Jia speaks during an unveiling event for the Faraday Future FF 91 electric car in Las Vegas, Nevada. Source: Reuters

LeEco’s ‘American dream’ gets derailed amid persistent financial problems

LEECO’s outlook has gone from unfortunate to bleak with a series of hard knocks being dropped on their doorstep in the last couple of weeks since news its acquisition of Vizio hit the rocks in late March.

Leshi Internet & Televion Corp. – LeEco’s Internet TV subsidiary and one of their biggest money makers – might be coming under fire. The company announced they would stop trading their stocks on the Shenzhen Exchange in light of a meeting its holding company will be having to review its plans for restructuring the business.

Despite an initial jump in their market price back at the end of March, it’s unclear exactly what the impact on Leshi will be.

SCOOP: Chinese tech giant LeEco misses sales forecast by seven-fold, plans layoff of U.S. workforce https://t.co/trSZX2Pt91

— Selina Wang (@Selina_y_wang) April 10, 2017

Investors seemed to be mostly assured the company had things relatively under control, but the chaos in LeEco’s management and finances might cause the company some serious problems. Since March 31, Leshi’s share price fell almost 10 percent from US$33.92, and the halt in trading has prevented it from falling further.

Leshi’s move comes amid news LeEco’s various ventures in the US have come to a screeching halt. Last week, LeEco announced it would be terminating its US$2 billion offer to purchase Vizio, a prince among American television makers, citing untenable “regulatory headwinds”. The death of the potential partnership is a huge blow to the Internet media company, which sought to find a foothold in the US, compounded by the absolute flop of The Great Wall among American moviegoers, a US$150 million venture it had helped to bankroll.

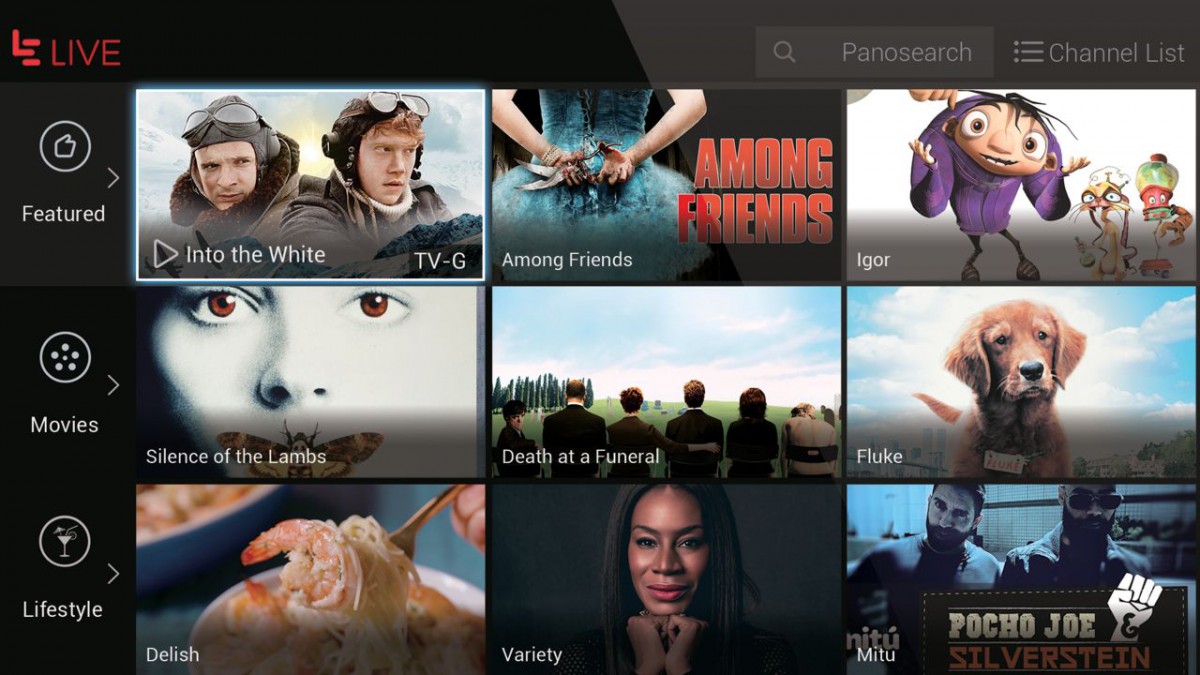

The company also announced last week it had terminated its EcoPass package at the beginning of April. EcoPass represented a Westernized version of the service that helped the company make its name in China. The service failed to catch on, seeing as how it faced stiff competition from other players in the SVOD market, such as Amazon and Netflix. According to Tech Crunch, however, the company is not willing to admit defeat, as it continued to tout the value add of EcoPass.

LeEco has pulled its EcoPass SVOD offering from the US due to low subscriber numbers. Source: LeEco

Other scandals that have rained down on LeEco include the departure of their head of corporate finance, Winston Cheng, and last week’s revelations the company would miss its US revenue goal of US$100 million by a wide margin – they only managed US$15 million in the brief period since its debut in October.

The death of LeEco’s “American Dream” is a by-product of the company’s continued financial problems. Last year, CEO and founder Jia Yueting admitted the company was facing serious liquidity issues because it had invested heavily and irresponsibly across its businesses.

Rumours the company was letting go of large chunks of its American staff was quickly followed on by confirmations the company’s San Jose headquarters had been sold off to Chinese Han’s Group, as reported by the Silicon Valley Business Journal.

If the company fails to course-correct soon, the narrative of LeEco’s journey will be that of a company that ran before it could walk, chasing dreams of achieving Tesla-level fame with little of its careful planning and groundbreaking innovations. Last year alone, LeEco splashed out large sums in debt to acquire stakes in Chinese electronics companies Coolpad Group and TCL Multimedia as well as a wholesale buyout of ride-sharing startup, Yidao Yongche.

LeEco’s predicament is a clear example of reckless Chinese spending that has come to characterize the country’s tech world. When in doubt, Chinese companies tend to throw lots of money at a problem to acquire companies to line their portfolios rather than sinking it into producing their own technology. This seems to be case with LeEco, and it seemed to have resulted in the company’s inability to fulfill existing supplier debts and the shuttering of its various US-based ventures. For example, the company’s driverless cars venture with Faraday Futures has run straight into a wall as it has emerged many suppliers are haranguing LeEco to fulfill their debt obligations.

SEE ALSO: Can LeEco outrun cash problems to achieve its Tesla-sized dreams?

Jia’s ambitions for the company are well-known. It has been remarked he aspires to a standard of startup cool that has been popularized by Silicon Valley’s tech icons – he has appeared at launch events in black hoodies and jeans favored by many in the industry. However, his dreams might have outrun themselves, but to a wider point, they are proof of an aspirational culture rather than substantive business plans.

Should the company fail to sort out a restructuring of its business that can pull it back from the brink, the company’s largely irresponsible jaunt across the US could impact LeEco’s bottom lines in China and hurt them where it counts.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications