PayMaya recently announced a partnership with SM Malls. Pic: Facebook

Singapore becomes first country in Asia to receive Google’s Android Pay

GOOGLE is finally joining the ranks of contactless smartphone payments in Singapore, where Apple Pay and Samsung Pay have already been in place since May and June respectively.

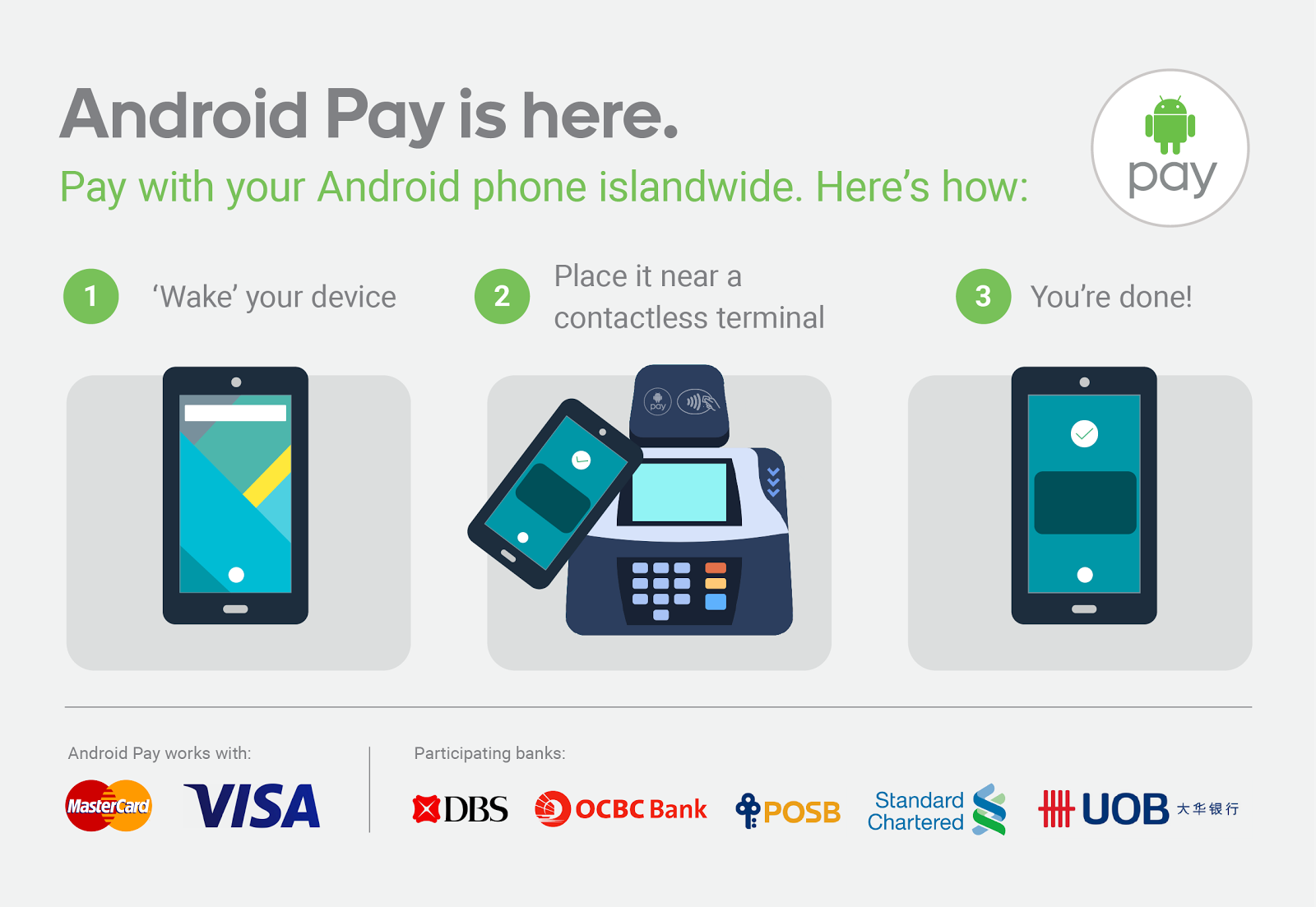

Android Pay, which launches today, allows Singaporean customers to load Visa and Mastercard credit and debit cards from six major banks in the city state to use at contactless payment terminals. Participating banks include DBS Bank, OCBC Bank, POSB, Standard Chartered Bank, and UOB.

Forbes reports that Google’s senior director of product management, Pali Bhat, said the company chose Singapore as Android Pay’s third market because of its high smartphone penetration rates and well-oiled retail sector.

Google may well have the upper hand here, considering Android phones account for about 60 percent of smartphones shipped to Singapore, according to Tech in Asia.

Users need to have an Android smartphone running on version 4.4 KitKat at least, with near field communications (NFC) capabilities.

SEE ALSO: Android Pay to tap into Singapore and Australian markets this year (VIDEO)

Users will also need to download the Android Pay app from the Google Play store, load their credit and debit card information, and then choose a default card and confirm payment settings.

The service also stores gift cards, loyalty cards, and special offers, eliminating the need to carry around extra bulk in one’s purse or wallet.

Pic: Google Singapore

Google has also solved the problem of having two payment systems on one phone, which is likely to happen if you have a Samsung phone that runs on Android. Users will be able to choose a default platform so that only one contactless system is activated when placed near a payment terminal.

The competition may prove to be a battle of capabilities. According to Channel News Asia, Forrester researcher Ng Zhi Ying said consumers who own NFC-enabled Android phones can adopt mobile payments, while Samsung Pay can only be used by “consumers who own the more recent Samsung models”.

Android Pay is also expected to be made available in Australia later this year, with Bhat telling media members on Monday that the company is still working with partners there.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach