Data breach spreads to the pet world. (Image generated with AI).

Barking up the wrong data tree: even pets aren’t safe from a data breach

- The best pet insurance for dogs could involve enhanced cybersecurity measures.

- Data breach exposes over 56,000 pet records, revealing cybersecurity vulnerabilities.

- Pet medical and microchip data highlights risks to pet safety.

Cybersecurity is now so severe that even pets aren’t safe. In a world where digital data breaches are increasingly common, affecting financial institutions, healthcare records, and personal identities, it now appears that the scope of cyberthreats has extended to our four-legged friends. And it may be, therefore, that the best pet insurance for dogs is increased cybersecurity.

Not long ago, the idea of pets fiddling with high-tech gadgets was pure science fiction. Now, it’s a different story – 83% of pet owners across North America and Europe have jumped on the pet tech bandwagon, according to The Wall Street Journal.

Does this tech invasion make our furry friends (and us) more susceptible to cyberthreats?

Sadly, it does. Connectivity means vulnerability.

Cybersecurity researcher Jeremiah Fowler’s recent discovery of a significant data breach highlights this new aspect of digital security. The recent breach, involving an unsecured database containing over 56,000 records, exposed not only owners’ data but included pets’ medical records, DNA test results, and detailed pedigree histories.

The impact of the data breach on pets and their insurance

Fowler’s discovery was striking as it involved records of thousands of dogs worldwide and their owners’ information. The database, accessible publicly on cloud storage, included 56,624 documents in PDF, .png, and .jpg formats, amounting to 25 GB. His investigation revealed that the database was associated with the Worldwide Australian Labradoodle Association (WALA). This international entity advocates for the Australian Labradoodle breed and maintains high standards in breeding practices, if not cyber-hygiene.

Thanks to WALA’s global presence (its main office is in Washington state, USA, and it has regional offices across many continents), Fowler’s discovery included documents from various countries in the database. He promptly sent a responsible disclosure notice to WALA, but the database was only secured several days later.

WALA, as per its website, focuses on uniting Australian Labradoodle breeders globally to ensure high breeding standards and the establishment of a detailed and accurate database for preserving pedigree and health information. The exposed documents in the breach were comprehensive, including medical reports and DNA tests of dogs, their pedigree details showing lineage details, and information about the dogs’ owners, veterinarians, and testing laboratories. The data included names, addresses, contact numbers, and email addresses, among other details.

This breach highlighted the often-overlooked implications of pet medical data breaches in a sector where, as reported by the American Pet Products Association (APPA), a significant portion of US households own pets and spend a substantial amount annually on pet-related expenses.

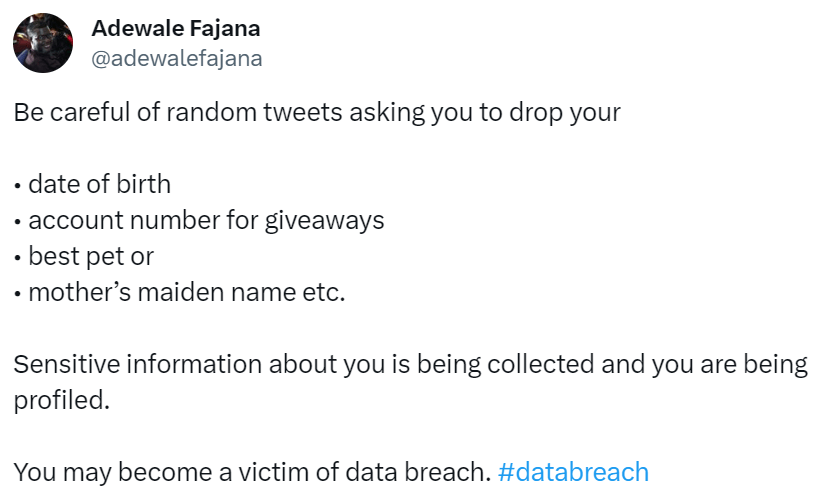

An X user warns users about leaking information online. (Source – X)

Rising concerns: pet insurance fraud and microchip risks

The breach also raised concerns about the risk of pet insurance fraud. Given that policies for the best pet insurance for dogs cover a range of scenarios, from accidents to routine care, the exposure of such sensitive information could potentially be exploited for fraudulent insurance claims. Historical trends have shown a marked increase in pet insurance fraud, especially between 2010-2015. The North American Pet Health Insurance Association’s 2022 report detailed a significant number of insured pets and a substantial amount of premiums paid. Current data on the prevalence of fraud in this sector is not publicly available.

An additional risk factor identified in the recent breach was the exposure of pet microchip numbers. Microchips aid identifying and recovering lost pets, and unauthorized disclosures alongside owners’ details, poses potential risks. Criminals could misuse this information, falsely claiming ownership of lost or stolen pets, given the high value of certain breeds, Labradoodles among them.

Beyond the risk of pet theft, there are concerns about social engineering tactics where criminals might impersonate authority figures to extract personal and financial information from pet owners, leading to fraud or identity theft.

Fowler stressed the importance of maintaining the confidentiality of pets’ microchip numbers and being vigilant about requests for related information. He advised pet owners to verify the identity of anyone asking for such details and to report any suspicious activities to the relevant microchip registry and local authorities. The exposed database underscores the need for robust data security measures and brings to light the diverse and often unexpected implications of data breaches.

Safeguarding against data breaches and scams

The phenomenon of “puppy scams” encompasses various deceptive activities connected to dog sales, often involving the advertisement of non-existant or falsely represented ‘pedigree’ puppies. A common scam is “breeder identity theft,” where fraudsters impersonate legitimate breeders to dupe buyers. Such scams comprise ads on classified websites or social media. Buyers should exercise caution and confirm the legitimacy of any breeder’s identity and credentials. Buyers should be wary of sellers offering high-value pedigree puppies at curiously low prices and avoid making payments or wire transfers without verifying the authenticity of the animal.

The WALA database leak, containing extensive pet health records and breeder information, presents a potential risk if exploited by criminals to falsely claim ownership of or breeding rights to specific dogs. The scope of access to the records by unauthorized parties remains unclear. The Better Business Bureau (BBB) in the United States reported that pet scams constituted 24% of online scams in their 2021 Scam Tracker.

The Federal Trade Commission (FTC) estimates less than 10% of scam victims report incidents, so the number of victims could be significantly higher. In 2022, Australians reported losses of over AU$ 3.5 million to pet-related scams, and the UK witnessed a 39% increase in such scams from 2020 to 2021, with an average loss of around £1,400.

The duration of exposure of the WALA database and the extent of access by unauthorized individuals is unknown. There is no direct claim that criminals accessed the exposed documents so no specific fraud risk. Similarly, there’s no allegation of related misconduct by WALA or that its members faced any direct threat. The focus here is on highlighting the potential risks associated with any data breach, especially those that could jeopardize the privacy and security of individuals or entities in such databases.

This incident not only underscores the widespread implications of cybersecurity in our everyday lives but also serves as a reminder that virtually no aspect of our lives, not even our pets’ information, is immune to the reach of cyberthreats.

So it could well be that the best pet insurance for dogs is simply stronger cybersecurity.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland