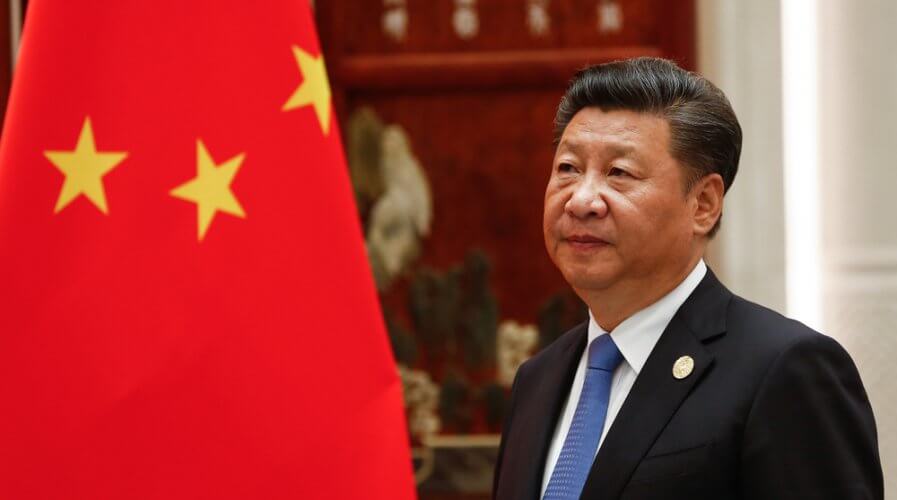

China’s Xi Jinping seeks to make the country a pioneer in the blockchain and digital currency space. Source: Shutterstock

If anyone can successfully launch a digital currency, at scale, it is China

XI JINPING has been quite vocal of his support for blockchain technology in recent times. In fact, the Chinese President has big plans to lead the world in the blockchain space — especially with the digital currency (RMB) project.

While the country has been looking into the possibility of issuing its own digital currency for almost five years, concrete steps, including the establishment of the People Bank of China’s Monetary and Digital Institute, have helped bolster efforts and accelerate the movement.

Since August last year, the country’s ambitions in the digital currency space are being promoted by officers of its central bank on various public platforms, including WeChat.

Truth be told, interest in central bank-backed digital currencies has grown significantly over the past six months, for various reasons, including Facebook’s announcement of the Libra project. And China has always been at the forefront.

“If anyone can successfully launch a digital currency, at scale, it is China,” IDC Senior Research Manager Michael Yeo told Tech Wire Asia.

“We haven’t seen any implementation of a digital currency at this scale anywhere else. Some of the functionalities such as offline payments that don’t require bank accounts are really something very new to the market and there will be huge interest from other markets to see how this pans out.”

Yeo is excited about China’s digital currency, and reasonably so, given the progress that has already been made. Although there is no set timetable or schedule for the launch, studies and trials are being carried out by the major banks and other key stakeholders in the financial markets, and public trials are expected soon.

According to Yeo, the reason that China is in a great position to take on such a project is because of the strong influence it has over the market at home, including in the technology space.

From IDC’s perspective, definite practical uses of the digital currency exist, and if executed well, it could create exciting opportunities, not just for big players involved in rolling-out the digital currency, but also for everyday businesses and individuals.

Yeo, who generally finds it easy to make forecasts despite uncertainties, believes that stakeholders, especially those outside the country, will need to wait and watch for the details and specifications of China’s digital currency when they’re made clear before making any plans for its adoption.

“We don’t know whether it is backed by gold, by state guarantee, or even if it will be pegged to the analog currency or to maybe a foreign currency such as the US dollar. We don’t know if its value will be consumer-driven or institution-driven. It’s a great project, but there are a lot of unknowns right now.”

Truth be told, the country and its people, with their lightning-fast adoption of cutting-edge technologies such as artificial intelligence (AI), the internet of things (IoT), and 5G, offer a degree of confidence to analysts and experts when it comes to forecasting that the digital currency project, ultimately, will be a huge success.

China’s digital currency will have a definite impact overseas

There’s no denying the fact that China’s financial system is archaic to a certain degree — especially when it comes to the payments coming into or going out of the country.

In fact, foreign institutions sending money into China often face delays in the clearance of funds and other challenges.

According to Yeo, that’s not a problem for China, it’s the way that their financial system was designed. If they wanted to improve it, they’d do it in a jiffy. However, there are other forces at play, such as economic plans and monetary policies, which keep things from changing.

Hence, China’s digital currency could serve as a sort of middle ground. Especially when it comes to cross-border transactions.

“There are significant potential benefits for institutions both in and outside of China to leverage the digital yuan for both cash replacement and for cross border currencies – reducing the manpower and time required for such transactions and saving billions of dollars globally – if their political and economic need aligns with China’s vision.”

Yeo, however, believes that the cross-border uses of the digital currency will be as much a political soft power tool as an economic hard power tool and will bear the potential to reshape the infrastructure of countries that interact and do business with China.

Betraying his nature as an analyst, if Yeo had to speculate, he believes that the digital currency can amplify its global impact significantly if it was coupled with China’s belt and road initiative.

“If China made the digital currency the official currency for the initiative, maybe offered project (infrastructure) financing in its digital currency, or did something on these lines at all — it could catapult the digital currency into the spotlight. Instantaneously, internationally.”

Ultimately, Yeo is confident that China will definitely do well with its digital currency, and expects public trials to be announced in pockets and phases in the coming months. “Whenever it arrives, everyone will pay close attention.”

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach