DuitNow and NETS QR are now connected, enabling QR Code payment between Singapore and Malaysia(Photo by ROSLAN RAHMAN / AFP)

DuitNow and NETS QR are now connected, enabling QR Code payment between Singapore and Malaysia

- QR code payment between Malaysia and Singapore have been enabled through NETS QR and DuitNow QR codes since last week.

- Person-to-person (P2P) fund transfers will be ready by year-end.

Quick Response, or QR code, was long considered old-school tech until recent years when it rapidly re-emerged with a new purpose – as a payment method. After all, consumers are evolving to want more contactless simplicity with an easy interface – and for many, that means adopting QR codes as a way to transact.

Compared to other regions, the Asia Pacific region has seen QR codes gaining solid traction over the last five years. In fact, fintech companies are witnessing strong growth in the cross-border payment area, recording rates often three or four times those of banking incumbents, a report by global consultancy McKinsey claims.

Just last week, Malaysia and Singapore launched their first cross-border QR code payment linkage, a few days after the Bank for International Settlements announced that it would work with central banks in the 10-member Association of Southeast Asian Nations (ASEAN) to connect their national payment systems to a cross-border payment gateway.

Bank Negara Malaysia (BNM) and the Monetary Authority of Singapore (MAS) launched the payment linkage that will allow customers of participating financial institutions to make retail payments by scanning DuitNow QR and NETS QR codes. “It will support in-person payments by scanning physical QR codes displayed by merchants and online cross-border e-commerce transactions,” BNM, Malaysia’s Central Bank, said.

Given that pre-pandemic annual traffic between the two countries averaged 12 million visitors, the DuitNow-NETS QR code payment linkage is a critical milestone in the ongoing collaboration between both countries to enhance cross-border payment connectivity. “This initiative is a testament to both countries’ commitment to improving the cost, speed, access, and transparency of cross-border payments, in line with the ASEAN Payment Connectivity Initiative and the G20 Roadmap for Enhancing Cross-border Payments,” BNM added.

For the cross-border QR code payment linkage to be made possible, a strong collaboration of various industry players from both countries was needed. Among those involved includes Payments Network Malaysia Sdn. Bhd. (PayNet), Network for Electronic Transfers (Singapore) Pte. Ltd (NETS), the Association of Banks in Singapore, and participating financial institutions from both countries.

BNM Governor Nor Shamsiah Mohd Yunus said, “this is a significant step in realizing the vision of an ASEAN network of fast, efficient, and interconnected retail payment systems. The QR linkage between Malaysia and Singapore will benefit millions of commuters across the Causeway and business and leisure travelers. It will also be a boost to retail businesses in both countries.”

In the next phase, BNM and MAS said they plan to expand the payment linkage to enable cross-border account-to-account fund transfers and remittances. The move will allow users to conveniently make real-time fund transfers between Malaysia and Singapore using just the recipient’s mobile phone number via DuitNow and PayNow. This service is expected to go live by the end of the year.

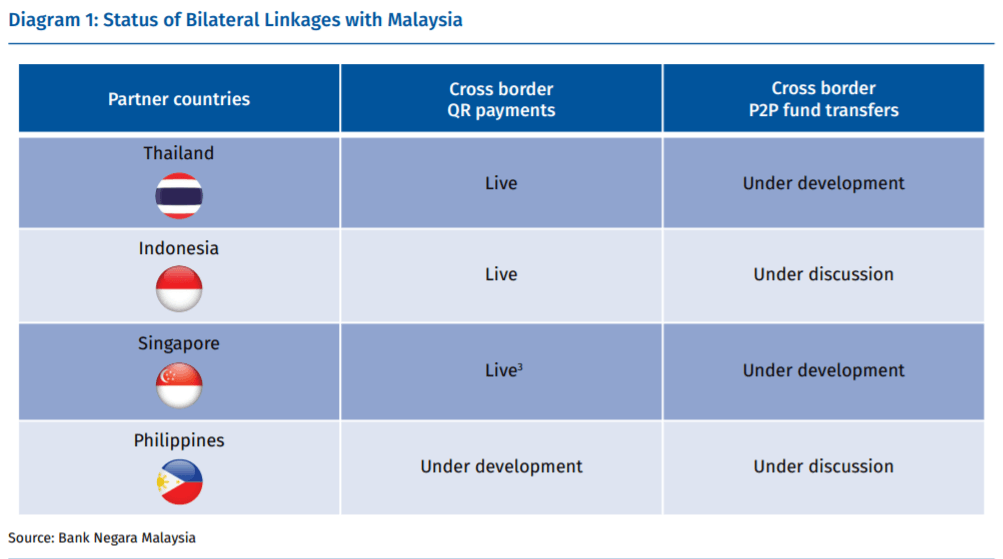

Malaysia has established bilateral cross-border payment linkages for QR payments with Thailand, Indonesia, and Singapore. This means that Malaysians traveling to these countries can make instant retail payments by scanning QR codes displayed at participating merchants in these countries, and vice versa.

Status of Bilateral Linkages with Malaysia. Source: Bank Negara Malaysia

Cross-border, QR code payment linkages via Project Nexus

According to the BNM’s Annual Report 2022, released on March 30, 2023, the Bank has been working on linking its IPS with other IPSs in several neighboring countries to mimic the benefits of faster, cheaper, and more seamless payments that Malaysians currently enjoy domestically, in the cross-border payment space.

“Recognising the challenge in scaling up bilateral payment linkages, the Bank for International Settlements Innovation Hub (BISIH) in Singapore has developed a blueprint for multilateral cross-border payment connectivity,” BNM stated in the report. Known as Project Nexus, the Bank, BISIH, PayNet, and central banks and IPS operators in Singapore and Italy undertook a one-year experiment to test if such a connectivity model is feasible.

The experiment in December 2022 demonstrated that a multilateral model for connecting IPSs is technically feasible. During the experiment, cross-border payments were successfully credited into a beneficiary’s account within 60 seconds. Given the success, BNM signed a Memorandum of Understanding (MoU) on Regional Payment Connectivity with the central banks of Indonesia, Philippines, Singapore, and Thailand during the G20 Summit in Bali in November 2022.

The five countries will participate in the next phase of Project Nexus, which aims to translate the current Nexus solution into an operationally and commercially viable model by 2025. “This project has tremendous potential for the region. It can also strengthen intra-regional trade and economic cooperation and spur greater innovation in the payments space. Ultimately, it is envisaged to set the global benchmark for next-generation payment infrastructure that all can use for cheaper and more transparent cross-border payments,” BNM concluded.

Prior to this, several E-wallet providers like Malaysia’s TouchNGo have also enabled cross border payments via their QR codes.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM