A fight for e-commerce dominance in India. Source: Shutterstock

Place your bets — Ambani and Bezos renew e-commerce price war

- Ambani & Bezos own two of the biggest e-commerce platforms in India

- They are set to battle each other and Walmart-owned Flipkart for dominance of the market during the biggest festive sales period of the year

It’s been a big week for e-commerce in Asia. First China and Southeast Asia (SEA) went through the massive 11.11 Single’s Day sales across all major online platforms. And now with the Diwali festival peak shopping season happening in India, the e-retail platforms of the two of the world’s richest men, Amazon’s Jeff Bezos and Reliance’s Mukesh Ambani, are set to compete with a cut-throat pricing game.

Asia’s richest man, Ambani owns Reliance Industries, which rose quickly after Ambani acquired telco Infotel in the Indian telecommunications sector, offering ridiculously cheap phone and data plans that undercut the competition. Using the same strategy, he is now taking on Indian e-commerce market leaders Flipkart, majority-owned by Walmart, and Amazon.com, owned by the world’s richest individual Bezos.

India is one of the last big e-commerce frontiers, with Morgan Stanley estimating that the market will generate US$200 billion in e-commerce sales by 2026. But the space is still fragmented with no clear market leader, and despite entering the game later than Amazon or Flipkart, Ambani has some major advantages going for his retail interests.

The biggest one is that foreign-owned retail entities are restricted by a number of regulations in India. For instance, since 2018, India’s foreign investment rules have barred Amazon and Flipkart from featuring exclusive products and owning inventory, in a bid to restrict their ability to directly influence prices and offer discounts.

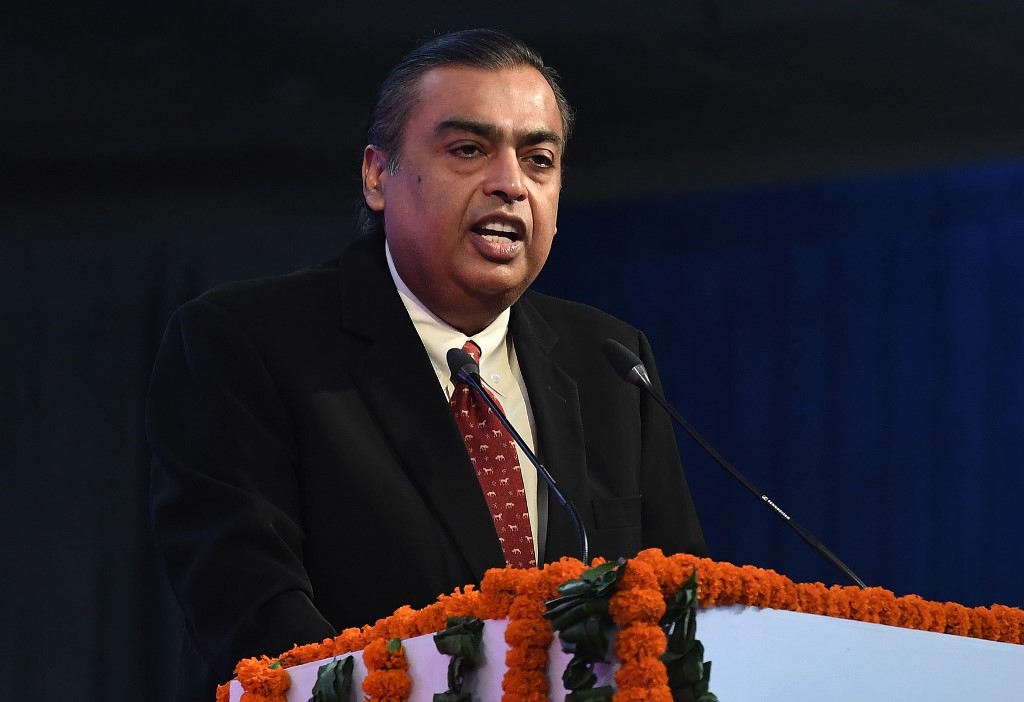

Mukesh Ambani, chairman of Reliance Industries, is taking on both Amazon and Flipkart with cut-rate prices during Diwali shopping season. Source: AFP

International firms are also prohibited from owning more than 51% of local brick-and-mortar supermarket chains. Even that limit is subject to conditions such as setting up only in cities with populations of less than 1 million in India.

Ambani’s Reliance is not only the biggest domestic e-retailer but also owns local physical stores, providing an all-around retail presence that is pervasive in the country. And it’s not only his online competitors that have to be leery.

“JioMart can dent the fortunes of grocery e-commerce majors like Bigbasket & Grofers,” commented RexEmptor Consult LLP chief experience officer, Siju Narayan, referring to the country’s biggest online grocers; “And impact the grocery, home & personal care category of e-tail majors like Amazon and Flipkart in the coming days.”

And just like his telco strategy, Ambani’s retail operations (most of the e-commerce entities can be found consolidated under Reliance Malls) have been ruthlessly slashing prices this festive shopping period. His Reliance Digital website is selling certain flagship Samsung smartphones at heavily-discounted prices compared to rivals, with as much as 40% rebates.

Meanwhile, Reliance’s JioMart platform is currently offering up to 50% discounts. It’s a push that comes as Ambani’s sprawling conglomerate, Reliance Industries, is flush with cash and has seen its shares rally about 35% this year.

But Ambani will face significant competition from seasoned rivals with deep experience in the retail game. Walmart is one of the largest retailers in the world and spent US$16 billion to acquire Indian portal Flipkart in 2018 in its biggest-ever deal, including sinking another US$1 billion this year and steadily plowed cash into its sister unit, the digital payments service PhonePe.

At the same time, Mukesh Ambani’s personal net worth of US$79 billion is dwarfed by Amazon boss Jeff Bezos’, who touts a staggering US$184.4 billion fortune. Following his earlier tussle with Ambani to acquire the Indian retailer Future Group, Bezos has committed to pour another US$6.5 billion into Amazon India to contest for the top e-commerce spot in the county.

READ MORE

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry