Global buy now pay later users may soon reach a billion mark, Juniper Research shows.(IMG/Shutterstock)

Global buy now pay later users may soon reach a billion mark, Juniper Research shows

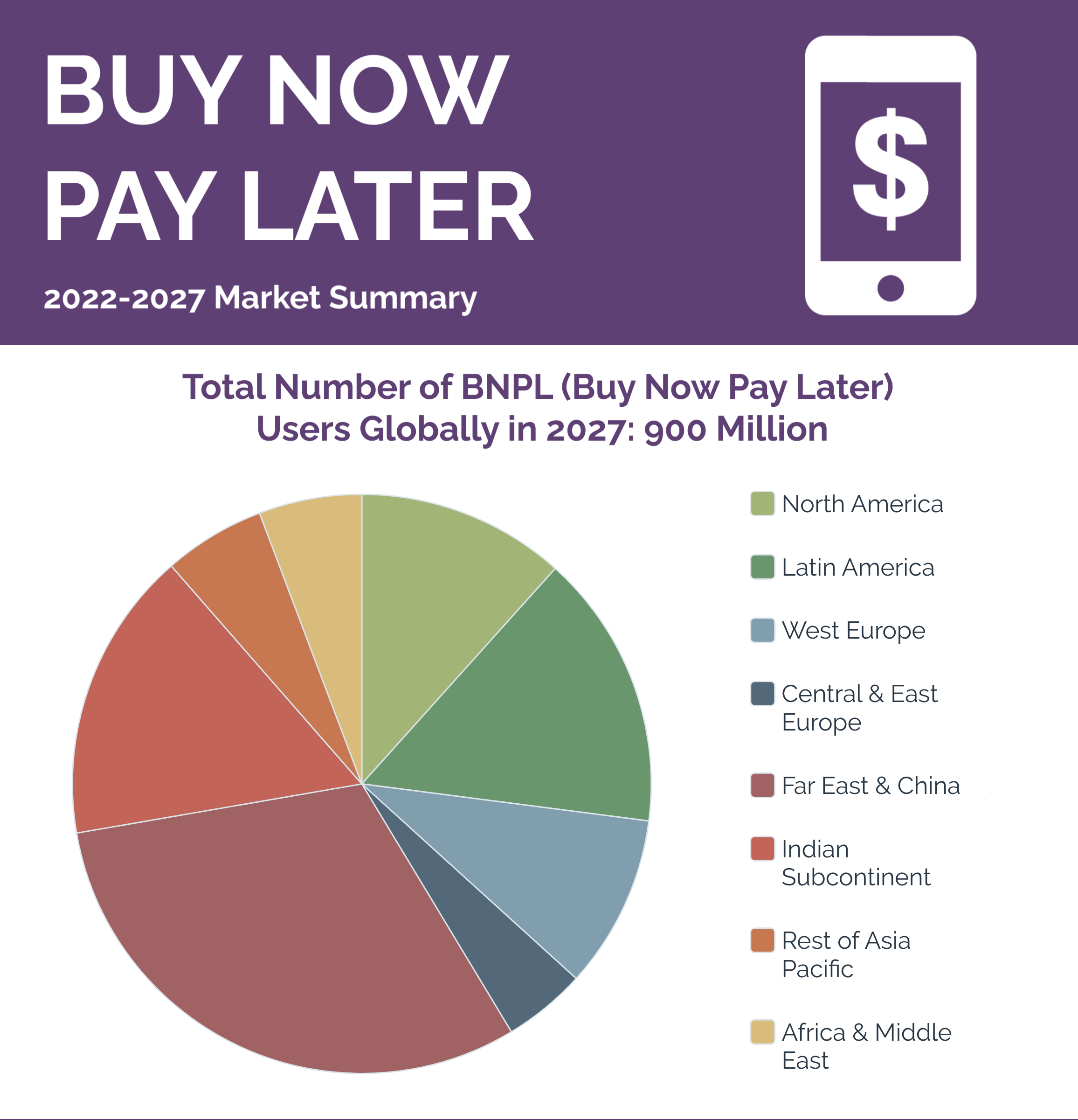

- Juniper Research has predicted that the number of buy now pay later users will surpass 900 million globally by 2027; increasing from 360 million in 2022.

- The increase will be driven by the anticipated economic downturn, which will increase the demand for low-cost credit solutions.

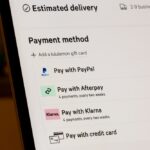

Buy now pay later, a short-term finance solution that enables consumers to pay for goods and services usually in interest-free installments, has been a growing force in the e-commerce industry, especially since the pandemic. It is fast emerging as a popular payment method globally, especially Asia, and Juniper Research predicts that globally, buy now pay later users will surpass 900 million by 2027.

The payment scheme has been a highly attractive alternative to credit cards, especially considering how it does not require hard credit checks. The 157% growth expected in the next five years, from 360 million users this year, will be driven by the anticipated economic downturn, Juniper said, which will increase the demand for low-cost credit solutions. To top it off, an increasing number of merchants are accepting this payment method; making it easier to access for consumers than traditional credit.

Projected number of BNPL users globally in 2027.

Source: Juniper Research

The study by Juniper also identified India as particularly having potential for rapid growth in buy now pay later payment methods, with Indian users predicted to grow from 25 million in 2022 to 116 million by 2027. According to Juniper’s analysis, this situation is due to rising e-commerce usage and growing interest in international goods available through online retailers among Indian consumers.

Therefore, the research arm recommends that BNPL vendors in the developed world build strategic partnerships with vendors in developing markets with established consumer bases, to successfully capitalize on this user growth and associated revenue. In fact, some of the biggest players in the BNPL space with the highest expected growth potential are in India.

As previously reported by Tech Wire Asia, Indian research firm Redseer reckons that India’s buy now pay later industry is thriving and is set to surge over ten-fold within four years — mainly because of the tens of millions of online shoppers the country has. In fact, Redseer estimates India’s buy now pay later market will rocket to US$45-50 billion by 2026 from the current value of US$3-3.5 billion.

To top it off, the research firm also estimates that the number of buy now pay later users in the country may rise and reach between 80 to 100 million customers by then, from 10 to 15 million currently. It will, however, take the sector some time to disrupt the cards market and snatch more market share considering how the maximum credit currently being offered on BNPL is 100,000 rupees (US$1,347.89), much lower than credit card offers.

Virtual cards to further boost buy now pay later usage

Juniper’s study also predicts that the adoption of virtual cards, where digital-only cards are used for purchases, will increase the usage of buy now pay later solutions globally. “This is because virtual cards only require retailers to accept card payments – overcoming previous limitations on buy now pay later growth,” Juniper said.

The study added that the advancement of virtual cards allows buy now pay later offerings to compete with credit cards, particularly in-store, where single-use BNPL cards can be used within a digital wallet to complete contactless transactions. Juniper recommends that in order to compete in this competitive landscape, BNPL vendors must differentiate their services, including by offering virtual cards, browser extensions that automatically facilitate buy now pay late payment services, and digital loyalty program.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM