05042024_A transformative deal on the horizon as Google parent Alphabet eyes HubSpot (Source – Shutterstock)

Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM

- Google parent Alphabet potential acquisition of HubSpot could revolutionize CRM technology.

- Alphabet’s interest in HubSpot highlights a strategic move to diversify Google’s offerings and tap into new markets.

From Microsoft splitting Teams from its Office Suite to Google potentially acquiring HubSpot, a lot is happening between these two tech giants.

Both companies continuously explore avenues to enrich customer engagement and streamline operational processes. This quest for enhanced connectivity and understanding of the consumer landscape is where integrating with, or in Google’s case, acquiring Customer Relationship Management (CRM) platforms like the online marketing software company HubSpot becomes a strategic imperative.

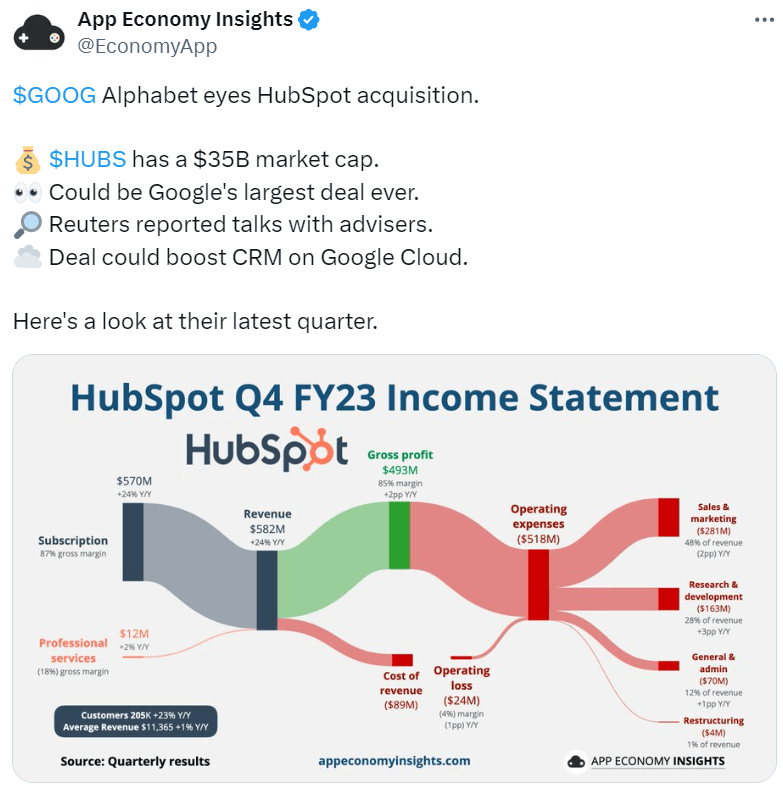

Companies like Google can leverage sophisticated analytics, personalized marketing tools, and comprehensive project management solutions by considering the incorporation or acquisition of the platform. The potential acquisition by Alphabet, Google’s parent company, of HubSpot—valued at US$35 billion, as exclusively reported by Reuters—underscores the importance of CRM systems in achieving these goals.

Alphabet’s eye on HubSpot

Alphabet’s contemplation of making a bid for HubSpot emerges as a noteworthy move in the tech industry, particularly under the intensified regulatory gaze of President Joe Biden’s administration in the United States. This acquisition, if pursued, would mark a significant venture for a leading tech entity into high-value deal-making amidst regulatory scrutiny.

This potential deal could represent Alphabet’s most substantial acquisition to date, offering an opportunity to strategically employ its substantial cash reserves, which stood at US$110.9 billion at the end of the last year.

Recent discussions have taken place between Alphabet and investment bankers from Morgan Stanley regarding a possible bid for HubSpot. These talks have focused on the bid’s valuation and the likelihood of obtaining approval from antitrust regulators. However, Alphabet has yet to extend an offer to HubSpot, and the outcome remains uncertain, as noted by sources who wished to remain anonymous while sharing insights on these private considerations.

In response to inquiries about these discussions, a representative from HubSpot stated the company does not engage in speculation or rumors, emphasizing their ongoing commitment to their business and clientele. Requests for comments from Alphabet and Morgan Stanley have not received immediate responses.

Following the revelation of these discussions, HubSpot’s stock experienced an 11% increase to US$693, whereas Alphabet’s shares saw a slight decrease of 1%, pricing at US$153.34.

Since its public debut in 2014, HubSpot has carved a niche in providing marketing software to small and medium-sized enterprises. Despite reporting a net loss of US$176.3 million in 2023 from revenues of US$2.2 billion, the company’s growth potential has captivated investors, as evidenced by a 50% surge in its stock price over the past year.

Google Alphabet eyes HubSpot acquisition (Source – X)

The future of CRM: What this means for Google and HubSpot

Currently, the discussions about Google potentially acquiring HubSpot are speculative, with no confirmation regarding whether this collaboration will materialize. Should such an acquisition proceed, it represents a significant shift for both companies.

Integrating HubSpot’s CRM capabilities could provide Google with deeper insights into customer behavior and preferences, potentially enhancing its user engagement through the use of HubSpot’s analytics and marketing tools.

The acquisition would enable Google to broaden its portfolio, especially within the CRM space—a sector where it has not yet established a strong foothold. This expansion could open up access to new markets and customer segments, particularly targeting small to medium-sized businesses that predominantly use HubSpot.

Furthermore, Google’s cloud computing services could see substantial benefits from incorporating HubSpot’s CRM solutions, potentially improving Google’s position relative to competitors like Microsoft Azure and Amazon Web Services.

Positioning the acquisition as a competitive enhancement in the CRM and broader software market could assist Google in navigating the complexities of regulatory approval, presenting the deal as a countermeasure to the market dominance of entities like Salesforce and Microsoft.

Such an acquisition could also quicken Google’s growth within the burgeoning CRM market, offering a pathway to expand its market share and influence significantly.

Regulatory scrutiny and market dynamics

This acquisition speculation comes at a time when Google faces multiple antitrust allegations, including a significant lawsuit challenging its dominance in online search. Alphabet CEO Sundar Pichai is exploring new growth avenues following a shortfall in advertising sales, as Google and YouTube vie for ad budgets against platforms like Facebook, Instagram, TikTok, and Amazon.com.

The technology sector is witnessing a resurgence in deal activity, exemplified by Synopsys’ agreement to acquire Ansys for around US$35 billion and Hewlett Packard Enterprise’s acquisition of Juniper Networks for US$14 billion. In the first quarter alone, technology mergers and acquisitions have surged over 42% year-on-year to approximately US$154 billion, as reported by Dealogic, highlighting the sector’s dynamism.

Overall, Google acquiring HubSpot could mark a pivotal development, potentially creating new synergies between their technologies and market strategies. This development could offer both companies opportunities for growth and innovation within the dynamic landscape of CRM technology.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland