(Source – Shutterstock)

Fintech services contribute to increase in financial literacy in India

With nearly 2000 fintech startups in the country, one would imagine India’s financial literacy to be high. Yet, statistics show that despite a population of over 1.3 billion people, about 76% of the adult population still lacks basic financial concepts.

Interestingly though, things are beginning to change in India. Financial literacy in India continues to see positive improvements as the adoption of fintech grows in the country. This is proven by the number of successful fintech companies in India and the increased adoption of fintech use cases.

Invest India stated that as of December 2021, India has over 17 fintech unciorn companies with a valuation of over US$ 1 billion. The digital payments sector has seen tremendous growth with around 5.7 billion transactions completed. India is also home to the highest number of real-time online transactions and is ahead of the US, UK, and China combined.

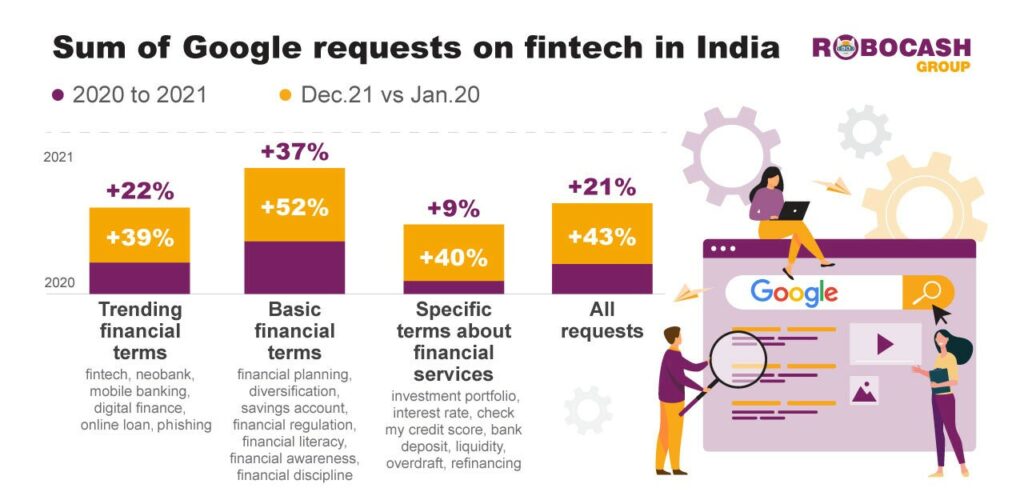

In fact, Robocash Group analysts showed that the number of Google search requests about fintech and financial services has nearly doubled since 2020. One of the biggest pushes for financial literacy in India was the COVID-19 pandemic. The pandemic has bolstered the financial adeptness of the population in India, and consequently, its financial awareness.

(Source – Robocash Group)

Among the highest search requests include basic financial terms which saw a 52% increase and specific terms about financial services (40%). The increase in financial terms search clearly indicates that the population is beginning to not only adapt fintech services but is also looking to understand more about the services being offered by fintech companies in India.

Moreover, most fintech companies tend to offer simpler and personalized services to customers compared to traditional banks. The simplicity and accessibility to such services are definitely one of the main factors why financial literacy is seeing a positive increase in recent times.

Prior to the pandemic in 2019, financial literacy was estimated to be only at 27% among the adult population aged between 18 to 80. The first wave of the pandemic had rapidly changed the current realities and forced consumers to expand their knowledge. A sharp rise was observed between May and September 2020. People in India are gradually becoming more involved with the topic, reaching a peak at the end of January 2022.

At the same time, the analysts also commented that the country still lacks in several areas. This included insufficient population income for 35% of the urban population and low Internet penetration of 45%.

However, there are also positive factors that may significantly accelerate the development of financial literacy. For example, a well-developed financial infrastructure, a government-backed system of measures geared for improving financial literacy, and quick penetration of financial services (financial inclusion index went from 43.4 to 53.9 during the FY2020).

The aforementioned pre-pandemic 27% of financially literate Indians may be considered a starting point for the growth of financial literacy. If the identified trend is directly imposed upon this figure, the analysts believe it should grow to 38.5% by the end of 2022.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland