Singapore’s Central Business District. Source: Shutterstock

Singapore has no plans on regulating cryptocurrencies – not just yet

THE Monetary Authority of Singapore (MAS) says it does not plan to regulate cryptocurrencies such as bitcoin, but will remain vigilant on money laundering and other potential risks that may arise from their use.

MAS managing director Ravi Menon told the Straits Times (via Bloomberg) the bank’s main focus was on looking at activities surrounding cryptocurrencies and evaluating the types of risks they pose that required a regulatory response.

“As of now, I see no basis for wanting to regulate cryptocurrencies,” he was quoted as saying.

Ravi’s remark came amid China and South Korea’s move to ban initial coin offerings and Russia’s President Vladimir Putin’s call for regulation over concerns of terrorism finding, among others.

“Very few jurisdictions regulate cryptocurrencies per se. Most have taken the approach that the currency itself does not pose the risk that warrants regulation,” Ravi said.

“It is a known fact that cryptocurrencies are quite often abused for illicit financing purposes. And so we do want to have anti-money laundering controls, countering the financing of terrorism controls in place”.

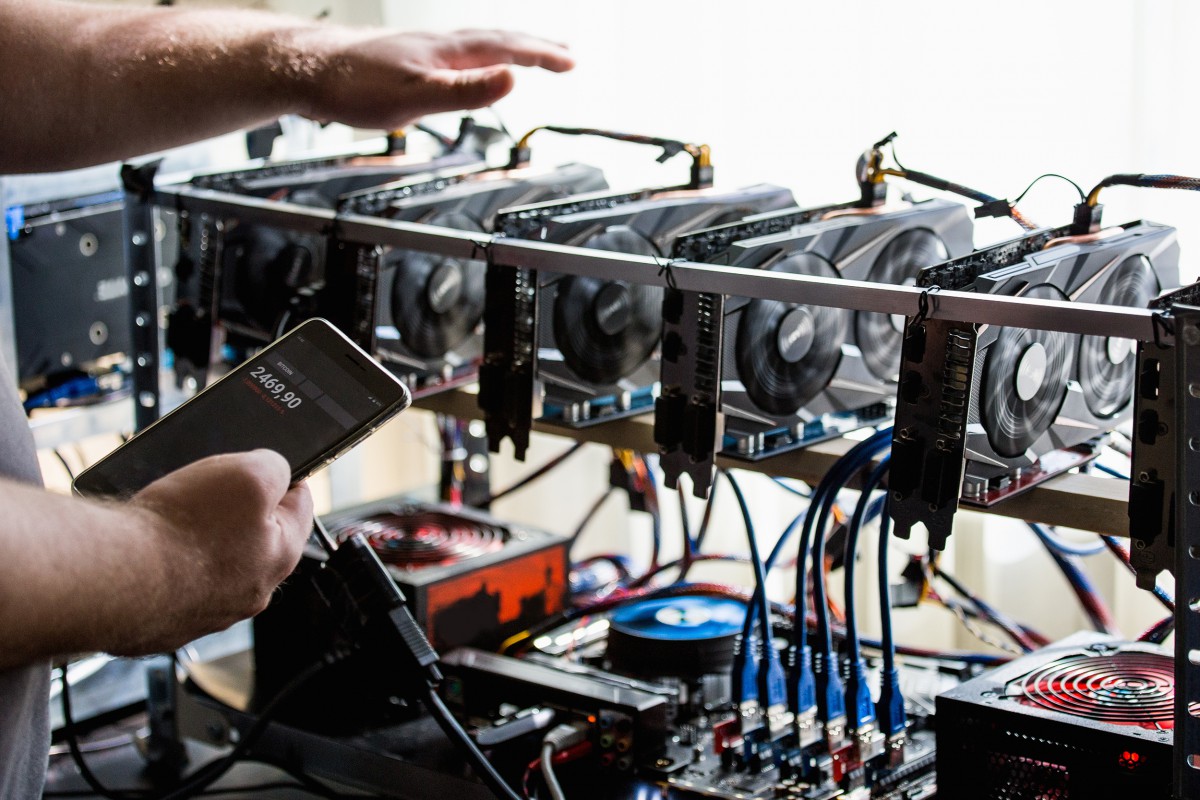

Bitcoin mines form the backbone of the bitcoin industry as miners verify and clear transactions. Source: Shutterstock

So, those requirements apply to activity around cryptocurrency rather than the cryptocurrency itself, he added.

Newer regulations, Ravi said, might not be needed as ICO’s can be covered under the present Singapore Securities and Futures Act if it promises dividends and other economic benefits.

The MAS was also monitoring other business models that circumvent the regulations.

“So, we just have to look at them case by case to see which ones we will need to bring into the regulatory ambit, and which ones can stay outside.”

Last week, prices of Bitcoin surged to US$6,000 for the first time, rising 500 percent since early this year despite scepticism from the world’s leading bankers and financial institutions.

“Our attitude is let’s keep an open mind on it. I think that is one of the areas where there has been excessive hype because people see it merely as an investment vehicle that is going to rise in value, and I think that is a rather misguided approach towards the use of cryptocurrencies,” Ravi said.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland