Are accountants embracing AI? (Image generated by AI)

How AI is shaping the future of accounting

- AI is set to transform accounting, offering more than efficiency gains for adopters.

- Successful AI integration in accounting hinges on AI literacy and proactive leadership.

- More AI needs more expert oversight, not less.

The size of a technology organization seems to play a significant role indeed when it comes to adopting new technologies like AI. There’s a noticeable division in the adoption of new technologies between large corporations, including significant accounting firms, and smaller enterprises, such as SMEs and SMPs. The former are typically ahead in incorporating new technologies and often do so with an eye towards gaining a competitive edge through digital transformation initiatives.

There’s a significant untapped potential to broaden the awareness and usage of advanced, widely relevant technologies like AI and machine learning within the accounting and finance sectors.

Navigating the risks and rewards of AI in accounting

Take generative AI as an instance; these models are celebrated for their efficiency in digesting and summarizing vast amounts of data and their capacity to generate original content from that data. They open new avenues in reporting, analysis, and risk evaluation when used with caution. However, there are inherent risks, especially if the generative AI models are not precisely trained or refined for a specific task or the latest data.

The limitations of the models’ capabilities to distinguish factual information mean they are usually restricted to scenarios where:

- Verifying or amending outputs is straightforward;

- There exists an unquestionable source of truth, either within the training data or within the original records;

- The generative abilities are applied for innovative or inspirational endeavors.

According to a survey from ACCA members, embracing digital tools like AI can yield numerous organizational benefits, such as increased flexibility, enhanced quality of products and services (78%), and better performance in sustainability, transparency, and regulatory compliance (72%).

Why incorporate new tech? Its aim should be to augment human productivity and effectiveness, leading to improved compliance, deeper insights, superior reporting, or completely new functions. The focus should be on these outcomes, not just the adoption and operation of the technology itself.

The Digital Horizons survey, which received 1,074 responses from global ACCA members, revealed that many finance professionals primarily view the advantage of technology as enhancing efficiency and internal processes (52%), with such improvements being among their top three goals in adopting new technologies.

Only a fraction, 18%, acknowledged competitive motives, like meeting customer demands, enhancing market insights, initiating round-the-clock operations, or keeping up with competition, as a reason for adopting technology.

According to a survey from ACCA members, embracing digital tools like AI can yield numerous organizational benefits. (Image generated by AI)

Overcoming the cost hurdle

Cost is the principal hurdle in adopting technology, with expenses being a significant factor, particularly noticeable in the deployment of IoT applications where scalability and cost have historically hindered broader adoption. In contrast, for technologies like analytics, AI, and advanced robotics, concerns about costs are often matched or surpassed by employee resistance.

Certain groups, notably the digital skeptics, tend to underscore three primary challenges: 1) the high costs associated with adoption, 2) the fear of being tied to a single vendor, and 3) the struggle to find suitable partners.

Despite these hurdles, the culture within an organization is also a crucial element in successful technological integration. Andrew Lim from ACCA believes that the successful adoption of technology is not just about the systems in place but also involves empowering individuals to utilize these systems effectively and recognize their personal advantages.

Lim highlights the importance of hands-on experience and training and the freedom to experiment and innovate, which can lead to improvements in existing workflows.

There’s no simple solution for better adoption. Having correct goals, skills, and leadership is essential, but these must be interwoven into a strategic vision that aligns internal efficiency improvements with competitive and transformational objectives.

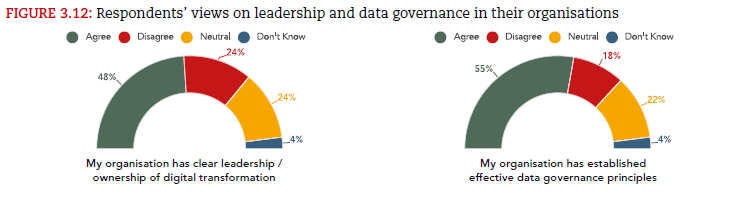

Role of leadership & data governance. (Source – Digital Horizons)

The Digital Horizons report emphasizes that while the finance profession is in a prime position to benefit from digital technologies, unlocking their full potential may require a shift in mindset—from focusing solely on efficiency to a broader comprehension of value—and an adaptation in skills and practices.

AI literacy for accountants – the next business necessity?

The survey revealed a varied perspective on how technology assists personal goals. Increased productivity (85%), improved collaboration (76%), and career advancement opportunities (65%) scored high, while job security seemed less influenced by technology, with only 30% feeling supported in this aspect. Career development, however, saw a notably positive impact, with many discussions focusing on the accessibility to learning and more adaptable opportunities.

Lim advocates for the strategic edge provided by automation in accounting, as it enables a shift from reactive to proactive engagement with data, allowing accountants to concentrate more on analysis and strategic insight rather than just transaction logging.

Lim stresses the importance of looking beyond mere efficiency as the fast-paced business world increases demands on financial departments. It may be necessary to rethink tasks to fully utilize technology as a facilitator of human capability and a translator of value.

Leadership was a recurrent theme in both the survey and discussions. Alistair Brisbourne of ACCA notes that leadership is a characteristic trait among the most innovative organizations and coincides with higher confidence among employees. Digital leadership instills the confidence to adopt new tools and methods, like AI and advanced analytics, that can significantly revamp processes.

The survey discovered a high confidence level among ACCA members in AI’s capacity to free up time for business-critical tasks, with 70% agreement. However, less certainty existed regarding AI performing these critical tasks. Yet, these figures still suggest a general optimism.

Despite a small percentage actively implementing AI within their organizations and another 8% experimenting with it, the aspirations to harness AI’s capabilities remain vast.

For finance teams, it’s believed that there should be a structured accountability framework when it comes to AI adoption.

Cultivating AI literacy within accounting teams

Central to this framework is AI literacy, which involves understanding the different types of AI models, their functionality, and the potential benefits and risks they may introduce. This also means recognizing that the precision of AI can wane over time.

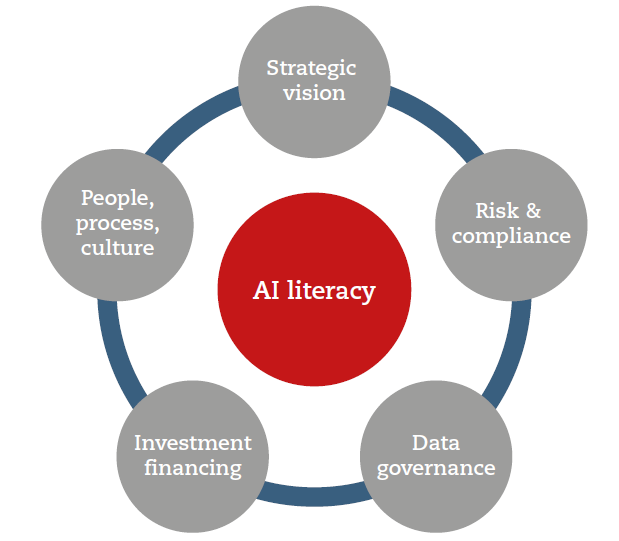

The AI circle of accountability. (Source – Digital Horizons)

Encircling this fundamental need are practices in five crucial domains:

- Strategic vision: understanding AI’s potential and having a clear plan for how it will help achieve organizational goals.

- People, process, culture: cultivating a transparent and collaborative environment that continuously seeks to improve AI adoption through active stakeholder participation.

- Risk and compliance: forging robust collaborations between risk and audit professionals with innovation teams to manage AI usage effectively.

- Investment mindset: committing to AI initiatives involves accepting uncertainty throughout the project lifecycle, requiring ongoing evaluation of costs and benefits, and the flexibility to financially support experimentation.

- Data governance: finance professionals play a vital role in ensuring data is managed properly, maintaining its quality, relevance, and compliance with legal and regulatory standards.

Brisbourne points out that AI is often considered a means to evolve existing processes. This view focuses on the efficiency AI brings to the industry, rather than its potential to add value in response to new and existing needs fundamentally.

Lim underscores that the presence of AI does not diminish but instead heightens the need for expert oversight in critical processes and functions.

He emphasizes the point that while AI can provide valuable support and productivity enhancements, it cannot replace the critical thinking and consideration of various contextual factors necessary when making decisions, even those informed by AI-driven insights.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland