AI-enabled proptech is eliminating the need to travel around Singapore & rest of around APAC to properly assess real estate values. Source: AFP

How AI proptech can instantly value properties around APAC

- How an AI-powered proptech platform is eliminating the need to travel to properly assess real estate locations around APAC

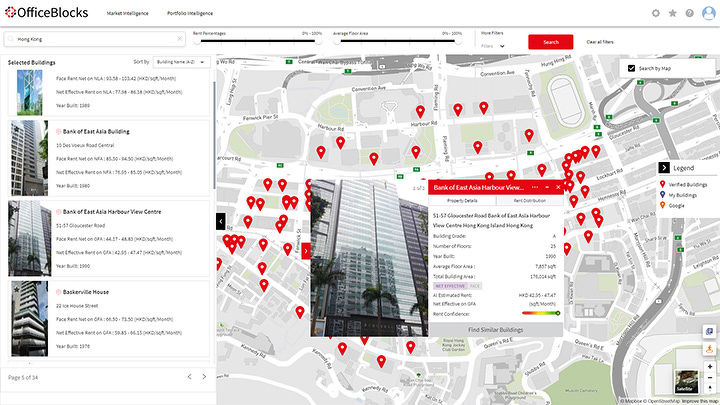

Property technology, often abbreviated as proptech, is becoming increasingly commonplace around the Asia Pacific (APAC) in recent years, and certain factors are set to see proptech truly takeoff. An excellent example of proptech disrupting traditional property investor tools is the AI-powered platform, OfficeBlocks.

According to the Urban Land Institute and PwC Emerging Trends in Real Estate Asia Pacific (APAC) 2020 report, awareness of and investment in proptech strategies are growing rapidly. And the recent world events have made things difficult for the property investor market, with travel restrictions and other restrictions limiting the possibilities.

But using the Market Intelligence App within the OfficeBlocks platform, a photo of a property can be uploaded, and the industry-first AI and big data tool will send out the rental estimates and valuation of the property to an email address within minutes.

And that is not the only proptech solution in OfficeBlocks, a commercial real estate platform that was launched in Singapore in mid-October, and is a joint collaboration between real estate consultancy JLL and Risk Integrated, a risk management company founded by PhD aerospace engineers.

“The app is powered by multiple AI algorithms. It can analyze the facade of the building and gain an appreciation of the age, size, quality as well as location of the building, which can give estimates of rental or market value effectively, within 10% accuracy,” says Yusuf Jafry, one of the aforementioned engineers who is also managing director at Risk Integrated and now a director at OfficeBlocks.

Jafry points out that artificial intelligence mimics how humans visually process information, to assess value from an image. “It’s similar to how our brains can assess some idea of value and quality from visual impressions. The AI tries to emulate the ability of a human, but you can get more insights from an AI.”

Besides the Market Intelligence App which provides nearly real-time location assessments, OfficeBlocks also hosts the Portfolio Intelligence Platform, which helps investors to itemize all the properties within their portfolio on the platform.

The app can then conduct risk and return an assessment when an investor is thinking of acquiring or divesting assets. “At the click of a button, the platform will immediately assess the impact and contribution to your portfolio,” adds Jafry.

OfficeBlocks uses AI-driven data analysis to give property investors near-instant evaluations. Source: EdgeProp Singapore

Lastly, there is also the Risk Intelligence Platform, where investors can evaluate the risk of their commercial property portfolio by analyzing multiple data points. “When you acquire an overseas property, you may have many investors and various lenders involved. You may end up with multiple tiers of loans and in different currencies. These complex factors affect the risk and return of the property investment,” Jafry explains.

OfficeBlocks leverages data from prolific real estate disruptor JLL, which has offices in 14 countries and over 50 cities, drawing from two million data points. Those enormous data sets contribute to predictive models of building images, physical attributes, historical rent patterns, and location data, according to JLL Asia Pacific chief research officer Roddy Allan, another director at OfficeBlocks.

“The more information and data that is gathered, the more accurate the tool will be. The technology could potentially predict today’s market rents for any building, anywhere,” says Allan, adding that the tool is timely since Covid-19 travel restrictions are limiting property investors’ ability to operate in multiple locations.

A property investor can also explore cities using the free OfficeBlocks mobile app, harnessing the Google Street View tie-in to take pictures of locations in different places, and get insights immediately on whether to invest.

There is also an advanced enterprise tool available on mobile and desktop, that is a pay-as-you-go cost model. OfficeBlocks plans to fully cover its initial launch locations of Singapore, Hong Kong, Shanghai, Bangkok, and Seoul within the next six months, with other key APAC markets like Tokyo, Osaka, and Melbourne to follow.

OfficeBlocks director Jafry says their AI proptech solution does the heavy data-crunching duties without committing errors and eliminates the time and hassle needs of visiting property locations and liaising with countless property brokers and agents. But he believes it will not replace human input entirely.

“Machines do the legwork, and they’re good at it as they are not prone to errors like humans, but humans are still necessary to do the finessing and make judgments.”

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland