All banks, regardless of size, felt the biggest gaps they had to make up for lies in data and analytics. (Source – Shutterstock)

How banks can achieve digital maturity

Article by Joe Ong, Vice President, and General Manager ASEAN, Hitachi Vantara

For banks and financial institutions, it’s a simple equation: the calculus of who gets the new customers increases revenue the fastest and improves efficiency the best will be determined by who can achieve digital maturity first. However, banks are also all too aware there is still a huge gap between getting the answer they want, and their ability to get that working.

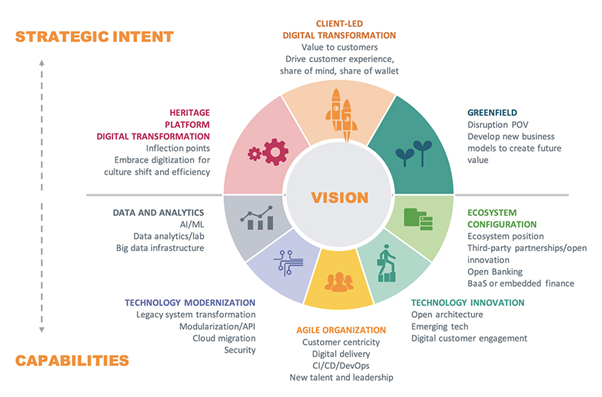

In a study on digital maturity in banking by Celent, a research and advisory firm focused on technology for financial institutions, banks were asked to self-assess their intended strategic intent against their current technical capability. All institutions agreed with the proposition that they needed to grow in several areas: modernizing technology, developing an agile organization, innovating technology, and creating the right ecosystem.

(Source – Hitachi Vantara)

All banks, regardless of size, felt the biggest gaps they had to make up for lies in data and analytics.

“Data has always been important, but it’s especially important today because of the changes that we’re seeing both from the customer perspective, and the rise of different sorts of intelligent technologies,” explained Thomas de Souza, Hitachi Vantara Global CTO, Financial Services.

How to help banks build a cloud-ready digital core

Companies looking to embark on a cloud-ready journey are encouraged to take advantage of assessment tools by their cloud service provider to measure their current maturity level and receive a customized report in return. Organizations can build a cloud-ready digital core, replete with cloud-native applications with Storage as a Service (StaaS) solution. Layered on top of that is high-performance data management, implemented by optimizing the data fabric with DataOps and taking advantage of technologies such as AI.

Financial institutions need to comply with a multitude of banking regulations and incorporate compliance-by-design to improve resiliency. When done correctly, it can help firms achieve competitive agility with innovative data management strategies, by delivering technology projects faster and doing so with accessible yet secure data-driven insight capabilities.

Modernizing a finance system

A large national distributor of building industry materials managed to find solutions that met their needs. They wanted to modernize their finance system to improve productivity while putting them in a position to comply with the regulatory and commercial challenges of the future. Many of their current processes were manual and time-consuming, with teams having to manually format their datasets.

After consulting with Hitachi Vantara, the distributor now has an ERP solution that gives a complete overview of their business. Information will be available at a click of a button, instead of spending hours collecting data manually.

Understanding before investing

For all the impressive advances that technology brings, the Celent report highlights that the real drivers for success are human in nature, not digital, and its recommendations include having a concrete use case or a problem that needs to be solved, while simultaneously keeping the big picture in mind.

Perhaps the biggest takeaway is the importance of properly understanding what the value is for the customer before investing. “The opportunity is beyond revenue because it could be efficiency, cost reduction and increases in control,” said de Souza. “These are all important components of running a bank.”

The views in this article is that of the author and may not reflect the views of Tech Wire Asia.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM