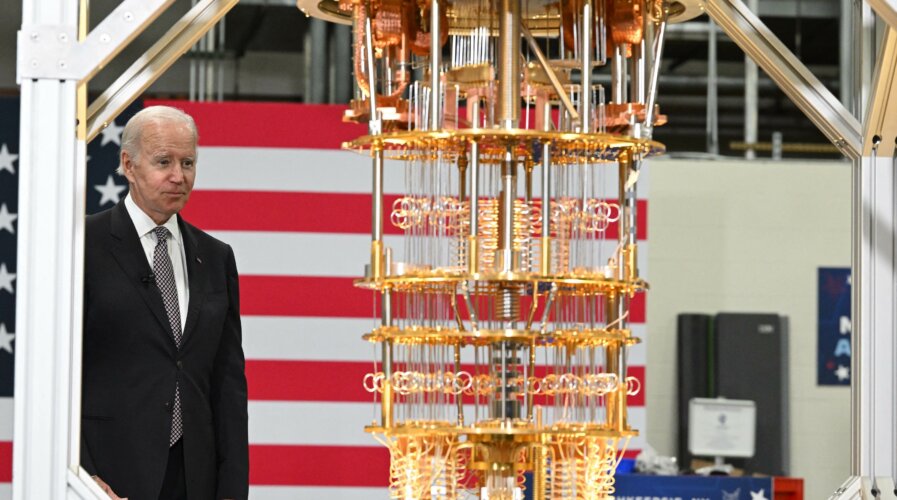

US President Joe Biden looks at a quantum computer as he tours the IBM facility in Poughkeepsie, New York, on October 6, 2022. (Photo by Mandel Ngan / AFP)

Why quantum computing is the future of finance

- Quantum computing in finance will be a game-changer.

- However, businesses need to be aware of quantum safety as well.

- The IBM Quantum Network has been helping partners to develop and test quantum computing use cases.

Despite quantum computing being still in its infancy when it comes to global use cases, many industries are already planning how they can use it not just to improve their products and services but also to protect their business.

Quantum computing use cases can be applied to most industries today. But with the technology still being a costly affair to many, most of these use cases are still in the testing phases. Yet this is not stopping industries from planning how they can usee the technology once it is more affordable and available.

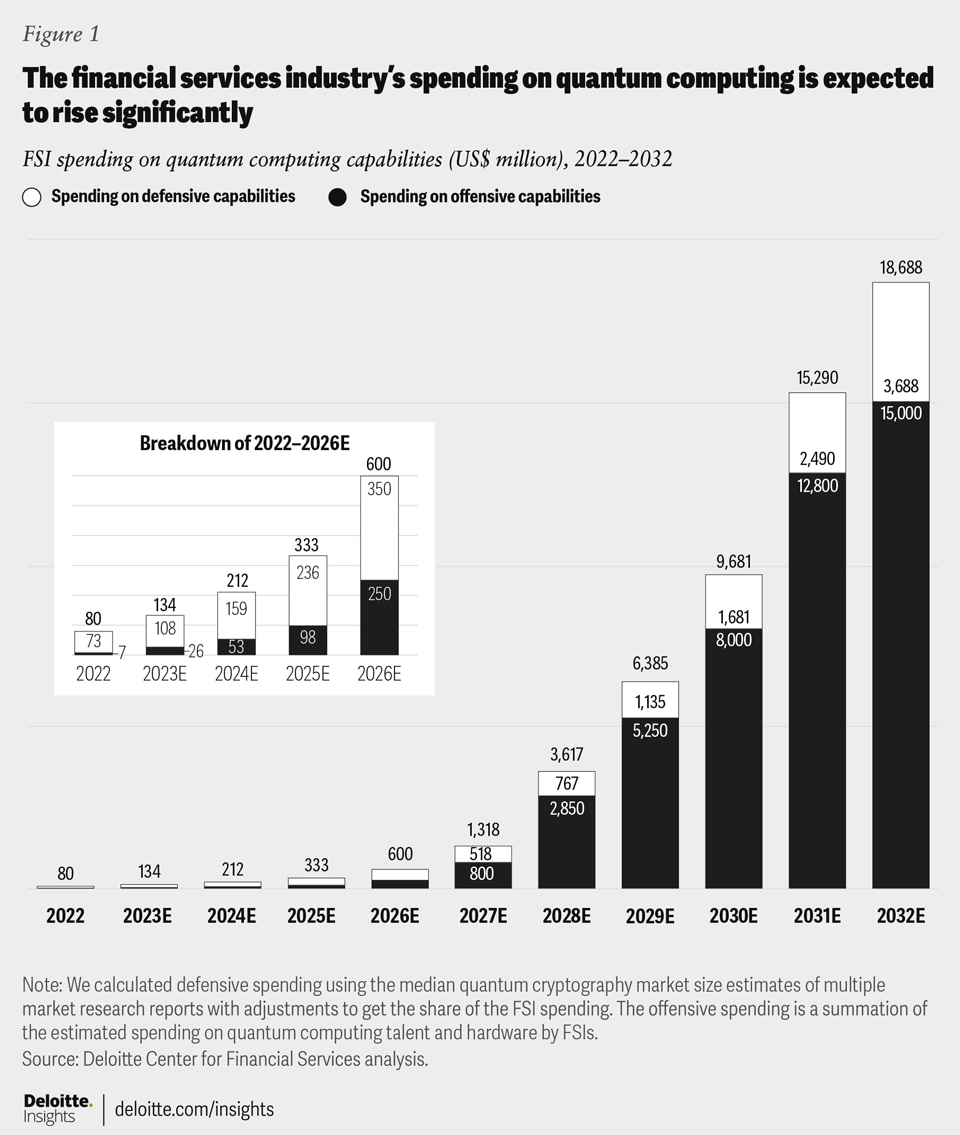

Quantum computing in finance specifically continues to see testing in a variety of use cases. In fact, according to a study by Deloitte, the financial services industry’s spending on quantum computing capabilities is expected to grow 233 times from just US$80 million in 2022 to US$19 billion in 2032, growing at a 10-year CAGR of 72%. Firms that are working on developing quantum-related capabilities now could enjoy a competitive advantage as these capabilities mature.

Quantum computing in financial investments. (Image by Deloitte).

Quantum computing in finance

According to a report by IBM, quantum computing in finance will be a game-changer. Not only is the technology capable of dealing with issues related to uncertainty and constrained optimization, but it can also ensure greater compliance, employing behavioral data to enhance customer engagement, and faster reaction to market volatility.

The report also stated that quantum computing can let financial service organizations to re-engineer operational processes, such as:

- Front-office and back-office decisions on client management for “know your customer,” credit origination, and onboarding.

- Treasury management, trading and asset management.

- Business optimization, including risk management and compliance.

Looking at the bigger picture, potential applications for quantum computing in finance include:

- Portfolio optimization: Quantum computing can help investors find the optimal allocation of assets in their portfolios, taking into account various factors such as risk, return, liquidity, and diversification.

- Risk management: Quantum computing can help financial institutions assess and manage various types of risks, such as market, credit, operational, and liquidity risks.

- Fraud detection: Quantum computing can help detect and prevent fraudulent activities, such as money laundering, identity theft, and cyberattacks.

- Encryption: Quantum computing can also pose a threat to the security and privacy of financial data, as quantum computers can potentially break the encryption schemes that are currently used to protect online transactions and communications.

Quantum computing has an almost unlimited range of uses, especially in finance. (Image generated by AI)

Developing quantum computing for finance and other industries

John Duigenan, IBM’s global leader in the financial services industry.

To understand more about quantum computing in finance, Tech Wire Asia spoke to John Duigenan, IBM’s global leader in the financial services industry. Duigenan is an industry veteran who has held technical and business roles spanning the entire product, sales, and implementation lifecycle, with extensive development, service, sales, and technology leadership.

When it comes to quantum computing in finance, Duigenan naturally believes IBM is at the forefront of the development of the technology. During a recent visit to its quantum computing research center in New York, Duigenan said that there was a lot of excitement about the innovations that are being developed in the field.

“We are close to having a quantum advantage. That means we’re about to have algorithms that will make conventional decisions better or more effectively on a quantum computer than on a traditional or classical computer. It’s very exciting. If we think about the areas where quantum computing will make a difference in finance, it will be in how we generate quotes when we assess risk, how we optimize a portfolio of investments, and even how we price securities for anything where there’s a large module, or large simulations,” said Duigenan.

While Duigenan did acknowledge that the world is still several years away from quantum computers being generally available, IBM is already working to develop and test more use cases with partners all around the world.

“Within IBM, we’re working with innovative financial services firms and innovative firms from every industry on the Quantum Network. The Quantum Network lets innovative companies use quantum computers today by connecting to IBM clouds. They are using quantum computers right now,” he added.

IBM’s Quantum Network.

The Quantum Network

The Quantum Network is made up of over 200 Fortune 500 companies, universities, laboratories and startups that are all pulling together toward the quantum future. Members of the network include financial institutions like Goldman Sachs, EY, the University of Tokyo, Capgemini, Chicago Quantum Exchange, Samsung and others.

In May 2023, IBM announced plans to open its first Europe-based quantum data center to facilitate access to cutting-edge quantum computing for companies, research institutions and government agencies. The data center is expected to be operational in 2024, with multiple IBM quantum computing systems, each with utility-scale quantum processors, ie, those of more than 100 qubits.

In June 2023, France’s Crédit Mutuel Alliance Fédérale and its technology subsidiary Euro-Information announced plans to continue their investment with IBM in quantum computing. After a successful initial phase, the organizations have identified specific use cases, among many areas of interest in financial services, for the collaboration’s next scaling phase. This includes research into customer experience, fraud management and risk management. This phase also intends to explore possibilities for how quantum computing could lead to future improvements in Crédit Mutuel Alliance Fédérale’s customer and employee experience.

Duigenan also acknowledged that while these partnerships let the most innovative companies get in front of the technology and gain their own advantage when quantum computers become generally available, there’s going to be a race for talent. And Duigenan believes that race for talent is going to be vigorous. That means the firms that are investing now will have the advantage in quantum computing.

Cybercriminals will most likely use quantum computers in the future as well. (Image generated by AI)

With great technology, comes a greater threat

As quantum computing use cases grow, Duigenan pointed out that there needs to be a focus on quantum safety as well.

“Quantum safety is an idea that is built on the premise that as soon as quantum computers exist, bad actors will use them for bad purposes. That primary bad purpose is, of course, breaking conventional encryption. This is a massive threat to any industry where encrypted data is a standard, because we all have to work on the basis that anything we’re encrypting today could be decrypted in the future,” he explained.

In the US, the National Institute of Standards and Technology (NIST) has been advocating for the importance of quantum safety. This year, the agency has begun the process of standardizing algorithms as the final step before making them available so that organizations around the world can integrate them into their encryption infrastructure.

“There’s a massive research effort into and beyond research standards which are being adopted in the US around quantum-safe algorithms. IBM is at the forefront of quantum-safe algorithms, both in terms of research and having those standards adopted by NIST. Quantum safety is an area where many clients are asking us how to prepare and what they should be doing,” added Duigenan.

Given the capabilities of quantum computing and the possible threats in the future, Duigenan believes that the greatest benefit of a quantum computer is its ability to support AI. That includes providing the computing power needed to run AI models, especially with the demand for greater compute by organizations today.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland