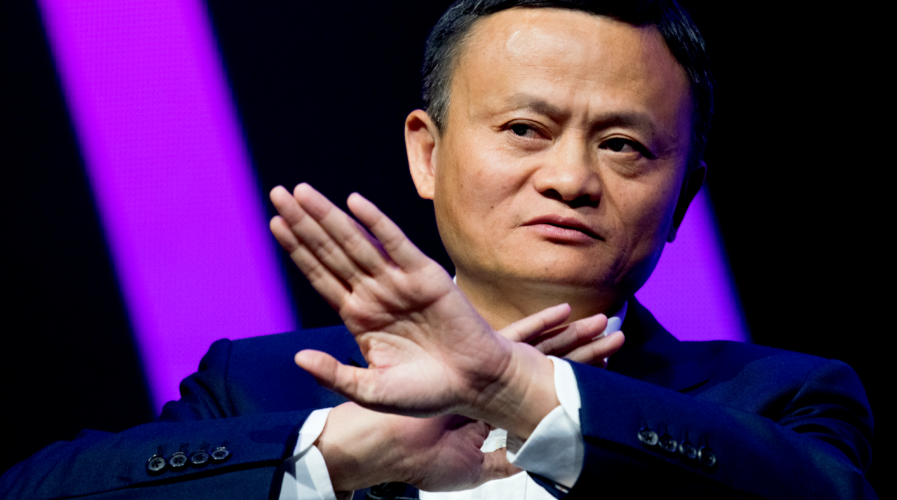

Are China’s internet giants under threat in their own backyard? Source: Shutterstock

What does Ant Group mega IPO mean for Asian fintech?

- The giant Chinese fintech upstart is expected to raise US$34 billion, eclipsing Saudi Aramco’s debut last year and Alibaba’s IPO in 2014

- Bypassing the US, Ant Group sees SEA as its battleground and its IPO will create a ripple effect across the region

Remember back in 2014 when Jack Ma’s Alibaba secured its place as the world’s largest-ever stock market flotation, raising US$25 billion? Then came Saudi Arabia’s giant state-owned oil company, Saudi Aramco, with a record US$25.6 billion (£19.4bn) in its initial public offering (IPO) in Riyadh last year.

Well, this week, things have come full circle with the news that Jack Ma’s financial technology firm Ant Group is aiming to raise more than US$34 billion, making it the world’s biggest IPO in history, and placing the company’s value at more than US$313 billion.

Ant will be selling shares on both the Shanghai and Hong Kong stock markets equally, bypassing US markets (and US scrutiny) altogether. The tech giant is seeking to raise about US$17.2 billion in each city.

A fintech giant

Ant runs Alipay, one of China’s two biggest mobile payment platforms, as well as other financial technology services including the Sesame Credit personal credit rating system.

Alipay had 711 million monthly active users as of June, with payment volumes reaching 118 trillion yuan in China, Ant’s filings showed. Last year it handled 110 trillion yuan (US$16 trillion) in payments — nearly 25 times more than PayPal, the biggest online payments platform outside China.

The company is expected to start trading on Nov 5, 2020, on Hong Kong’s technology-focused Star market, but has yet to disclose when its shares will begin trading in Shanghai.

Alibaba, via its subsidiary Zhejiang Tmall Technology, has agreed to buy 730 million A-shares to maintain its approximately 33% stake in Ant Group. Ant is selling 3.34 billion shares in the flotation, accounting for 11% of the group’s total outstanding stock. The Shanghai-listed shares will be priced at 68.8 yuan each, and the Hong Kong shares at $80 each.

The group could raise up to a maximum of US$5.2 billion more if the flotation proves popular and underwriters exercise an option to purchase up to 15% more shares.

What does it mean for Asia?

Trends arising in China often give us a preview of what might happen in Asia and elsewhere, soon after. Within the last five years, we have seen Chinese investment within its own region intensifying, gaining momentum with Alibaba’s investments in regional e-commerce giants Lazada and Tokopedia. At the same time, rival Tencent also made its mark through investments in Gojek, Sea Group, and VNG, among others.

The IPO of Ant Group offers investors a chance to secure a slice of Asia’s fast-growing tech sector.

According to Kaiyuan Capital chief investment officer Brock Silvers, a growing number of Chinese companies have been seeking refuge on national exchanges as tensions between Washington and Beijing ramp up, and Ant’s success could encourage more firms to follow suit.

“US threats and restrictions against Chinese tech companies such as Huawei, TikTok, and WeChat have sent a clear warning, while scrutiny of Chinese firms on Wall Street is rising.”

Singapore’s EY emerging markets expert Varun Mittal, said: “Digital commerce and infrastructure platforms in Asia provide an unprecedented opportunity for Asian and global investors to be part of the next wave of value creation in Asia.

“Earlier this year, India saw a rush of international investors keen to invest in infrastructure and platforms ecosystem, which is being replicated in the Chinese ecosystem now.”

Unlike Western mobile wallets, Ant’s platform touches on nearly all aspects of one’s financial life. It goes beyond what PayPal and Apple Pay do, offering services for everything from payments to credit to insurance to investments within Alipay, which the company calls a “ubiquitous super app.”

South China Morning Post writes that Ant Group’s decision to list in Hong Kong and Shanghai, instead of New York City, “illustrates a shift in the balance of financial power eastward as more of China’s leading technology companies raise capital in markets closer to their users.”

For the startup ecosystem in China, the IPO could trigger more Chinese startups to go public, especially amid the country’s recovery post-COVID-19 crisis. For Southeast Asia, meanwhile, it will trigger even tighter competitions among local e-payments companies, especially those with ties to Chinese tech giants.

For example, earlier this year, two major Indonesian digital payments platforms OVO and Dana were reported to have agreed to merge. Both platforms are already the top three most popular digital wallets in the country, hence, this move will lead to the rise of a mega-player in the local market, which has begun to embrace digital payments on an unprecedented scale.

It is important to note that Dana is the result of a joint venture between Ant Group and local media and tech giant Emtek Group.

Even in emerging markets such as Myanmar, Ant Group has announced plans to invest more than US$70 million in local fintech company Digital Money Myanmar (Wave Money).

Whatever’s said and done, this IPO will surely create a ripple effect.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM