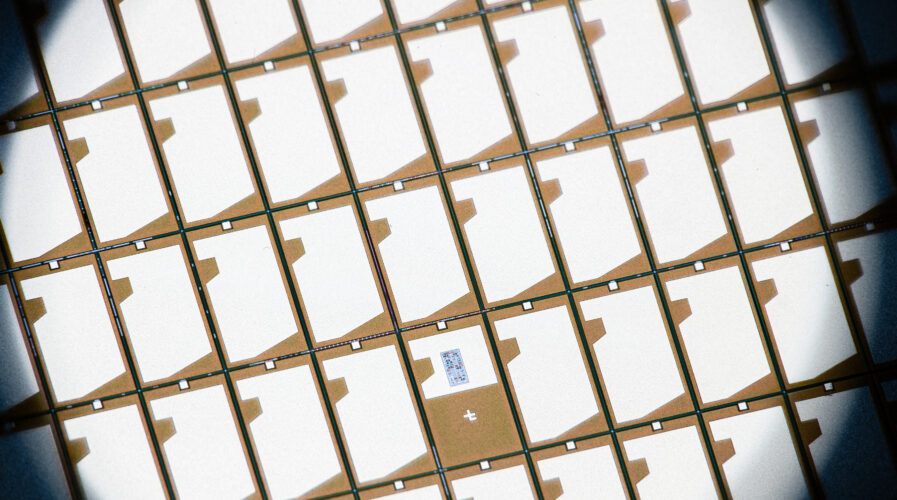

The Tokyo-based Showa Denko, which supplies essential chip fabrication materials to some of the world’s largest chip players, has been forced to drastically increase the cost it passes on to customers, according to Somemiya. Considering the fact that it is a key supplier of the chemicals used early in the production chain by chipmakers and other manufacturers like Toyota Motor Corp, Showa Denko price hikes could potentially squeeze margins or pressure customers to follow suit.

“A big theme this year common to all the players in the materials industry is how much cost burden we’d be able to convince customers to share with us. The current market moves require us to ask twice the amount we had previously calculated,” Somemiya said. Apparently, Showa Denko has started terminating the sale of certain commodity products and contracts with customers where it doesn’t see the potential to carry on business profitably.

Even chipmakers like TSMC and Samsung Electronics Co. have notified their own customers of their intentions to raise prices, TWA has reported. Quoting Toyo Securities analyst Hideki Yasuda, Bloomberg in its report said other component makers and materials suppliers have been making similar moves to cope with the tough market. Eventually, consumers of durable goods like electronics won’t be spared higher price tags further down the road, Yasuda added.

To recall, in mid 2021, the lingering chip shortages caused the world’s biggest contract chipmaker, Taiwan’s TSMC, to hike its prices on chips made using its N7 and N5 process technologies by 10%, while prices of older N16 and thicker nodes grew 20%. Earlier this year, TWA reported that TSMC was considering increasing chip prices by up to 9% starting from 2023, but a most recent report by DigiTimes indicates that the world’s largest contract maker of semiconductors plans to increase prices for most of its fabrication processes by only 6% starting from January 2023.

However, TSMC isn’t alone — in fact, even the second-largest firm in the semiconductor market Samsung, the world’s largest memory chip maker and the second largest contract chip manufacturer after Taiwan’s TSMC, is reportedly planning to increase prices of production, Apparently Samsung is discussing with foundry clients about charging as much as 20% more for making semiconductors this year.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM