A digital engagement platform can enable banks to accelerate their digital journey. (Image – Shutterstock)

How banks can modernize banking systems

|

Getting your Trinity Audio player ready... |

- Banks in Southeast Asia want to upgrade their banking systems.

- Legacy infrastructure and regulatory requirements are holding some of them back.

- A digital engagement platform can enable banks to accelerate their digital journey.

For traditional banks, legacy infrastructure can be a hindrance to modernizing banking systems. In fact, as most traditional banks look to improve their delivery, having banking systems that can meet the demands of customers today is essential.

According to an Infobrief by IDC and Backbase, many banks in the Asia Pacific are still struggling with their current banking systems. While these banks are looking to improve their digital banking architecture, most of them prefer to in-source and build their architecture in-house. While there is nothing wrong with this, many of these banks keep coming back to the question of whether their digital transformation has been effective and has yielded them the ROI, growth, retention, and preference they envisioned.

The study highlighted that Asia Pacific financial institutions are spending up to US$100 billion annually on technology. However, the problem is that this spending does not guarantee competitiveness if not executed properly.

In the past, most banks would prefer to reinvent the wheel and “build” new applications from scratch, especially when offering new digital products. The reason for this is that they need to rely on their legacy infrastructure as well as ensure they meet all regulatory requirements. However, technology has allowed banks to take a different approach to their digital journey.

Ashish Kakar, Senior Director of Research, APAC of IDC.

“Building in-house has been a de-facto strategy by banks, but it’s no longer feasible to deliver to the pace and scale that is required to be competitive. The complexities that come with the extensive amount of data layers, channels, features, upstream and downstream integration that needs to support legacy and modern systems to manage and orchestrate sophisticatedly is where in-house implementation breaks apart,” said Ashish Kakar, Senior Director of Research, APAC of IDC.

Today, banking customers encounter difficulties accessing various services through separate interfaces. They also lack a consolidated overview of their portfolios and must undergo lengthy onboarding procedures. The desire for instant approvals and efficient digital processes remains unsatisfied. Moreover, providing personalized experiences, targeted segmentation, and pertinent promotions based on customers’ lifestyles, life events, and objectives remains elusive.

Furthermore, backend operations in banking systems are adversely affected due to the absence of intelligent support in contact centers. This leads to customers repeating information to different service agents because a comprehensive, all-encompassing view of the customer is absent. This situation arises because banks excessively emphasize allocating resources to improving banking platforms. This emphasis has come at the expense of prioritizing developing unique customer journeys and enhancing the overall customer experience.

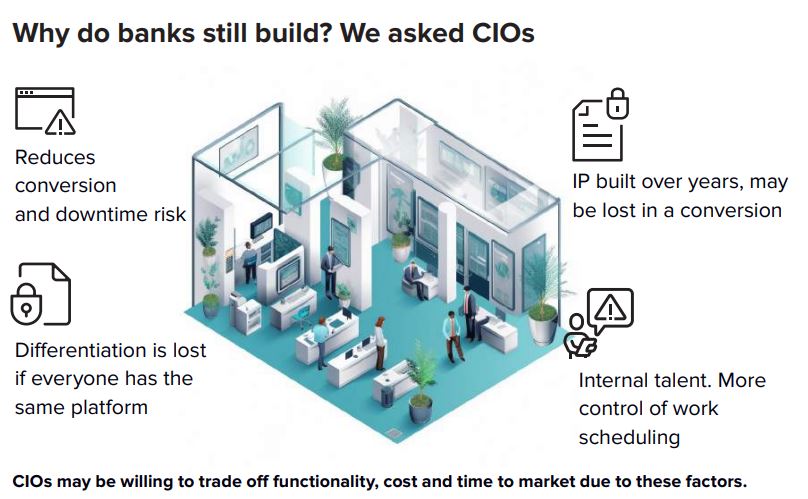

Some of the reasons why banks still build applications. (Source – IDC)

The Digital Engagement Platform

The analysis in the IDC Infobrief finds the “Adopt and Build” approach a pragmatic solution for banks to accelerate their go-to-market efforts. The approach differentiates where it matters instead of reinventing the wheel. By adopting and building upon a collaborative platform, banks can achieve 40% faster time-to-market. And this is also where digital engagement banking platforms can benefit the bank.

A digital engagement platform is a unified platform with the customer at the center, empowering banks to accelerate digital transformation. From customer onboarding to servicing, loyalty, and loan origination, the single platform improves every aspect of the customer experience.

Built from the ground up, Backbase’s Engagement Banking Platform easily plugs into existing core banking systems. It comes pre-integrated with the latest fintech so that financial institutions can innovate at scale.

Riddhi Dutta, Regional Vice President, Asia of Backbase

A bank can launch an engagement banking platform within 11 months. In contrast, a complete “build” approach taken by a traditional bank would take around 20 months. The “Adopt and Build” method is also 2.3 times more cost-effective than the typical in-house “build” option.

Riddhi Dutta, Regional Vice President of Asia of Backbase, explained that even some digital banks use engagement banking platforms to understand better and serve their customers.

“If you look at any digital banking stack, when they start operating as a bank, they need some bare minimum, such as a core banking engine, because that’s the system of records and that’s where transactions and customer data would be.

They need an engagement banking platform. What some of the digital banks are doing is they’re probably taking a shortcut to build some components of this platform on their own and launching to the market quickly. It’s a balance between cost, investment, and resources.

Some banks are not going for a full-fledged engagement banking platform, but the banks who have gone for it have realized many more benefits and have been able to differentiate much more than their competitors. And that’s what we have also been telling all the digital banks – that investing in platforms like this is worthwhile,” he said.

A Tweet on how Backbase focuses on customer centric banking.

Digital banking systems in Southeast Asia

While the report draws insights from 125 banks and 316 CIOs in APAC, a closer look into the ASEAN region shows that banks are concerned about maintaining their legacy infrastructure and potential disruptions and operational risks associated with migration.

In Malaysia, for example, Dutta pointed out that many incumbent banks are rethinking their digital offerings and modernizing their banking journeys for retail and business banking to create a more customer-centric, inclusive, and interconnected financial ecosystem.

Dutta also explained that Backbase is currently talking to both digital and incumbent banks in Malaysia on how they can leverage the engagement banking platform to speed up their digital offerings.

“In each country that each bank operates in, it is mandated by its central bank with its nuances around regulatory requirements. The way the engagement banking platforms are built is meant to cater to all the local regulatory requirements. Now, our advantage is that we are not the customer master here. That’s still the core banking system. Hence, many regulatory requirements would still be more pertinent to a core banking system than an engagement banking system because we are not storing data as such. That leads to much of the flexibility that we can offer,” added Dutta.

Regarding utilizing legacy infrastructure on modern banking systems, Dutta also mentioned that Backbase is working with regional banks still using mainframe and an AES 400-based system. The system can coexist with all types of infrastructure, whether legacy or modern.

In Vietnam, Techcombank, Vietnam’s top four bank by asset size, is a prime example of the adopt and build strategy. The bank has achieved control and freedom to create differentiated digital banking customer journeys, engagement, and experiences. Two more banks in Vietnam, ABBANK, and OCB, have also announced their investment in the engagement banking platform to gain acceleration in the modernization of customer-centric omnichannel banking.

OCB has chosen Backbase to power its omnichannel banking modernization in a signing ceremony on 20 July 2023. (Image – Backbase)

OCB is the top private bank in Vietnam and is Backbase’s fifth customer in Vietnam. In 2022, OCB expanded OCB OMNI to more than 200 products, services, and utilities. OCB OMNI users increased more than 1.7 times, while transactions increased by more than 200% compared to 2021. OCB’s deposit rate through digital channels also increased by 178% over the same period.

“Over 150 modern and forward-looking banks have adopted and built on top of Backbase’s Engagement Banking Platform to accelerate their go-to-market visions and prioritize innovating differentiated digital customer engagement and experiences. A true platform comes with all the hygiene requirements, from market fit to security and regulatory compliance to being versatile and customizable to support each bank’s unique customer needs. The platform is a composable fabric, providing modularity and re-usable data and journeys to help banks futureproof at scale,” Dutta continued.

Backed by a robust partner ecosystem, Dutta hopes that Backbase will be able to be an undisputed market leader in the region by 2025. Backbase is already leading in the Philippines and Vietnam, and Dutta believes it will soon be working with a few banks in Malaysia as well.

The future of banking.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland