Lim Paik Wan, Country Manager of Wise in Malaysia, shared the transformative tech for travel with Tech Wire Asia. (Source – Shutterstock)

Wise: Revolutionizing travel and finance in Malaysia

- Lim Paik Wan, Country Manager of Wise in Malaysia, shared the transformative tech for travel with Tech Wire Asia.

- Lim also shared the impact of the pandemic and how digital adoption accelerated, driving demand for transparent, cross-border solutions.

In an age where traditional wire transfers and steep fees once hindered international money transfers, the landscape of financial transactions has undergone a remarkable transformation. With the emergence of borderless banking platforms such as Wise, sending money across borders has been redefined. As this fintech trailblazer continues to disrupt the industry, it’s imperative to unravel the narrative behind Wise and understand its profound impact on travel and financial experiences in Malaysia and across the globe.

Born out of a desire to challenge the status quo of traditional banking and tackle the opaque and often exorbitant fees associated with cross-border transactions, Wise has emerged as a disruptive force in the digital finance arena. Its innovative platform has empowered millions of individuals and businesses worldwide to navigate the complexities of international finance with unparalleled transparency and ease.

Through an insightful interview with Lim Paik Wan, Country Manager of Wise Malaysia, we delve into how the company harnesses the power of technology to reshape the travel and savings landscape in Malaysia and beyond.

The digital renaissance has brought transformative shifts in travel. How do you see technology shaping every aspect of travel beyond being a mere tool to smoothen the process?

Technology has now made travel more accessible and has allowed consumers to personalize their holidays, as people now take to blogs and social media platforms for inspiration. Additionally, consumers are now accustomed to instant and seamless experiences, with everything readily available through a few taps on their smartphones. This seamless digital connectivity has also changed how people make transactions for their travels.

Lim Paik Wan, Country Manager, Malaysia at Wise

In years past, travelers needed to exchange cash physically and were usually required to pay for most meals and excursions in cash. Today, contactless payment options are offered almost everywhere, making it easier and safer for consumers to make international transactions.

Even how consumers plan their travels has changed, with hotel bookings and flights done through travel apps. However, consumers still face challenges as the world transitions to a largely cashless society. A common one is a general unfamiliarity with international transaction fees, causing them to spend more than anticipated or budgeted for. Issues like these have led fintech providers to create solutions to make these processes smoother and more manageable.

How do Wise’s digital cards and contactless payment solutions like Apple Pay and Google Pay enhance travel safety?

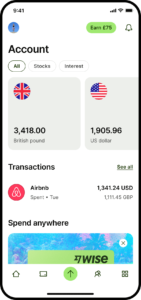

Today, contactless payment methods are widely accepted in many countries, lessening the burden of carrying large sums of cash. However, when used internationally, most traditional credit or debit cards tend to come with additional fees and hidden costs. Providers like Wise offer users the ability to hold money in over 40 currencies and make transactions at the mid-market exchange rate with no markups, helping travelers save money on international transactions.

This relieves users of having multiple traditional cards, where they would have to bear the cost of foreign transaction fees and interest fees. Wise’s smart technology automatically converts the currencies you hold in your account for you, which have the lowest conversion fee; the card even allows users to withdraw money from ATMs with low fees while traveling.

Another great thing is that Wise users can start spending immediately with its digital cards, available instantly upon request in the app. Users can get up to 3 digital cards with different card details for an extra layer of protection. These digital cards can be deleted anytime, so customers can generate new card details when they need them.

The cards can also be added to Apple Pay and Google Pay — these contactless payment methods are powered by NFC technology, which is generally more secure. Additional features on the account allow users to track their spending in real-time, ensuring smoother user and travel experiences.

How has the pandemic impacted Wise’s services, particularly regarding international travel and cross-border transactions?

Digital adoption during the pandemic created the expectation for instant and real-time processes and a trend of contactless payment options. This has dramatically impacted the Malaysian market, as e-wallets and mobile payments are now expected payment options that businesses should offer. Additionally, we found that Malaysians are spending more time online, adopting more

Wise app shows that users can manage all their currencies all over the world. Source: Wise

international lifestyles, and traveling more frequently, leading to an increase in cross-border spending and shopping.

These trends suggest a need for efficient cross-border payment solutions that offer faster, cheaper, and transparent international payments. Wise addresses these needs with its multi-currency account, empowering Malaysian consumers to seamlessly navigate global payments and lifestyles with no hidden fees and complete transparency.

The recent launch of Wise on Apple Pay and Google Pay in Malaysia is part of our commitment to making international transactions more convenient and accessible for customers. A few other ways Wise is providing more convenience is by offering our users the ability to send money to popular e-wallets in the region, including Touch’nGo in Malaysia, GrabPay in the Philippines, and ShopeePay in Indonesia — being able to offer multiple money movement options makes moving money across borders even more convenient.

How does Wise promote financial literacy and awareness among users regarding currency exchange and international transactions?

A crucial part of our mission has been advocating for transparency in foreign exchange fees, empowering people with knowledge and insight into their transactions. This is reflected in our services and is why we support transparent and fair cross-border transactions. With Wise, all fees are transparently displayed to customers when they set up a transaction.

Customers pay a single upfront fee, and the exchange rate they get is the one you see on Google with no markups or hidden charges. People also gain visibility into what’s happening to their money from start to finish when making cross-border payments, which includes the actual total cost to make the payment.

Wise also offers price comparison tools in the app, which allows our customers to compare the exchange rates and fees across a range of currency routes to make better decisions when choosing their preferred provider.

What upcoming advancements can users anticipate from Wise, and how will they improve travel and financial experiences?

Not to give too much away, but we are always looking to bring globally available features to Malaysia, such as Wise Business and Wise Platform. Wise Business accounts are for businesses that want to grow and operate internationally, making it easier to manage their finances across borders, such as paying overseas vendors and employees or receiving funds from clients.

Wise Platform is our infrastructure offering, which enables financial institutions and businesses to incorporate our global payment network into their platforms. As Wise operates globally, we’re always looking to see what would benefit Malaysian customers and work to solve their pain points.

Lastly, in the rapidly changing landscape of digital finance and travel, how does Wise stay adaptive and responsive to its diverse user base’s dynamic needs and preferences?

At Wise, we constantly listen to our customers, and our goal continues to be making Wise as convenient, low-cost, fast, and transparent as possible. As more Malaysians look for cross-border opportunities, it’s vital that our users can use Wise to broaden their lifestyles globally.

Looking ahead to 2024 and beyond, we’ve got a number of exciting things coming up in our product roadmap to improve the speed, convenience, and cost of cross-border payments for our customers around the world.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland