Shou Zi Chew, CEO of TikTok, testifies during the US Senate Judiciary Committee hearing, “Big Tech and the Online Child Sexual Exploitation Crisis,” in Washington, DC. (Photo by Brendan SMIALOWSKI/AFP).

This is how much ByteDance and Shein spent on US lobbying in 2023

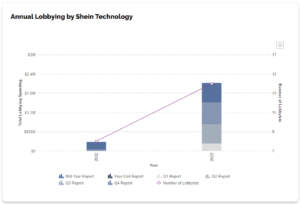

- In 2023, Shein increased its lobbying in the US by 657% to US$2.12 million; less than a quarter of ByteDance’s US$8.74 million was spent the same year.

- In 2023, ByteDance had 45 lobbyists, while Shein increased from eight to 14 amidUS IPO uncertainties.

- What are they spending all the money on? What are they getting in return?

In the corridors of power in Washington, the clout of corporate giants often speaks volumes. In 2023, two notable Chinese-founded companies, ByteDance and Shein, made headlines for their substantial lobbying efforts. As scrutiny intensified over their Chinese ties, TikTok’s parent company, ByteDance, and the fast fashion giant Shein significantly ramped up their lobbying expenditures in the US.

According to data from OpenSecrets, Shein experienced a staggering 657% surge in lobbying spending, reaching a total of US$2.12 million in 2023 compared to the previous year. Despite this substantial increase, it’s noteworthy that Shein’s lobbying budget remained less than a quarter of ByteDance’s expenditure, which stood at a whopping US$8.74 million for the same period.

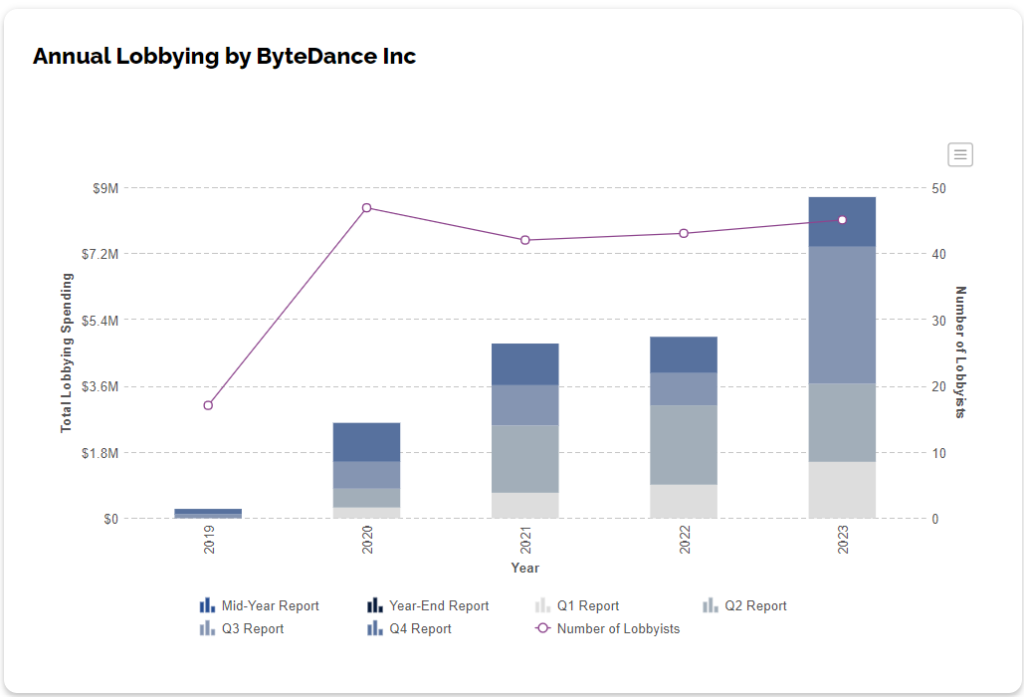

These figures underscore the growing importance of influencing US policymakers for companies with international stakes, particularly those facing scrutiny due to their origins. Tighter regulation and possible bans that continue to loom over TikTok’s future in the US pushed ByteDance to ramp up its lobbying efforts last year. Since 2019, ByteDance has spent a total of US$21.27 million.

The parent company of the immensely popular video-sharing app TikTok also ensured it maintained a formidable presence in lobbying, employing 45 lobbyists throughout 2023. This figure, essentially unchanged from previous years, highlights the company’s ongoing efforts to navigate the complex regulatory landscape in the US, where concerns about data privacy, national security, and censorship have often dominated the discourse surrounding Chinese tech firms.

ByteDance spends millions lobbying, outpacing prior years amid crackdown on TikTok’s China ties. Source: Open Secret.

TikTok boasts over 150 million American users, and therefore, US lawmakers harbor suspicion regarding the app’s data accessibility to the Chinese government and its potential role in expanding China’s influence. On the other hand, Shein, known for its rapid rise in the fashion e-commerce space, made a strategic move by increasing its lobbying team, hiring 14 lobbyists in 2023 compared to just eight the year before.

This surge in lobbying personnel reflects Shein’s proactive approach to addressing regulatory challenges and uncertainties, especially against a potential initial public offering (IPO) in the US market.

Why are Chinese entities increasing their lobbying efforts in the US?

Source: Open Secrets.

The increased lobbying activities of ByteDance and Shein coincide with a broader trend of Chinese companies facing heightened scrutiny and regulatory challenges in the US. Allegations of espionage, data privacy concerns, and geopolitical tensions have fueled calls for stricter oversight and regulation of Chinese tech firms operating on American soil.

Additionally, Shein’s decision to bolster its lobbying efforts amid an uncertain IPO outlook underscores the significance of regulatory clarity and favorable legislative conditions for companies seeking US capital markets.

The success or failure of Shein’s lobbying endeavors could have far-reaching implications for its IPO aspirations and the broader landscape of Chinese companies seeking to establish a foothold in the US market.

In conclusion, the increased lobbying expenditures of ByteDance and Shein shed light on the evolving dynamics of corporate influence and regulatory challenges faced by Chinese-founded companies in the US. As these companies navigate a complex web of political, economic, and regulatory pressures, their lobbying efforts testify to the strategic importance of engaging with policymakers and stakeholders to safeguard their interests and ensure continued growth and success in an increasingly competitive global marketplace.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland