APAC leads in Web3 gaming development. (Source – Shutterstock).

APAC leads in Web3 gaming development

- Web3 gaming thrives with APAC’s development and US funding, showing stable post-2022 investments and diverse genres.

- The report shows the industry overcoming distribution hurdles and favoring indie over AAA titles.

- Games are migrating to new networks in 2023.

The Web3 gaming ecosystem is undergoing significant changes, especially after the market shifts in 2022. While growth has slowed, the sector continues to expand, with the Asia-Pacific region becoming a major center for Web3 game development, while the US remains a key market.

In 2023, there was a marked increase in blockchain networks focusing on gaming, coinciding with a steady introduction of new Web3 games. Game7’s State of Web3 Gaming Report offers an in-depth overview of the ecosystem’s evolution over the last six years. The report is based on extensive research, analyzing data from over 1,900 blockchain games, 1,000 funding rounds, and 170 blockchain ecosystems.

The report covers various aspects of the industry, including the gaming stack, gameplay trends, blockchain networks, competitive dynamics, and fundraising. It provides valuable insights into the development of Web3 gaming post-2022 correction, making it a crucial resource for game developers, investors, blockchain enthusiasts, and anyone interested in the direction of the industry.

Expanding horizons in APAC and US

The Asia-Pacific (APAC) region increasingly dominates game development, hosting 40% of developers and launching half of the new Web3 games this year. This dominance highlights APAC’s growing focus on Web3 gaming.

Meanwhile, the USA remains a significant player, with 30% of new Web3 gaming teams based there, demonstrating the country’s steady engagement in the sector. South Korea, in particular, has doubled its contribution from last year, and now makes up 27% of new teams, signaling a surge in its Web3 gaming activities.

Despite the APAC’s ascent, the USA still commands the largest market share for Web3 game developers at 30%. Other notable contributors include South Korea (12%), the UK and Singapore (6% each), and Vietnam and Australia (4% each), reflecting a diverse and globally distributed Web3 gaming industry.

Web3 gaming investments: resilience post-2022 market correction

In 2023, Web3 gaming investments have stabilized, echoing the levels seen in 2021, before the bull market surge. Since 2018, there’s been a shift in investor focus towards gaming content, especially in sports and Metaverse-related MMOs, rather than on infrastructure. The US leads in investments, with France, Canada, Singapore, and Hong Kong also showing strong interest.

The investment peak of 2021 has now leveled off in 2023, reflecting a return to more stable, pre-bull market conditions. The Web3 gaming sector has attracted around US$19 billion in funding since 2018, signifying investor confidence in its potential.

Despite the 2022 market correction, the Web3 gaming market has continued to grow. By Q3 of 2023, blockchain gaming investments reached US$1.5 billion, with over US$800 million exclusively for Web3 gaming. The US has attracted over US$4 billion in Web3 gaming funding, with notable contributions from other regions.

Since 2018, funding within this landscape has varied by genre. Sports and MMOs have each attracted around US$1 billion, with RPGs receiving US$0.7 billion and Action games US$0.3 billion. This finding shows the varied interests and potential within this gaming ecosystem.

Is Web3 a gaming landscape on the rise? (Source – X)

Diverse gaming genre landscape

In the Web3 gaming sector, indie and early-stage projects are the mainstay, making up most of the market. This starkly contrasts the limited presence of larger AA and AAA titles, constituting only a small segment. The sector is marked by various genres, with RPG, Action, Strategy, and Casual games being the most popular. This diversity extends to platform-specific trends, with RPG and Action genres favored on PC, a more varied genre mix on mobile, and Casual games leading in browser-based play.

Indie-level and midsize projects overwhelmingly dominate the Web3 gaming ecosystem, comprising 94% of the market, leaving only 6% for AA and AAA titles. This dominance is reflected in the preference for RPG, Action, Strategy, and Casual games, with nuances in genre popularity across different platforms. PC gaming tends to lean towards RPG and Action, while mobile gaming offers a broader genre spectrum, and Casual games are more common in browser-based gaming.

Regarding game accessibility and models, most games (69%) follow a free-to-play (F2P) model. Meanwhile, 26% of the games require players to possess specific non-fungible tokens (NFTs) for access. This range in accessibility and models illustrates the Web3 gaming sector’s commitment to catering to diverse player preferences and interests, offering various ways to engage with gaming content.

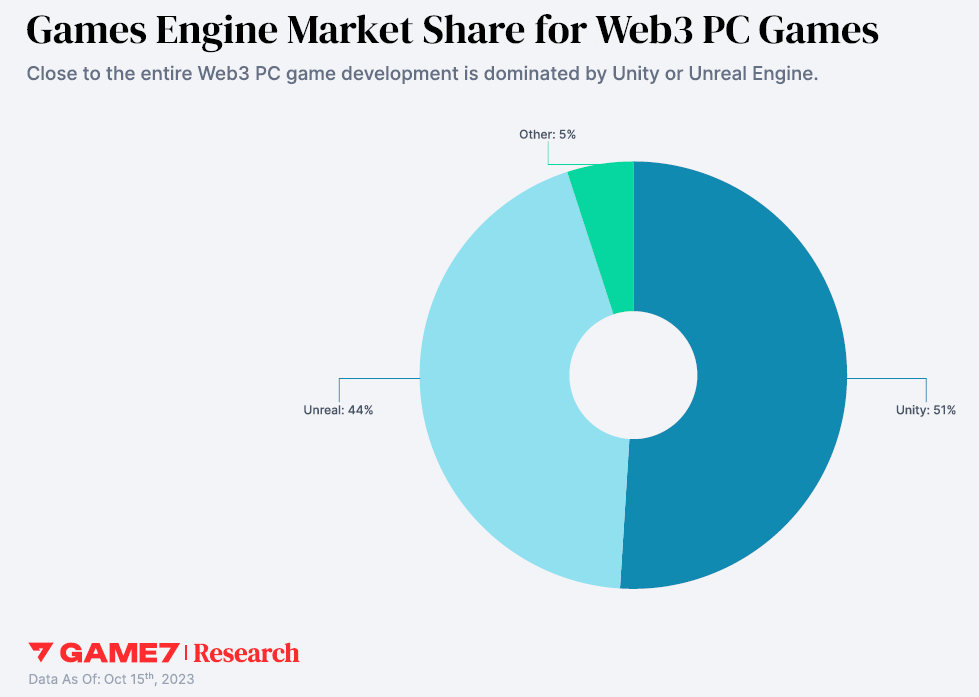

Distribution challenges in the gaming stack

Distribution remains a significant hurdle in the Web3 gaming sector, with many games still not featured on mainstream channels. This trend is slowly changing, as exemplified by the Epic Games store, which has begun including Web3 games following a change in its self-publication strategy. Most Web3 PC game development is dominated by Unity and Unreal Engine, which are used in 95% of such games.

Around 60% of Web3 games are absent from significant distribution platforms, instead relying on direct channels or Web3-specific platforms. The Epic Games store’s increasing incorporation of Web3 games, growing from just two listings in June 2022 to 69 by October 2023, indicates a shift toward wider acceptance in mainstream gaming outlets.

Most Web3 games use Unity and Unreal Engine for development, underlining the strong preference for these tools in the Web3 space. While 85% of these games use blockchain mainly for tokenizing assets, they often keep core game mechanics off-chain, suggesting a selective use of blockchain technology. In contrast, only 5% of these games are fully on-chain, reflecting diverse approaches in integrating blockchain into gaming.

Games engine market share for Web3 PC games. (Source – Game7)

Network migration trends in Web3 gaming for 2023

The landscape of gaming in 2023 has been marked by a significant migration of games to new networks, highlighting a period of active exploration and adaptation within the community. Polygon, Immutable, and Arbitrum have become the top choices for this migration, indicating their growing appeal among developers.

The Polygon ecosystem currently leads in hosting Web3 games, with BNB and the Ethereum Mainnet also playing key roles. This diverse range of platforms, each with unique features and benefits, illustrates the dynamic environment in which Web3 games are being developed and hosted.

In Layer 2 (L2) gaming ecosystems, Immutable stands out as the most popular, followed by Arbitrum. Solana, meanwhile, is the largest non-EVM ecosystem in the Web3 gaming sector. This diversity in ecosystems shows the vibrant nature of the industry, with different networks meeting the varied needs of game developers and players.

OP Stack has become the preferred blockchain framework for creating networks tailored to gaming use cases, reflecting its alignment with the specific game development requirements within the blockchain arena.

George Isichos, core contributor at Game7, emphasized the importance of research in understanding and addressing the complexities of the Web3 gaming ecosystem. He noted that the report aims to index and comprehend the Web3 gaming world credibly neutrally, focusing on the core challenges of game development rather than just tokens and speculation.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland