Could Huawei find itself back in China’s AI chip race? Photo: Shutterstock

Huawei is prepared to challenge Nvidia’s position in the AI chip industry

- US restrictions on Nvidia give Huawei the chance to gain a larger market share.

- Baidu recently bought servers with Huawei’s Ascend 910B processors.

- The move appears to be an attempt to reduce dependence on Nvidia hardware for AI applications.

In March this year, the rotating chairman of Huawei, Eric Xu, made a bold claim that the tech restrictions imposed by Washington would ultimately strengthen China’s domestic semiconductor industry, rather than weakening it. “I believe China’s semiconductor industry will not sit idly by, but take efforts around… self-strengthening and self-reliance,” he said during a March 2023 press conference. He also boldly stated that China’s chip industry will be “reborn” due to US sanctions.

He wasn’t entirely wrong, and he wasn’t alone in his prediction. Months after the US imposed a stringent set of export controls on October 7, 2022, China started making strides, specifically in semiconductor technology. China even went as far as introducing a 5G smartphone featuring a domestically manufactured miniaturized silicon chip, which many analysts previously thought was unachievable by Chinese firms in the wake of the US-led technology ban.

The strides from China signaled the limits of the US-led sanctions. So, what could the US do to better constrain China’s expansion? The Biden administration targeted the hottest commodity in the market: AI chips.

Last month, the US Department of Commerce unveiled new rules intending to close loopholes left after last year’s restrictions on AI chip exports went into effect.

The earlier restrictions banned the sale of the Nvidia H100, the processor of choice for AI firms worldwide, especially in the US and China. Following that, Chinese companies could buy a slightly slowed-down version called the H800 or A800 that was explicitly made to comply with US restrictions (primarily by slowing down an on-device connection speed, called an interconnect).

The updated rules have banned those ‘slower’ chips as well, leaving Chinese companies scrambling for stockpiles. Experts were quick to explain how the restrictions would immediately cut off a significant and growing market for AI semiconductors. Nvidia thinks the restrictions might hurt its business in the long term, but what is certain amid all the US efforts to cripple China’s technological advancement is that they will actually boost Chinese developments rather than hampering them.

Huawei could fill the AI chips gap in China

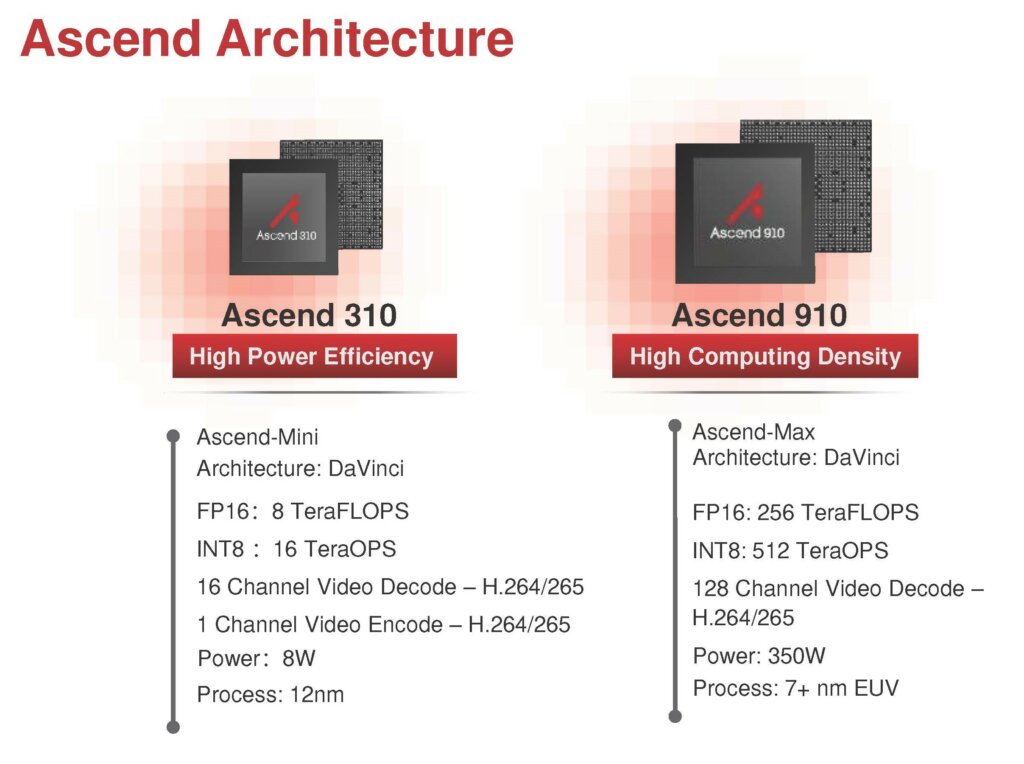

Huawei, more widely recognized worldwide for its telecommunications and smartphone business, has been actively developing an AI chip product line for the past four years. It unveiled its push into AI technology at Huawei Connect 2018, releasing two chips, neural networks compute architecture, a development toolkit, and a cloud training framework across AI.

What would have stood out if it were unveiled amid the current fascination around AI is Huawei’s Ascend AI chip series, which then included the Ascend 910 and Ascend 310. The chips were made available in 2019, the year Huawei was hit by the most severe US restrictions.

Back then, Huawei asserted that its chip was the most powerful AI processor globally, and according to Chinese media reports, the initial Ascend 910 chip was fabricated using a 7-nanometer manufacturing process. With that process, the chip couldn’t significantly challenge Nvidia’s supremacy, either in domestic and international markets.

Nvidia launched its A100 and H100 chips in 2020 and 2022, capturing the lion’s share of the global AI chip market, a trend further fueled by the rise of generative AI. The main product to rival Nvidia’s A100 chip would later be the Ascend 910B.

Analysts have also noticed that Nvidia held a significant advantage over Huawei as an incumbent player, mainly due to the existing AI projects relying on Nvidia’s well-established software ecosystem.

Although Huawei has its own ecosystem called CANN, experts say it has limitations when training AI models compared to Nvidia’s ecosystem. But there have been some changes in China of late, and Huawei might again be in the race to grab a slice of Nvidia’s AI chip market share.

According to a report by Reuters this week, Baidu, one of China’s leading AI companies, had ordered 1,600 of Huawei’s 910B Ascend AI chips. Baidu had been a long-time client of Nvidia, so the move demonstrates how Chinese firms are exploring alternatives to the latter’s products due to the export restrictions by the US.

Reuters indicated that the order by Baidu was for 200 servers.

When was Huawei’s Ascend 910B launched?

Huawei Ascend 910 And Ascend 910 Overview. Source: Huawei

Huawei hasn’t made an official announcement regarding the Ascend 910B, but it is undoubtedly a revised version of the Ascend 910. Specific details about the chip have surfaced through comments from Chinese firms and academics, along with technical information available on Huawei’s website.

In August this year, Liu Qingfeng, the chairman of the Chinese AI company iFlytek, lauded Huawei for developing a GPU that he likened to Nvidia’s A100. He mentioned that iFlytek was collaborating with Huawei on hardware development. Subsequently, Chinese media outlet Yicai reported that the hardware in question was powered by the previously undisclosed Ascend 910B chip.

Within the same month, documents related to Ascend 910B, such as driver and firmware upgrade guides, began appearing on Huawei’s website. Even during iFlyTek’s recent earnings call, senior vice president Jiang Tao reiterated that the capabilities of the Ascend 910B were comparable to Nvidia’s A100.

“Analysts and insiders suggest that the 910B chips offer comparable raw computing power to Nvidia’s chips but may lag slightly in overall performance. Nevertheless, they are considered the most advanced domestically-produced option available in China,” the report by Reuters reads.

Perhaps this was what Huawei’s chief financial officer Meng Wanzhou meant when she said the company would go big on AI by “building a solid computing base for China – and a second option for the world.”

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland