Insurance is going digital, slowly but surely | Source: Pexels

Why traditional insurers are living on borrowed time

INSURANCE is an industry that hasn’t really transformed for a very long time. We still buy the same kind of policies from the same types of companies through the same channels.

Unlike the banking and financial services space, insurance hasn’t been disrupted enough. But that’s about to change.

According to a new study by GlobalData, Artificial intelligence (AI) provides unprecedented opportunities for the insurance industry, and the changes it can bring about will transform insurers forever.

In fact, AI will be a key enabler for insurance businesses to prepare themselves for the emerging risks that result from an increasingly digital world.

However, the path to adopting AI in insurance is riddled with challenges. There are several regulatory concerns that the sector will face in its efforts to accommodate the new risk management models, says the report.

Over time, as the adoption of AI increases, insurers will continue to explore examples of how AI can be used to address many current operational challenges – in particular, streamlining underwriting processes.

Overall, intelligent augmentation and automation of data collection, sharing and processing will be vital to avoid inadequate and poor risk modeling in the digital future.

Ruby Ghunia, Digital Insurance Practices Lead Analyst at GlobalData, says

Incompatible legacy systems mean that data entry may take longer and involve costly duplication and entry errors. Inaccurate or absent data leads to poor pricing decisions and underwriting processes, resulting in inadequate risk assessment and negative consequences for the capital reserve.

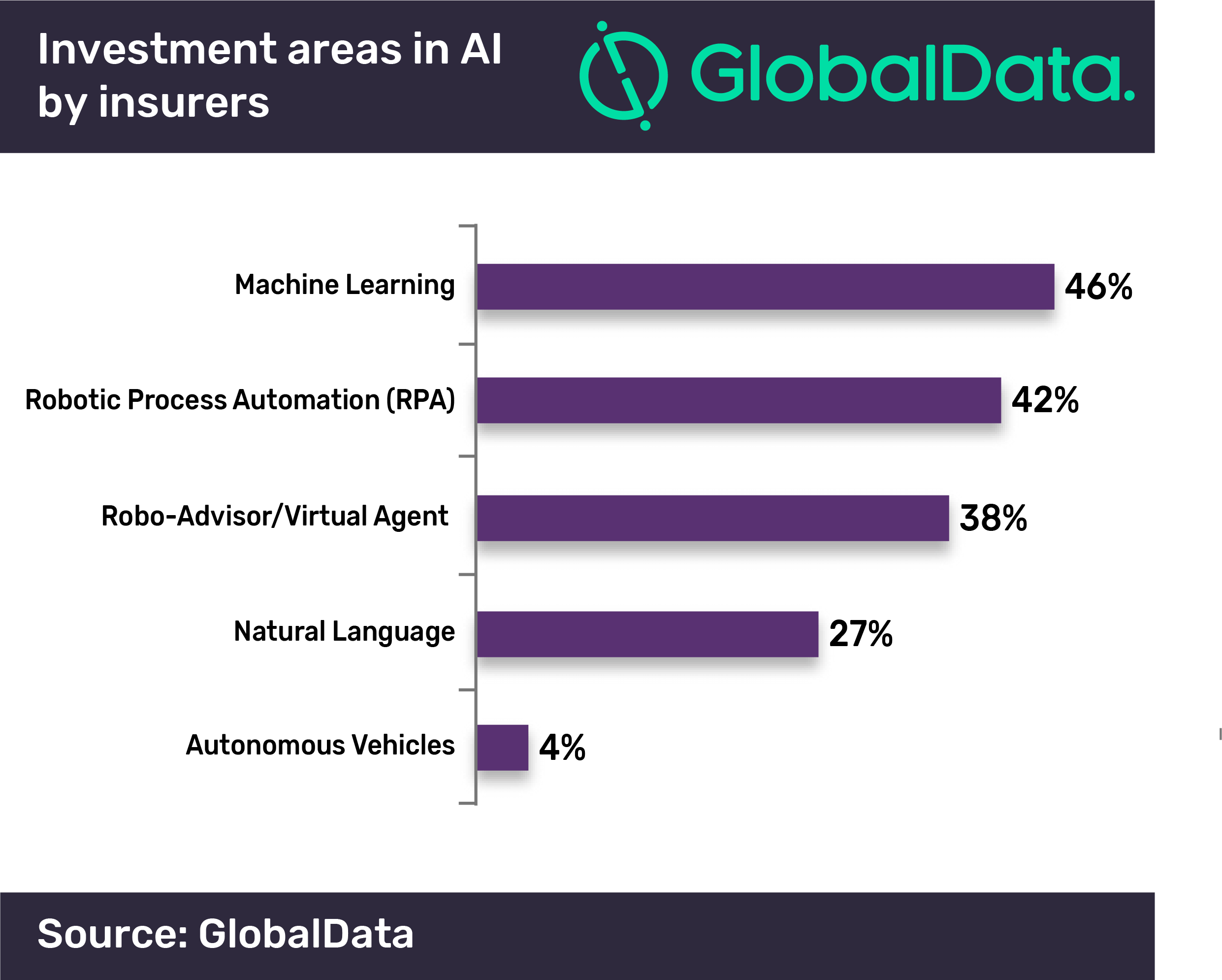

According to the study global insurers have invested heavily in the AI areas of machine learning, robotic process automation, and robo-advisor/virtual agents so far.

One of the biggest obstacles to AI adoption in insurance might come from the Government and other regulating bodies.

Regulators, according to GlobalData, are already fretting about the perils of AI in insurance.

A recent report by the Financial Stability Body (FSB) said that the insurance industry is increasingly becoming dependent on third-parties/firms that provide AI and machine learning (ML) solutions. The body felt that the real threat to the industry comes from the fact that these third-party firms are not bound by regulations.

The FSB report cited the paradoxical nature of AI, and ML in particular. While an ML algorithm may seem to offer better understanding of customers’ needs, more affordable coverages, and improved customer service, it might lead to adverse risk selections, where insurance become unaffordable.

Finally, the report suggests that the greatest challenge for the insurance industry lies in the fact that the world is becoming more connected and digital.

According to GlobalData, this will change the nature of risk and affects demand, primarily driven by consumer/business behaviors and technology adoption.

“The risks consumers and business face have changed faster than their insurance policies. New business and pricing models are therefore needed to keep up and provide insurance coverage aligned with emerging risks,” added Ghunia.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland