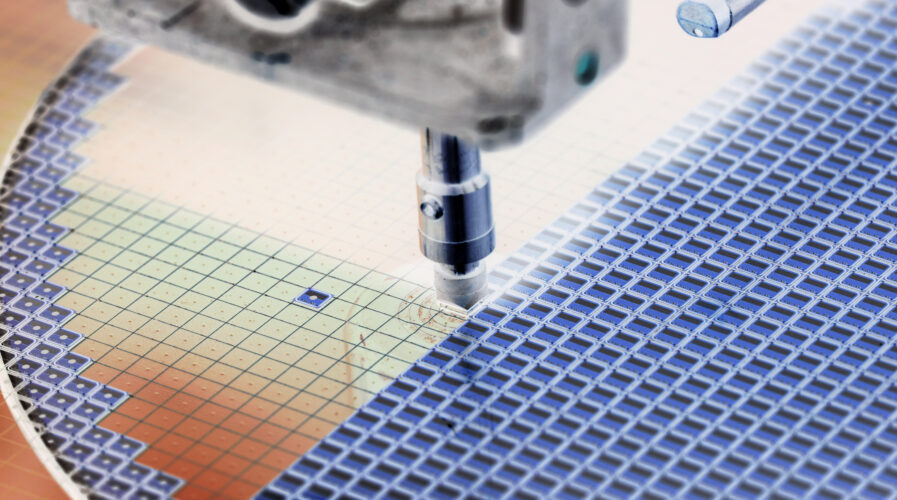

The rise of third-generation semiconductors.(Source – Shutterstock)

The rise of third-generation semiconductors

- The third-generation semiconductors has materials like GaN and SiC, a must-have technology for many manufacturers at this point of time.

- They are suitable for high temperature, high frequency, radiation resistant and high power devices like electric vehicles, data centers, and renewable energy production.

In the last few decades, semiconductors have evolved from the first to third generation as technology advancement phases out traditional semiconductors deemed as less effective in high power applications. At present, the materials with the most development potential are Wide Band Gap (WBG) semiconductors, which falls under the third generation category — presenting far superior physical properties that replace the first and second generation materials.

For context, the material of first-generation semiconductor is known as silicon (Si) and Germanium. However, their properties limited their use in optoelectronic, high-frequency and high power devices. As for the second generation, Gallium Arsenide (GaAs) and Indium Phosphide (InP) were mainly used but they were scarce, expensive and toxic thus limiting their usage.

The most recent is the third generation semiconductors that were made using Gallium Nitride (GaN) and Silicon Carbide (SiC) and suitable for making high temperature, high frequency, radiation resistant and high power devices. SiC is precisely suitable for applications such as energy storage, wind power, solar energy, EVs, new energy vehicles (NEV) and other industries that utilize highly demanding battery systems.

GaN on the other hand is suitable for high-frequency applications, including communication devices and fast charging for mobile phones, tablets, and laptops. Compared with traditional fast charging, GaN fast charging has higher power density, so charging speed is faster within a smaller package that is easier to carry. These advantages have proven attractive to many OEMs and ODMs and several have started rapidly developing this material.

According to research by TrendForce, the SiC power semiconductor market is estimated to reach US$3.39 billion by 2025 while the GaNmarket is estimated to reach US$1.32 billion within the same period. Overall, TrendForce estimated that the output value of third generation power semiconductors will grow from US$980 million in 2021 to US$4.71 billion in 2025, with a CAGR of 48%.

Key advantages of third generation semiconductors

In a report by Vertex Holdings titled “Third-Generation Semiconductor: The Next Wave?” the venture capital firm shared five key advantages of the latest generation of semiconductors. Firstly, due to its SiC component, they have higher bandgap which then allows for higher power efficiency, better thermal performance, and higher frequency. SiC also means the third-generation semiconductors have higher thermal conductivity which allows for faster heat transfer; and higher saturation velocity for higher current and higher frequency.

The GaN on the other hand allows for high breakdown strength which then allows for higher voltage and more compact; and higher melting point which translates to higher power. Although chip players have now developed into the third-generation semiconductor materials, the first and second generation semiconductor materials have not been eliminated and are still widely used.

However, as experts put it, the third generation of wide bandgap semiconductor materials has more advanced properties, which can break through the development bottleneck of the first and the second generation semiconductor materials. Eventually, with the development of technology, the third generation is expected to completely replace the first and second generation semiconductor materials.

Over the last two years, the US-China trade war and the pandemic slowed down the third-generation semiconductor market worldwide. However, analysts reckon this segment has entered a rapid upturn owing to high demand from automotive, industrial, and telecom applications since last year. In fact, the GaN power device market, in particular, will undergo the fastest growth, with a US$61 million revenue, a 90.6% increase over 2020, according to a survey by TrendForce.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM