Gartner: The semiconductor bust is looming as sales tapers off. Source: Michael M. Santiago/Getty Images/AFP (Photo by Michael M. Santiago / GETTY IMAGES NORTH AMERICA / Getty Images via AFP)

Gartner: The semiconductor bust is looming as sales tapers off

- Even as chip shortages abate, the global semiconductor market is entering a period of weakness, due to weakened sales, which will persist through 2023.

- Gartner noticed weakness in semiconductor end markets, with lower spending on electronic products especially PCs and smartphones.

- Among industry players, inventories are recovering rapidly, lead times are beginning to shorten, while prices are starting to weaken, Gartner shares.

Early last month, data on global PC shipments were released by Gartner Inc, highlighting the sharpest decline the segment has seen over the last nine years. Worldwide PC shipments in the second quarter this year fell 12.6% year-on-year, mainly due to “geopolitical, economic and supply chain challenges.” For a market that has recorded stellar growth over the last two years, a decline would eventually reduce the sector’s demand for relevant components–including chips.

A month after its forecast on the continued decline of the global PC market, the global technology research and consulting firm shared its outlook on the global semiconductor industry. It is apparent now, at least from the data gathered and shared by Gartner, the chip industry is in for a bust, as sales on consumer-end segment records gradual monthly declines since the first quarter of this year.

At this point, countries around the world are battling with higher energy and fuel costs leading to rising inflation, taxes and interest rates, putting pressure on consumer disposable income. That in turn, as Gartner puts it, has affected spending in common electronic products such as PCs and smartphones, dragging down the semiconductor industry that has yet to fully emerge from the global shortage conundrum.

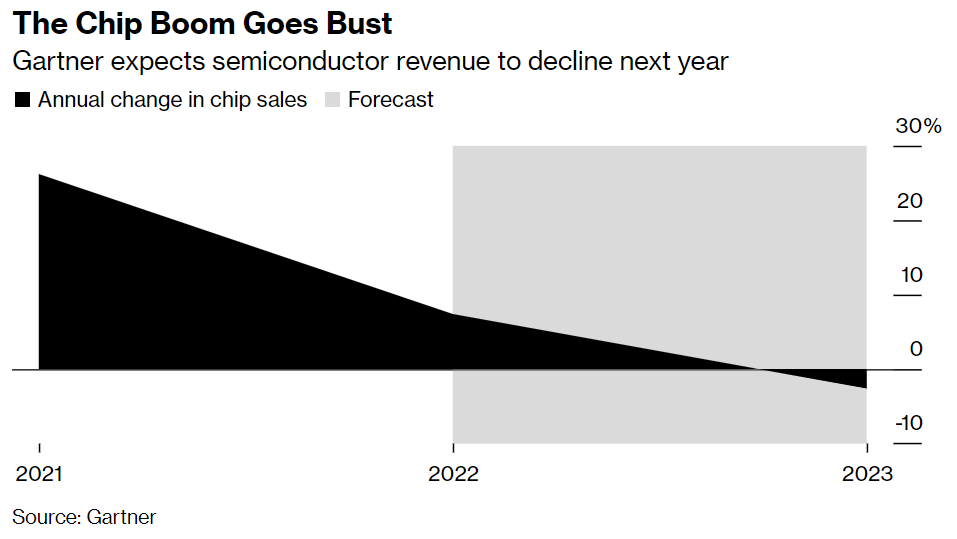

The slowdown in sales means the industry’s most historic boom cycle is coming to an end. In fact, Gartner notes that chip sales are growing much more slowly than expected and the growth rate’s inevitable decline will be more apparent as we move into 2023. “Although chip shortages are abating, the global semiconductor market is entering a period of weakness, which will persist through 2023 when semiconductor revenue is projected to decline 2.5%,” Gartner’s Practice VP Richard Gordon said.

Though fortunately from an enterprise perspective, inventories are recovering rapidly, lead times are beginning to shorten, and prices are starting to weaken, global semiconductor revenue is projected to grow by a mere 7.4% this year. That’s a far cry from the 2021 growth of 26.3%, according to Gartner. “This is down from the previous quarter’s forecast of 13.6% growth in 2022,” it added.

Source: Bloomberg’s chart from Gartner’s data

In simple words, the global chip shortage is ending but sales, especially in the consumer-centric segment, are tapering. “We are already seeing weakness in semiconductor end markets, especially those exposed to consumer spending. Rising inflation, taxes and interest rates, together with higher energy and fuel costs, are putting pressure on consumer disposable income. This is affecting spending on electronic products such as PCs and smartphones,” Gordon said.

Overall, Gartner reduced its 2022 global semiconductor revenue forecast by a staggering US$36.7 billion, to US$639.2 billion, as economic conditions are expected to worsen through the year. “Memory demand and pricing have softened, especially in consumer-related areas like PCs and smartphones, which will help lead the slowdown in growth,” Gordon emphasized.

How much will the consumer-related segment slow down?

PC shipments are expected to decline by 13.1% this year, after recording impressive growth in 2020 and 2021. In fact, the demand, since the start of this year, has been on a downward trajectory, eventually leading to the sharpest decline in the worldwide PC shipments by the second quarter of this year.

In a report on July 11, Gartner’s research director Mikako Kitagawa said “The decline we saw in the first quarter of 2022 has accelerated in the second quarter, driven by the ongoing geopolitical instability caused by the Russian Invasion of Ukraine, inflationary pressure on spending and a steep downturn in demand for Chromebooks.”

He also added that even as supply chain disruptions continued, the major cause of PC delivery delays changed from component shortages to logistics disruptions. Enterprise buyers continued to experience longer PC delivery times than usual, but the lead times began to improve by the end of the second quarter, partially because key cities in China reopened in the middle of the quarter.

Now, Gartner predicts semiconductor revenue from PCs for the entire year will decline by 5.4% As for sSemiconductor revenue from smartphones, it is on pace to slow to 3.1% growth in 2022, compared to 24.5% growth in 2021. “The semiconductor market is entering an industry down cycle, which is not new, and has happened many times before,” said Gordon.

Data center market on the other hand, will remain resilient for a longer period of time, the consulting firm said, attributing it to continued cloud infrastructure investment. Even the automotive electronics segment is expected to continue to record double-digit growth over the next three years as semiconductor content per vehicle will increase due to the transition to electric and autonomous vehicles.

READ MORE

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry