Shanghai Micro Electronics Equipment is expected to deliver its proprietary SSA/800-10W by year-end, a 28-nm lithography machine. Source: Shutterstock

China is anticipating its first 28nm lithography machine by the end of 2023

|

Getting your Trinity Audio player ready... |

- Shanghai Micro Electronics Equipment is expected to deliver its proprietary SSA/800-10W, a 28-nm lithography machine, by year’s end.

- The significant technological breakthroughs are spurring hopes the country can lessen its reliance on US semiconductor techniques.

In 2020, China was sure it was on track to make its own 28nm chips by late 2021 and 20nm chips by early 2023 – all without recourse to US fabrication technology and equipment. The confidence was attributed to progress at Shanghai Micro Electronic Equipment (SMEE) in developing ultraviolet (UV) based lithographic technology. Its first Chinese-assembled 28nm lithography machine was scheduled for customer delivery by the fourth quarter of 2021.

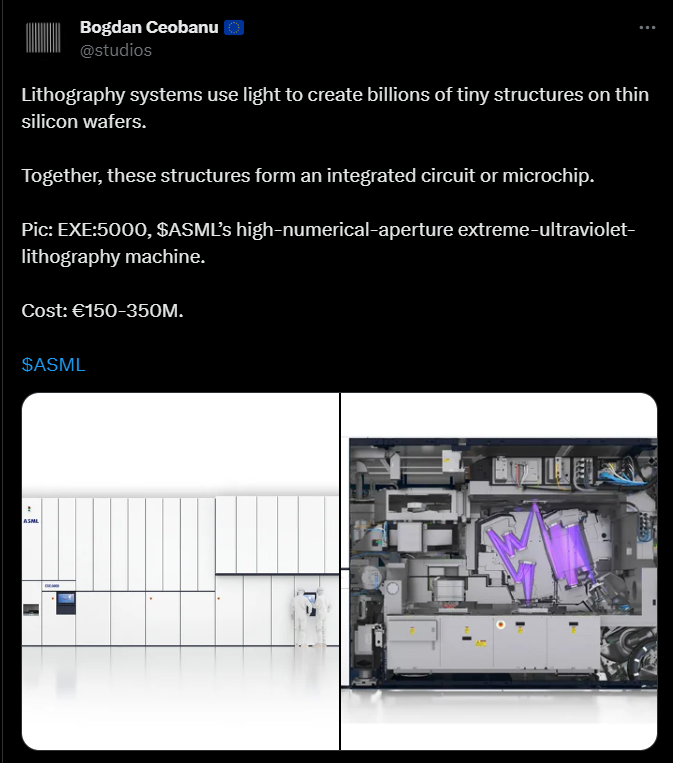

Regrettably, the US, Japan, and the Netherlands started imposing restrictions on Chinese companies on the sales of advanced wafer fab equipment, which hindered the progress of the state-owned SMEE. Chipmaking gear is regarded as among the weakest links in China’s semiconductor supply chain, an area currently dominated by firms including ASML Holding NV and Tokyo Electron Ltd.

The country’s top chipmakers, including Semiconductor Manufacturing International Corp. and Hua Hong Semiconductor Ltd., rely on foreign-made equipment. That said, the actions taken by the three countries can be interpreted as a strategic alignment with the US-led “Chip-4 Alliance,” aiming to curb China’s semiconductor industry.

However, the restrictions have triggered new perspectives amongst industry experts: will these measures effectively contain China, enabling the US-led chip alliances to maintain their strategic advantages, or will they trigger a recent crisis for the chip industry by inadvertently providing China with an opportunity to accelerate its collective efforts toward achieving chip self-sufficiency?

At this point, the latter is turning out to be the outcome. Local newspaper Securities Daily reported on Monday, citing an unnamed source, that SMEE, the Chinese leader in so-called lithography gear blacklisted by the US, is working to deliver its first system based on 28nm technology later this year.

Specifically, the first domestically produced SSA/800-10W lithography machine by SMEE will be delivered to the market by the end of 2023.

Still, it remains to be seen whether the Shanghai firm can deliver such machines in bulk, considering that, to an extent, they are still relying on foreign equipment. Even when Japan unveiled new export control measures for chipmaking equipment recently, it encompassed twenty-three items across six categories, including lithography machine, etching, cleaning, deposition, and masking.

While the specific targets of these measures were not explicitly mentioned, it is evident that China, being the largest importer of chipmaking equipment since 2020 and accounting for close to 40% of Japanese chipmaking equipment exports in 2021, is likely one of the intended targets. The rule took effect on July 23.

Meanwhile, the Dutch government announced a ministerial order to restrict exports of specific advanced semiconductor equipment in early July. The export controls will come into effect on September 1. Reuters described the company as China’s only potential competitor to the Netherlands’ world-leading lithography machine maker ASML.

ASML’s lithography machine. Source: Twitter

However, the reality is that chip production is not something one country can do independently. China can and should seek cooperation with those who advocate for globalization, Zhang Hong, a Beijing-based semiconductor industry analyst, told the Global Times.

For context, the most advanced EUV lithography machine has more than 450,000 components, exceeding the number of parts in an F1 racing car by more than 20 times. Even ASML, dominant in the world’s EUV lithography machine manufacturing, makes up only 15% of the total components. The rest must be sourced from the global supply chain.

US Commerce Secretary Gina Raimondo had recently expressed concerns over China’s large-scale investments in legacy chip production capacity, highlighting the importance of cooperating with allies to address this challenge. “The amount of money that China is pouring into subsidizing what will be an excess capacity of mature chips and legacy chips — that is a problem that we need to be thinking about and working with our allies to get ahead of,” Raimondo said.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland