Investment research hasn’t experience the disruption that other industries have. Source: Shutterstock

Smartkarma is reinventing how investment research gets made and consumed

INVESTMENT research is an industry that hasn’t seen much technological disruption in the ways it’s created, distributed and consumed, but in today’s global economy investors need better, on-the-ground information more than ever before if they’re going to make the right decisions.

Traditionally, the investment research space is one that is centered around what researcher and entrepreneur Jon Foster calls the “push” — teams of analysts produce and package information on a clutch of companies which their houses may or may not have corporate relationships with. Those documents are slapped into an email, and thrown out into the world with little care as to whether or not such information sticks.

“There is no feedback. Are they providing something that consumers actually want? What are [researchers] doing to ensure that consumers have access to content they really want?” Foster said to Tech Wire Asia during a phone conversation.

Foster, together with Raghav Kapoor and Lee Mitchell, founded a B2B platform – Smartkarma – that is looking to totally reinvent the way the marketplace thinks about and interacts with investment research. The three men all have backgrounds in the investment research space, while Kapoor brought in additional experience as a technologist. Fosters said that when they looked at the market, they saw one that was no longer efficiently meeting what consumers actually wanted.

“The whole industry needed a rethink,” he said. “We were responding to some structural problems within [the investment research] industry where the needs of the customer were not being met.”

(From left) Kapoor, Foster and Mitchell. Source: Smartkarma

Smartkarma leverages on technology tools such as artificial intelligence, data analytics and connective networks in order to bring the research industry screeching into the future for banks, hedge funds, asset managers, and stock brokers. The company’s platform is looking to reinvent the way people interact with investment research, and their platform could set a trend, especially in Europe.

A new regulation in the European Union called MiFID II is set to fundamentally change how fund managers and stock brokers charge and pay for investment research. The new laws coming into place, Foster said, will “unbundle” research from other services offered by financial services companies in order to make way for more transparency.

“For research now, external research has to be separately priced,” he explained. “Do you pay for external research to enhance what we’re doing internally, or do we pay to build up our own team of analysts internally?”

Smartkarma will play a part in the future of investment post-MiFID as they offer a cheaper alternative to building up an in-house research team, while also being able to offer in-depth research from all across Asia.

“Outside the very largest asset managers in the world, it makes no sense trying to do all of this in-house,” he said.

“You can imagine the complexity of trying to cover thousands of companies across all of Asia — from Japan, to Asean, Australia and New Zealand, Hong Kong and China. To have an expert on China and an expert on Japan are two totally different things, and you’re going to have to have people who are very much on the ground.”

Foster, throughout the interview, referenced many of today’s technological innovations from Spotify, LinkedIn and Facebook which all served as inspirations and templates for their own platform. His platform seeks to be as disruptive, by bringing down costs, and reducing the complexity of managing a huge team through the power of technology.

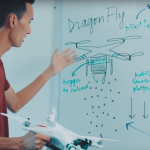

Smartkarma’s platform brings investors and researchers onto a singular platform. Source: Smartkarma

He said that today’s information landscape is much more “dynamic” than it was 20 years ago. Through social media, information can be quickly disseminated, engaged with and accessed in ways that helps individuals build up their communities and resources.

“It’s a much more dynamic place to be, you can even stream content on LinkedIn for example,” he said.

“You’re doing it from a group of people that you’ve selected for a specific type of interest, you interact with it with comments, discussions. There was no marketplace like that at all, it was just people pushing something out in the hope that someone might want to read it.”

The platform is also looking to fix the fragmented research marketplace, where many different players are producing similar products. Foster said that this isn’t an efficient use of time by either the writers or consumers of such content.

“If people are looking to replicate standard processes a hundred times over, you don’t have an efficient marketplace or industry,” he said.

Smartkarma circumvents the inefficiency question by engaging contributors from all over the world, both freelance and not, to source research from all over the world. The company provides the tools for these researchers to create and publish their work, but their business model allows for a wide breadth of information genres. Rather relying on a clutch of researchers who can access a small base of corporations, Smartkarma’s model allows for a wide variety of products.

“I think there is a huge difference [between what you get in house and outside]. At the end of the day, you often go external as an enhancement to what you’re doing internally,” Foster explained.

Investment research has traditionally been a lopsided industry. Source: Smartkarma

“We don’t consider ourselves a replacement, we consider ourselves as a key tool. This is where in-house researchers and portfolio managers come to discover new ideas, information or challenging information, background and context that might be outside their areas of expertise.”

Central to Smartkarma’s focus is the effort to make the platform as personal as possible for their clients in the investment space. According to Foster, there are three ways in which Smartkarma creates a personalized experience for their clients: manual selection, machine learning algorithms that aid discovery, and curated themes.

Clients can input the types of information they’re interested in — whether it’s certain geographies or industries — which can be used by the in-built machine learning processes. Smartkarma will “learn” what investors are regularly looking for in order to feed them as much information. The company also has a team of content specialists who will curate feeds or streams into broad thematic sweeps “where work is broadly contextualized around helping people around a particular problem.”

“It’s a combination of people overtly selecting [topics], our algorithms, and the way in which our suppliers work with each other, that creates all those links that can create something relevant,” he said.

“For consumers, we want to make sure it’s a place that is very unique and personal to them, and help them find what’s most relevant for them.”

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach