(Source – Shutterstock)

China’s decline in smartphone sales a wake up call to the industry

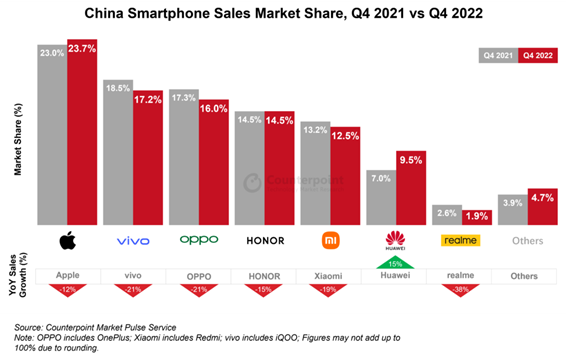

- China’s smartphone sales declined 14% YoY in 2022 to record their fifth consecutive year of decline.

- Apple’s sales outperformed the country’s market in 2022, falling by only 3% YoY.

- Major Android OEMs such as OPPO (-27% YoY), vivo (-23% YoY) and Xiaomi (-19% YoY) saw big YoY declines.

Despite the trade sanctions with the US, China is still a key player in the manufacturing industry, especially for smartphones, laptops and electric vehicles. While some brands have moved their operations out of China during the pandemic, the country is still home to several large enterprises, manufacturing products to meet global demand.

Now, the country has reopened its borders and many hoped that business would return to pre-pandemic levels. However, this may not be the case for some products. While electric vehicles in China saw record sales in 2022, smartphones in the country saw a huge decline.

In fact, a report from IDC showed that globally, smartphone shipments have also declined by 18.3% to just 300.3 million units in the fourth quarter of 2022.

“Heavy sales and promotions during the quarter helped deplete existing inventory rather than drive shipment growth. Vendors are increasingly cautious in their shipments and planning while realigning their focus on profitability. Even Apple, which thus far was seemingly immune, suffered a setback in its supply chain with unforeseen lockdowns at its key factories in China. What this holiday quarter tells us is that rising inflation and growing macro concerns continue to stunt consumer spending even more than expected and push out any possible recovery to the very end of 2023,” commented Nabila Popal, research director with IDC’s Worldwide Tracker team

According to Counterpoint Research’s Market Pulse Service, China’s smartphone sales declined 14% YoY in 2022 to reach their lowest level in a decade. 2022 was also the fifth consecutive year of YoY sales declines in China. Macroeconomic headwinds and the impact of COVID-19 led to the sales plunge.

In 2022, Chinese smartphone brand Vivo retained the first spot with a 19.2% market share, followed by Apple at 18.0% and OPPO at 17.5%. While Apple sales declined by 3%, the smartphone was still able to become the number two brand in China for the first time in a full year. This was despite the shortages faced by the iPhone 14 Pro versions as well as the comparatively lower popularity of the iPhone 14 series’ non-Pro versions due to limited upgrades compared to the iPhone 13.

(Source – Counterpoint Research)

HONOR was the only brand in 2022 to have positive YoY growth at 38% YoY. However, this growth was mainly due to a lower base in 2021, when the brand had started its resurgence in the Chinese market. HONOR made its comeback with the HONOR 50 in 2021. Now the brand has stabilized with more product lines covering all price segments.

Vivo, OPPO and Xiaomi saw YoY declines of 23%, 27% and 19% respectively in 2022 as demand dropped amid economic uncertainty. Chinese OEMs (original equipment manufacturers) continue to believe that the premium segment is the key and launched premium smartphone models during the year. They also introduced more foldable devices. Competition in the foldable segment is likely to intensify in 2023 and Chinese OEMs will look to expand their foldable offerings in the overseas markets.

The sudden change in China’s COVID-19 policy caught the market off guard, but the reopening process is also ahead of the expected schedule. Looking ahead, China’s smartphone sales may show a positive YoY growth in Q2 2023, when the country should have restored normal social activities.

“However, consumer sentiment will take longer than the economy to recover, particularly when it comes to income prospects. Therefore, we do not expect any explosive growth in smartphone sales this year. But a marginal recovery can still be expected,” stated Counterpoint Research.

READ MORE

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry