Chip makers are bracing themselves for the worse downturn in a decade(Source – Shutterstock)

Chip makers are bracing themselves for the worse downturn in a decade

- Fading tech demand and rising interest rates are hampering the outlook for major chip makers across Asia.

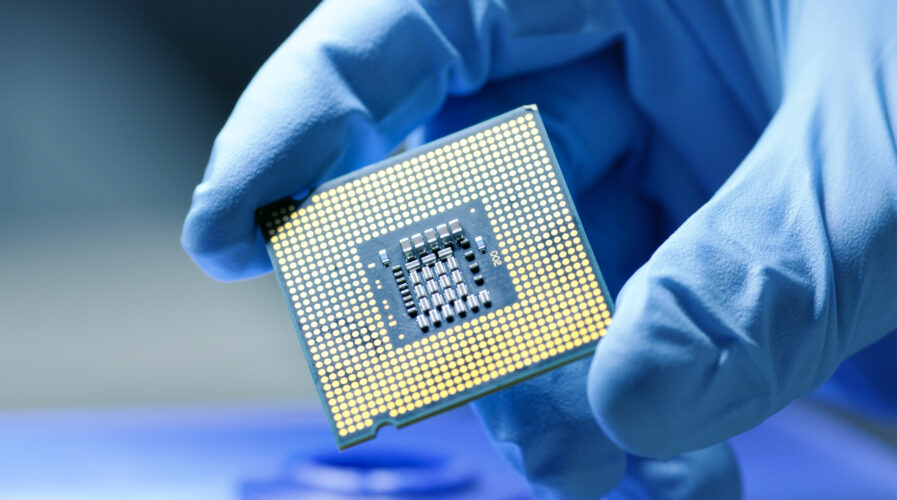

- Major chip manufacturers Micron Technology Inc, Nvidia Corp, Intel Corp and Advanced Micro Devices Inc. have warned of weaker export orders.

- Even Gartner Inc. predicts an abrupt end to one of the industry’s biggest boom cycles.

We are currently at a juncture where chip shortages are abating (at long last). Semiconductor supplies are rising, demands are easing and at the surface, that paints a rosy picture for chip makers. The reality however is far from that. Gartner Inc, in its latest report, highlighted that the global semiconductor market is actually entering a period of weakness and to make it worse, it is expected to persist through 2023. Even chip players can vouch for that outlook and a lot of that is due to rising inflation, taxes and interest rates, paired with higher energy and fuel costs — all which are putting pressure on consumer disposable income.

Over the last few weeks, major chip manufacturers like Micron Technology Inc. Nvidia Corp, Intel Corp, and Advanced Micro Devices Inc. have warned of weaker export orders. Even South Korean behemoths including Samsung Electronics Co. and SK Hynix Inc. have signaled plans to dial back investment outlays, and the sentiment is similar with the world’s biggest contract chip maker, Taiwan Semiconductor Manufacturing Co.

Personal computer makers, some of the biggest buyers of chips, felt it first. Then desktop processor shipments dropped to their lowest level in nearly three decades in the second quarter, according to Mercury Research. Total processor shipments experienced their largest year-over-year falloff since about 1984 — and these are just few indicators of a typical boom-to-bust cycle.

“We are already seeing weakness in semiconductor end markets, especially those exposed to consumer spending,” Gartner’s practice VP Richard Gordon, said in a report recently, adding that an abrupt end to one of the industry’s biggest boom cycles is looming. The research firm even slashed its outlook for revenue growth to just 7.4% in 2022, down from 14% seen three months earlier. The revenue is predicted to fall further by 2.5% in 2023.

Echoing Gartner, Citigroup Inc analyst Christopher Danely also noted that “We continue to believe we are entering the worst semiconductor downturn in at least a decade, and possibly since 2001 given the expectation of a recession and inventory build.” The warning from Micron came after disappointing results from Nvidia, Intel and Advanced Micro Devices.

Referring to the speed with which demand is evaporating, Micron said orders have deteriorated since the company last gave an update just over a month ago. While the personal computer market had already been in a slump, the weakness in demand is now spreading widely. “Compared to our last earnings call, we see further weakening in demand because of adjustments broadening outside of just consumers to other parts of the market including data centers, industrial and automotive,” Chief Executive Officer Sanjay Mehrotra said in an interview with Bloomberg Television.

Notably though, not all companies are getting enough chips. For instance, Toyota said its ability to secure semiconductors will remain unpredictable, as it kept a conservative profit outlook for the current year. Separately, PC giant Lenovo Group’s CEO Yang Yuanqing during an earnings call recently indicated that supplies were still mixed.

At the same time, weaker-than-expected consumer demand in China could also cause a meaningful downshift in demand for large technology categories such as iPhones or automotive. For context, the Chinese government data this week showed that output of integrated circuits plunged 17% in July after robust growth in 2021, reflecting supply chain shocks as well as a tapering in demand for lower-end chips from the world’s biggest semiconductor market.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM