Moving Asia 2017: How technology is defining the future of transport

THE YEAR 2017 has been a year of ups-and-downs, and no industry has experienced as many troubles and travails as the transportation industry.

From regulatory bans and boycotts to the latest and greatest innovations in driverless vehicles, the transportation industry has exemplified the fast-paced changes that have turned technology into one of the biggest economic drivers in the world.

Big players such as Uber and Alphabet are challenging our assumptions about what tomorrow’s driver will look like, while China aggressively edges into its neighboring markets and looks to leading the future.

On the surface, the tiny political spats and messy flare-ups might look like minor upheavals in a string of other bigger world events–but if we look deeper, we can see that transportation lies at the heart of the great debate about the future of urban living.

Mass transit is crucial for any metropolis to thrive and small upstarts are challenging old modes of thinking in favor of improving how we interact with public spaces and how we can innovate our way out of old problems.

The changes wrought on the transportation industry have also become an example of what can and will happen as technology becomes a bigger factor across industries.

Every day, innovators, creators, thinkers and makers of tomorrow are challenging traditional belief systems and making us question our knowledge of the world. These innovators now stand at the forefront of disruptions in virtually every sector imaginable and those who dare push back inadvertently find themselves swept up anyway in the tide of technological change.

The big question is – where is this going?

Will regulators crack down on all technological innovations and edge them out in favor of more inefficient legacy systems? Or will traditional industries find themselves out in the cold thanks to the new kids on the block? Is there a way for the old and the new to co-exist for the better of consumers, governments and their bottom lines?

As the world ushers in a brand new year, we take a step back to examine how far we’ve come, looking at some of the biggest news to emerge from the industry over 2017, what kind of impact Asian superpower China will have on entire industries, and where exactly this road is going to take us.

1. The China effect

When you think of China, you need to think big.

The People’s Republic has emerged from its industrial phase and has quickly shifted gears to lean into the disruptive technologies that will characterize the global economy for the next decade.

China’s involvement in all kinds of technology has had many effects but a single unifying theme: when China puts its mind to big projects, they make it work, to paraphrase Dany Qian, the vice-president of the biggest solar producer in the world, Jinko Solar.

At the forefront of China’s transportation efforts is an eagerness to dispel its reputation as smog central by improving access to renewable energies and cutting back on fossil-fuel vehicles. The environment has moved up the country’s agenda which has informed most of its transportation-related policies.

The push comes a few months after United States President Donald Trump pulled out of the Paris Climate Agreement, thus opening up a leadership void that China has eagerly filled. Since then, China has vowed to cap its carbon emissions by 2030 and just a few weeks ago confirmed that it is building what is expected to become the world’s largest carbon market.

“This is the Mount Everest of climate policy,” Nat Keohane, head of the Global Climate program at the Environmental Defense Fund said, echoing reports calling China, the world’s No 1 polluter, a climate leader.

Electric vehicles

The country made headlines throughout the automotive industry when they announced a deadline for the end of sales of fossil-fuel powered vehicles. It’s a significant feat for a country that makes up 30 percent of global market.

There is no concrete date for when fossil-fuel vehicles will depart the People’s Republic forever, but there are suggestions that they could follow the footsteps of the United Kingdom, which set 2040 as their deadline.

Several incentive programs have been created for EV researchers, including substantive subsidies and ancillary support for innovators in the renewable energy spaces. Additional subsidies were made for consumers too, though these are set to be phased out.

Chinese industry, with the backing of the government, have been pushing the boundaries of electric vehicle development through engine design, new forms of power generation such as solar, and so on. The country is also experimenting with electric buses and trucks to ease both congestion and carbon emissions.

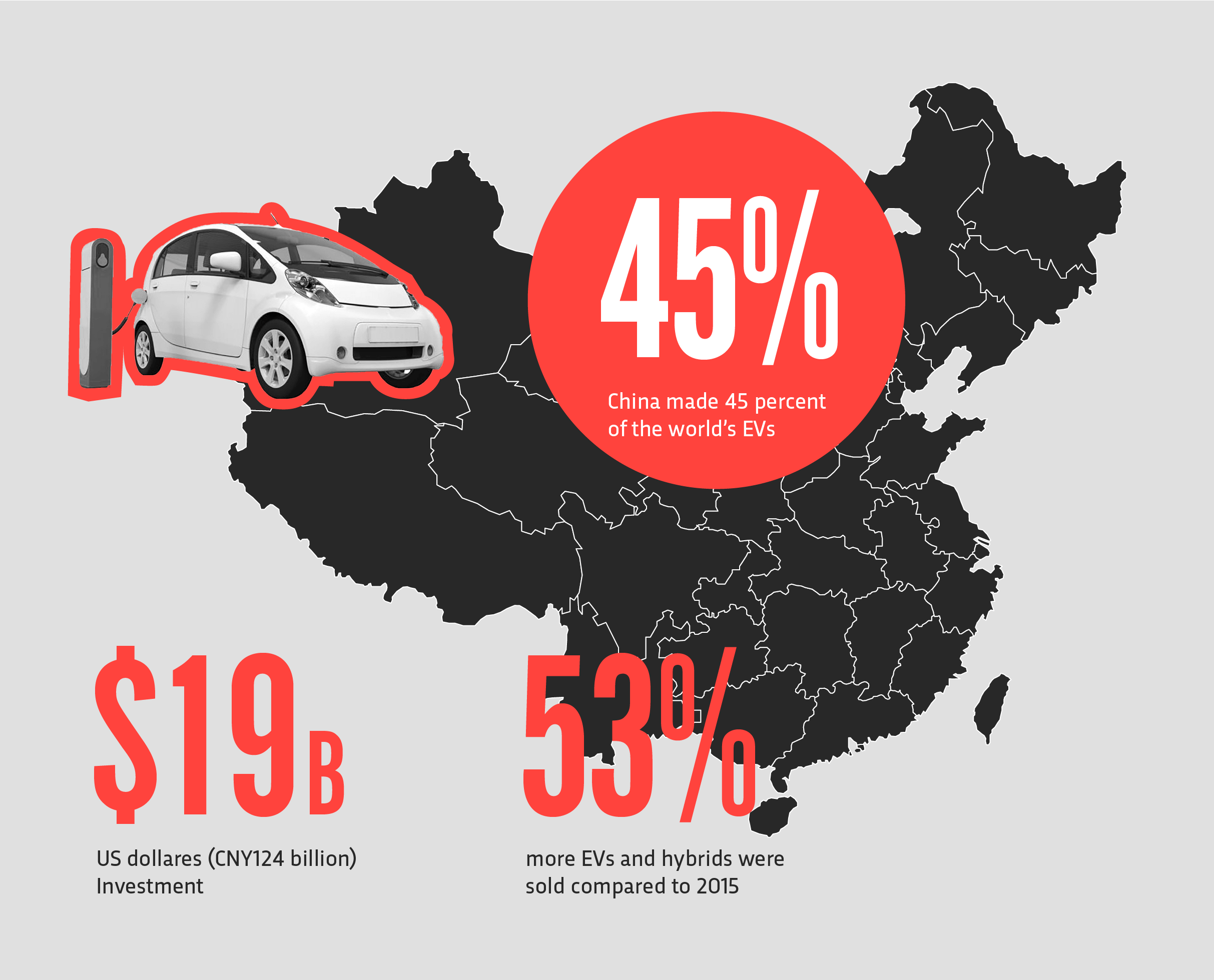

Major developments in the electric vehicle space

- Ping An Securities has estimated China will invest CNY124 billion (US$19 billion) into electric vehicle infrastructure including charging stations and outlets

- China already leads the sale and adoption of electric vehicles. In 2016, 53 percent more EVs and hybrids were sold compared to 2015 compared to Europe’s 14 percent increase

- Last year, China made 45 percent of the world’s EVs, but Goldman Sachs estimates that number will rise to 60 percent (Financial Times)

- China has secured huge deals for supplies of lithium – which are integral for EV batteries–ahead of competitors in the US and other countries

Bike-sharing

Bike-sharing is a curious phenomenon that has its roots in Western markets, but has been perfected by Chinese companies. Private firms such as ofo, Mobike and Bluegogo have populated cities all across China with their leave-me-anywhere forms of bike-sharing, and are now turning their sights onto Southeast Asia and Oceania.

The bike-share in China isn’t quite like the dock-centric ones made popular in Western Europe. Bike-sharing firms (correctly) recognized that the European dock model limited their ability to penetrate any town or city–they’d have to build substantial infrastructure to get anywhere. Instead, they created a “lock” system that pairs up with app-based QR codes that are able to track usage by time. Users can then leave their bikes wherever they stop for the next person looking for a lift.

The idea turned into a craze that sparked anger on the part of municipal authorities who were left to deal with the oversupply of bicycles and poor maintenance by the company and its users. The streets of Shanghai and Beijing were littered with discarded and destroyed bicycles, then were made famous through social media postings.

Now, regulations threaten to strangle the spread of these bikes throughout the city–some cities in Thailand and Malaysia are pre-empting these bikes by placing regulations on where they can be left–but bike-sharing is unlikely to go away. It’s eco-friendly and fun, and most of all it exemplifies China’s “go big or go home” ethos.

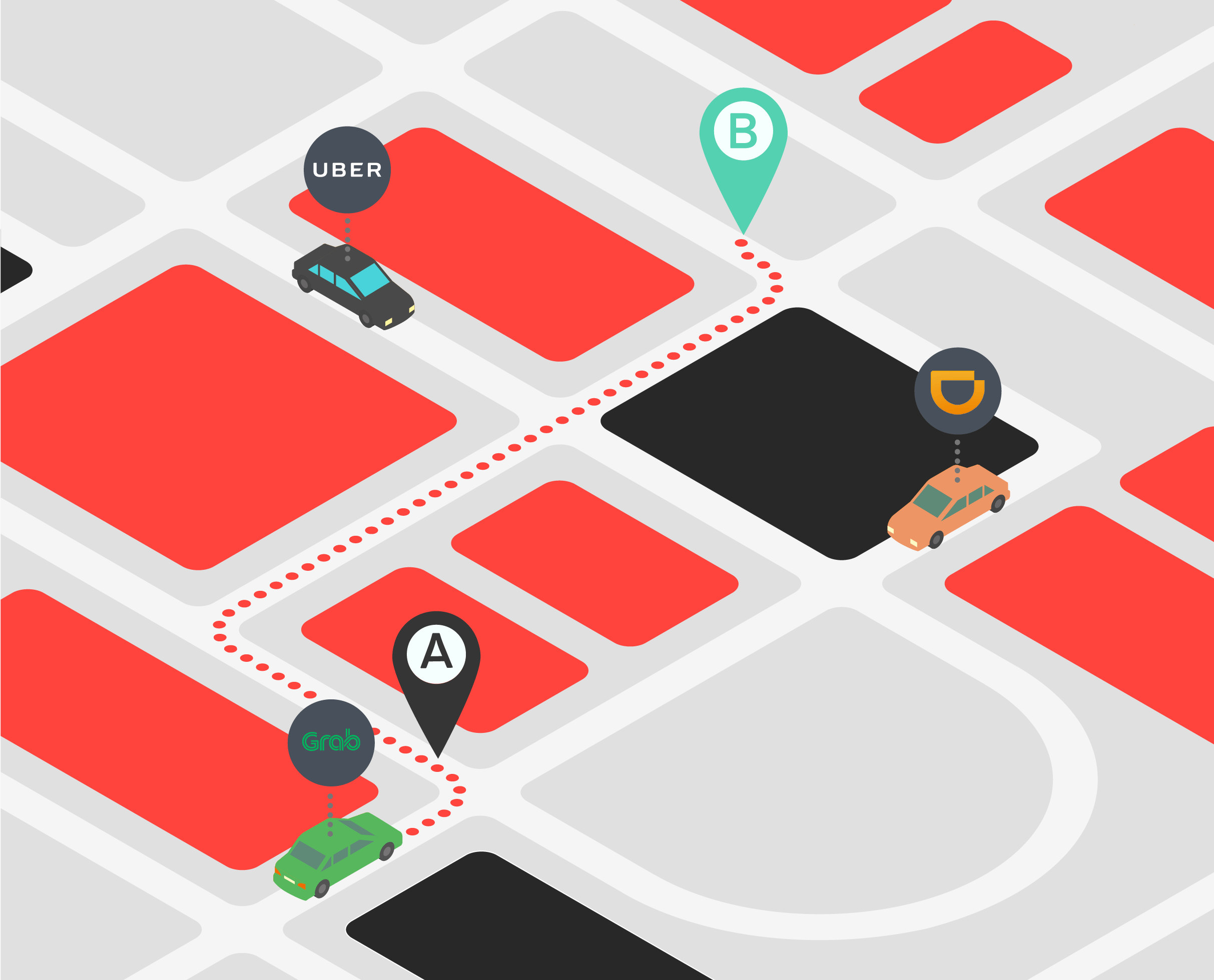

2. Ride-hailing wars

Ride-hailing has grown into its own over 2017, but perhaps no other transportation subsector has experienced as much turmoil as the ride-hailing industry. Whether it’s the high-octane scandal-ridden adventures of Uber’s internal politics or the collaborative spirit of Asia’s companies, ride-hailing has become an integral part of our transportation ecosystem.

Competition grows stiff

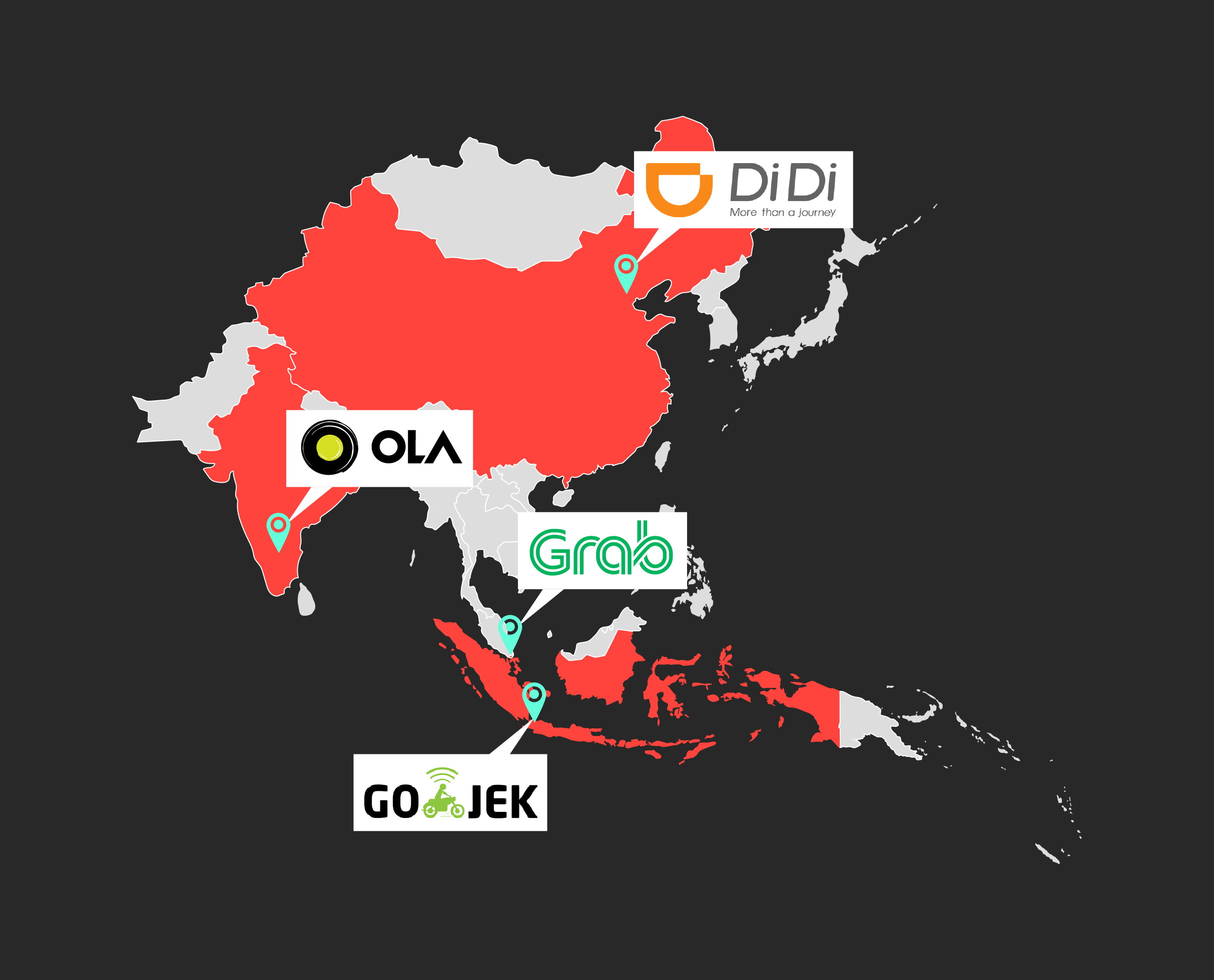

Ride-hailing firms are eagerly snapping up as much market share as they can, and Southeast Asia is proving to be fertile ground thanks to its 651 million potential “riders”. The region is currently locked in a three-way fight between Singapore-based Grab, international behemoth Uber and Indonesian Go-Jek.

Indonesia’s Go-Jek empire is vast, but it’s largely limited to the one country–but its power should not be estimated; organizing logistics across an archipelago and various services is a significant achievement.

Across the rest of Southeast Asia, Uber and Grab compete head-to-head in seven countries: Indonesia, Thailand, Vietnam, Singapore, Malaysia, the Philippines and Myanmar. Competition is fierce as local companies battle it out with their culture-specific offerings while Uber traffics on high brand-recognition. Local players look to be winning out this year: Grab has 16 million app downloads compared to Uber’s 9.9 million based off Sensor Tower statistics.

The quick and dirty

Uber

- Present in 674 cities in 83 countries

- 40 million rides monthly

- 160,000 active drivers

Grab

- 65 cities in seven countries

- 1.1 million drivers.

- Average three million rides a day

Go-Jek

- 35 cities in Indonesia

- 250,000 drivers

Ola

- Present in 102 cities across India

- 800,000 drivers

- 750,000 rides a day

Didi Chuxing

- Present in 400 cities across China

- 21 million registered drivers

- 20 million rides a day

Grab-bing the spotlight

Grab has had quite the year in 2017. From a humble startup to SEA’s largest ride-hailing company; today Grab is the preferred app that most drivers and passengers use in Southeast Asia. Grab has around 2.5 million rides daily, is available in 55 cities across Southeast Asia, and has been downloaded on over 45 million devices – triple from the number from the previous year. They’re making huge plans to expand throughout the region, and it sounds as if everyday features a new city launch.

Last July, Grab announced it had raised US$2 billion (with another US$500 million on the way). Reports say the Singapore-based firm has attracted nearly US$1.5 billion from investors, including Tokyo Century, SoftBank Capital and Tiger Global Management.

The popular service is continuing to innovate its business. This year, the app announced GrabNow, a new service which digitises the street hailing experience. Passengers can flag down a driver on the street and book a ride immediately, paying via the Grab app.

Grab will also expand its telematics and GrabChat, a first-of-its-kind in ride-hailing messaging feature to keep improving the user experience.

The company has also seen great success with its proprietary payments platform, GrabPay, which has helped the company turn some of its valuation into actual cash. Recent news suggests that the company could allow users to pay restaurant and shopping bills using the platform. The expanding empire reflects a few copycat moves from its counterpart Go-Jek in Indonesia, but it’s clear that Grab has Southeast Asian dominance in its grasp.

Uber courts trouble

Uber CEO Dara Khosrowshahi attends a meeting with Brazilian Finance Minister Henrique Meirelles (not pictured) in Brasilia, Brazil. Source: Reuters

Uber has long been considered the problem child of the technology world, especially after the dramatic events and exit of ex-CEO Travis Kalanick. Though new CEO Dara Khosrowshahi is embarking on a Grand Apology Tour around the world, the company’s reputation and trustworthiness have taken a hit thanks to the anti-authority stances they have traditionally taken.

Take for instance the company’s ban from the Philippines by the Land Transportation Franchising and Regulatory Board (LTFRB) that took place in July. The tussle over the legality of the app was contested as Uber was branded as a “colorum”- as a result, the app faced a one-month ban, which was later lifted.

The company received significant funding from Japanese tech investor Softbank recently, and while it sparked hopes in some that the company could see a resurgence in fortunes. However, Uber has hinted that they could be looking to leave the “tough” region by consolidating with Grab, which features Softbank as a major investor.

Meanwhile, the company’s scandals, ranging from sexual assault to obscene partying and a current legal battle with Alphabet’s Waymo, have tarnished its reputation in the region’s conservative circles. It’s not helped their funding situation, while giving an upperhand to rivals in the region.

The question of Uber’s future in the region is under serious scrutiny and the deal with Softbank could spell the end of the company’s tenure in the region. Will Khosrowshahi’s Apology Tour make a big difference among Southeast Asian users who view the company as an “outsider”? We’ll see.

Ride-hailing alliances

Many ride-hailing companies around the world have formed an anti-Uber global alliance – that’s bad news for Uber, but good news for consumers. Companies including US-based startup Lyft has now partnered with Grab, Indian Ola, and Dida Chuxing; three of the largest ride-hailing companies in Asia.

Under this new alliance, the companies can operate their services in one another’s home countries. By forming this partnership, the companies plan to achieve an increased scale of service and wider adoption in a shorter amount of time, while also catering to more cross-country travelers.

Uber made news on Monday when they announced that they would be joining up a global public transport alliance. The move is both an appeasement of anti-Uber regulators as well as a proclamation of where Uber sees their place: another part in the wider public transportation industry and a solution to last-mile problems.

The Softbank Factor

Softbank has been slowly but surely making well-placed investments into the major ride-hailing services all over the world. They’ve got fingers in the pies of Grab, China’s Didi Chuxing, and now, Uber. It’s evident why they’re doing this: Softbank wants to be on the pulse of the technology world, and no other industry exemplifies technological success the way that these ride-hailing firms have.

Their moves over the last year have proven one significant thing: Softbank is looking to get invested in the biggest, most lucrative industries today. It’s pretty apolitical, judging by their cross-contamination all over the industry, and clearly they understand that moving Southeast Asia is tech’s next big challenge.

4. Autonomous vehicles

Driverless vehicles are no longer just a futuristic fantasy of science fiction novels. While it may have taken a few decades, the age of autonomous cars is almost here. The biggest players here are companies in the Europe and the US, including Uber, Lyft and Alphabet’s Waymo.

China is also making significant strides in this direction. The Big Three technology firms – Baidu, Alibaba and Tencent, also know as “BAT” – are all investing in some form of artificial intelligence technology software that will be key in driving the technology. Some Japanese firms such as Toyota, in partnership with NTT, as well as South Korean Samsung are all testing their own versions of autonomous cars.

Southeast Asia is also driving up their game. Singapore is leading the way in autonomous cars for Southeast Asia. Its small size, efficiency and world-class infrastructure allows it to be the perfect location for driverless car testing in Southeast Asia. The government has recently made several partnerships and concessions to autonomous vehicle researchers to begin testing their toys in their central business district (CBD), including pioneers nuTonomy.

“We expect that the autonomous vehicles will greatly enhance the accessibility and connectivity of our public transport system, particularly for the elderly, families with young children, and the less mobile” said Singapore’s Transport Minister Khaw Boon Wan, as reported by The Asean Post.

As well as public transport, Singapore has recently looking into driverless vehicle systems for their port cargo transportation.

What’s the big deal?

Perhaps no other technology subsector has sparked the imaginations of consumers everywhere the way that autonomous vehicles have. The potential of the technology to not only save more lives but change the way we think about transportation and driving is huge.

In the future, it could prove to be “irresponsible” allow people to drive, according to Doug Parker, the COO of nuTonomy. In fact, it could transform driving from a necessary practice into a leisure activity.

Furthermore, significant strides in the autonomous vehicle space could spark a host of innovations in other related spaces including autonomous buses for reducing congestion rampant across the region; or autonomous airplanes, as are being championed by Airbus and Boeing.

Some are skeptical about the raw potential of autonomous vehicles–estimates for their adoption range anywhere from the next two years to a decade’s worth of testing before we see any real, critical change in the way we think about these technologies.

However, it’s clear that we’re going to see a future where the driver is digital, whenever that moment does arrive.

5. Transportation trends 2018

The future looks bright for the transportation industry, and 2018 will likely see more innovations, drama and development.

So here are some potential trends to keep an eye on as we move cautiously into the new year.

Public transportation gets a tech update

The public transport industry is going through a tech revolution. And necessarily so. Birth and life expectancy rates are increasing, and as a result, the global population is growing, creating with it an inevitable future of overpopulated cities, congested roads and pollution. More and more, governments, city planners and policymakers are forced to face with growing demands for better, more sustainable, more efficient and well, smarter transportation options.

For example, commuters can now buy train tickets through apps, and with Apple Pay. In cities, you can simply tap your contactless bank card to pay for your public transport journey, and in some cities, such as Shanghai, subway systems are implementing AI technology, which means you can use facial recognition in order to purchase tickets.

Last-mile first

The “last mile” is a phrase used to describe the movement of people and goods from a transportation hub to their final destination, ie. their homes.

New developments across Southeast Asia seek to address this problem. For instance, in the last year, the bike-sharing market has boomed. Companies such as Chinese startup Mobike (available in Kuala Lumpur and Bangkok), and Singapore’s oBike, allow users to unlock bikes docked along sidewalks through their smartphones.

“Bike-sharing has been crazy since late last year … The general belief is that [it] boosts the utilization of public transport as shared bikes help to complete the journey,” said Harry Liu, a downstream consultant with IHS Markit. (as reported by csmonitor)

The growth of ride-hailing services also seeks to solve the problem of the first and last mile connectivity for passengers. Often, people do not use public transport due to the unavailability of stations within walking distance to their homes. Ride-hailing services such as Uber and Grab enable commuters a cheap and convenient way to get to and from stations.

Go-Jek’s empire

Founded in 2010, Go-Jek started as a motorbike taxi on-demand service but has since expanded into a courier, transport, and shopping service in Indonesia. Its fleet now exceeds 400,000 drivers, including motorcycles, cars and trucks and is available to people in 50 cities in Indonesia.

READ MORE

- Analyzing Malaysia’s top e-commerce players of 2017

- Machine learning is going to be the next big tech since the Internet

- Which tech trends proved the biggest for small and medium businesses in 2017?

- Here’s a recap of your favorite Tech Wire Asia stories of 2017

- Trends in email marketing for 2018 you can use today