Gartner estimates that Java licensing by Oracle is two to five times more expensive for most organizations.Source: Shutterstock

Oracle Java licensing changes are too brutal for most. Here’s what could happen next

- Gartner estimates that Java licensing by Oracle is two to five times more expensive for most organizations.

- By 2026, more than 80% of Java applications may be deployed on third-party Java runtimes.

- One in five Java users can expect an Oracle audit in the next three years.

In January 2023, Oracle modified its licensing policies and pricing by introducing the new Oracle Employee Java SE Universal subscription model. The changes meant businesses would have to license the software per employee under the new model, a dramatic shift from the one Oracle previously afforded them.

Formerly based on “Named User Plus (NUP)” for client devices and “Processors” for servers, Oracle Java now licenses based on the “employee” count of an organization. Big Red – which acquired Java with its buyout of Sun Microsystems in 2009 – said the new Java SE Universal Subscription is “a simple, low-cost monthly subscription that includes Java SE Licensing and Support for use on desktops, servers or cloud deployments.”

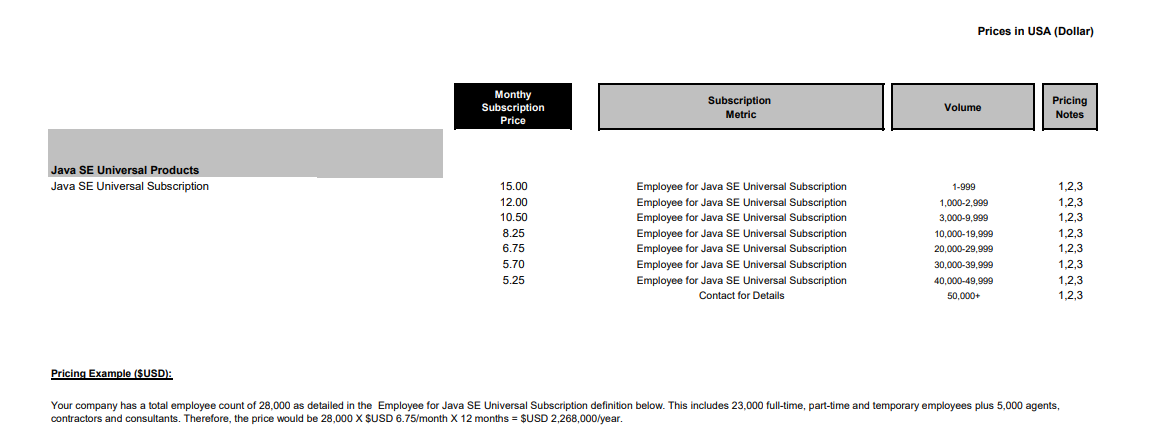

Oracle Java SE Universal Subscription Global Price List — March 1, 2023. Source: Oracle

In layman’s terms, organizations must count every employee, contractor, consultant, and agent to determine their Java subscription bill regardless of the number of Java users or server footprint. Organizations are potentially on the hook for a massive subscription fee increase that may have minimal benefit to your operation.

According to Oracle, the pricing starts at US$15 per employee per month for as many as 999 employees and drops as low as US$5.25 per employee per month for 40,000 to 49,999 users. Oracle cited an example in which a company with a total employee count of 28,000, including full-time and part-time employees and agents, consultants, and contractors, would be charged US$2.268 million annually.

New Oracle Java licensing, now what?

The changes primarily affect large companies with many employees but will also significantly impact medium-sized businesses. Although Oracle promises to allow legacy users to renew under their current terms and conditions, the company, as experts reckon, will likely pressure users to adopt the new Java licensing model over time.

Gartner had recently estimated that most organizations adapting to the new licensing terms by Oracle for Java should expect the per-employee subscription model to be two to five times more expensive than the legacy model. The global technology firm has spoken to clients since the new model was introduced in January.

Having spoken to many clients, Gartner concluded that the steep increase in Oracle licensing costs for most Java users would mean that by 2026, more than 80% of Java applications will be deployed on third-party Java runtimes, up from 65% in 2023. Gartner also warned that Oracle is ready to test whether users comply with Java licensing terms as it sees them.

“One in five Java users can expect an Oracle audit in the next three years,” Gartner said. Nitish Tyagi, the co-author of the new Gartner research note, told The Register that for large organizations, the research analyst expects the increase to be two to five times, depending on the number of employees an organization has.

“Please remember, Oracle defines employees as part-time, full-time, temporary, agents, contractors as whosoever supports internal business operations has to be licensed as per the new Java Universal SE Subscription model,” he added. To top it off, Gartner also estimated that by 2026, one in five organizations using Java applications will be audited by Oracle, leading to “unbudgeted noncompliance fees.”

By the same year, more than 30% of organizations using Java applications won’t comply with their Oracle contracts, Gartner predicts. Adding to that, pressure from Oracle on license costs will translate to 80% of Java applications deploying on third-party Java runtimes by 2026 – up from 65% in 2023, Gartner said.

Tyagi noted that clients are moving towards third-party Java runtimes such as Azul, Amazon Coretto, Eclipse Temurin, and IBM Semuru since the heavy pricing model was announced. Other “surveys also indicate a decline in Oracle JDK usage and an increase in the use of other Java runtimes,” Tyagi added.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach