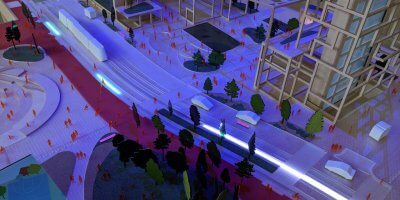

Which industries could stand to gain from Japan’s recent ‘super cities’ bill? Source: Shutterstock

Japan’s ‘super cities’ — what they could mean for business

- Japan has passed a bill to build “super cities” which will address their societal issues by using emerging tech like AI & big data

- The bill makes it easier for cities to clear regulatory obstacles & apply for government funding

- The super city initiatives represent a significant business opportunity for enterprises dealing in smart technology

Late last month, Japan’s parliament, the Diet, passed an updated bill that is set to pave the way for the building of “super cities” throughout the country.

The so-called super cities bill, sometimes referred to as smart cities elsewhere, aims to accelerate change in regulations of various governmental ministries and industrial sectors – sectors that are instrumental in supporting the creation of such future-ready townships.

As part of its directive, the bill’s removal of regulatory hurdles and complexity that could delay smart city rollouts is intended to encourage select municipalities to submit their individual super city blueprints to the central government.

Japan views the integration of technologies such as artificial intelligence (AI) and big data into their cities as potentially crucial in addressing societal issues like aging and the country’s declining population. But this also means that it will be necessary to have a deep collaboration between the public and private sectors to make these cities a reality, offering many business opportunities for private companies to fulfill demand needs.

Business advisory powerhouse PwC released a recent report on smart city infrastructure, estimating that the global market for the tech-forward townships will be worth more than US$2.5 trillion by 2025, with the private sector providing digital solutions and professional services to round out the urban digital ecosystem of these urban areas. Forecasts estimate that these solutions will account for a US$987 billion global market, while services will be worth US$441 billion globally by 2025.

Japan has already initiated one “Super City Open Lab” kick-off event last year that attracted 90 different companies, but there is still interest in a variety of fields including autonomous driving vehicles, telemedicine, environmental infrastructure, and digital payments, among others.

Furthermore, such expansive projects that leverage big data will certainly require copious amounts of data to be collected and organized across various administrative regions and associations. Hence companies that can provide data gathering services, and even better supply real-time data analysis in varying scenarios and perspectives will go a long way towards securing long term prospective business from Japan’s super cities.

Smart, IoT sensors to detect activity will be a big part of any large scale smart city project, and vendors will be needed to supply or manufacture these sensors for a variety of use cases, from smart parking detection to tracking traffic congestion patterns. For example, a smart neighborhood project in Canada was having sensors installed in the road that could sense temperature changes. It would then heat up the road accordingly to prevent dangerous icing incidents.

In Australia, sensors are being used to monitor parks and other public spaces, and this application could be valuable in Japanese super cities, as Japan has a sizable aging population that would need extra care and monitoring. So smart sensor tech would be highly in-demand as Japanese cities begin getting approval to advance their smart city ambitions.

As of May, there are over 50 proposals from local governments for smart city funding, and the government intends to officially vet proposals by this fall and decide at least five designated smart city zones by the end of 2020.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM