Singapore’s fighting financial crimes through a centralized digital platform with analytics

A new digital platform and regulatory framework for financial institutions are in the pipeline to tackle a variety of financial criminal activities in Singapore.

The Monetary Authority of Singapore (MAS) announced last Friday that it will introduce these so institutions are able to share relevant information on customers and transactions with each other.

The areas MAS are looking to address include the prevention of money laundering (ML), terrorism financing (TF), and proliferation financing (PF).

Enhancing inter-jurisdiction comms

A common challenge that FIs in most jurisdictions face is that they are unable to warn one another about unusual activity in customers’ accounts.

This gap is frequently exploited by financial criminals to make illicit transactions through a web of entities with accounts in different FIs, such that each FI on its own does not have sufficient information to detect these transactions in a timely manner.

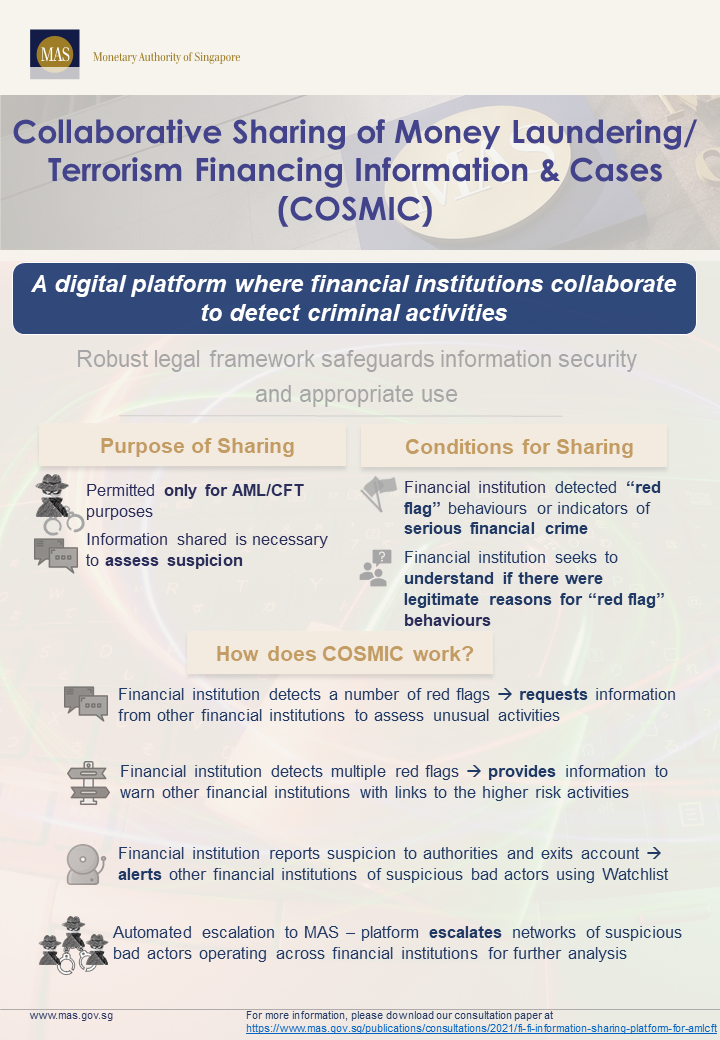

The new digital platform, named COSMIC, for “Collaborative Sharing of ML/TF Information & Cases”, will enable FIs to securely share information on customers or transactions, where they cross material risk thresholds. Such information sharing will help FIs identify and disrupt illicit networks, thus helping to safeguard the Singapore financial center.

A digital platform borne through collaboration

The COSMIC platform is co-created by MAS and six major commercial banks in Singapore, namely, DBS, OCBC, UOB, SCB, Citibank, and HSBC.

It will have strong security features to prevent unauthorized access to information and will be operated by MAS.

MAS will provide in legislation that this information sharing by FIs is permitted only for the purpose of combating ML, TF, and PF.

MAS will also require all COSMIC participants to implement robust measures to safeguard against unauthorized use and disclosure of COSMIC information. MAS will supervise FIs for compliance with these requirements and take action against errant FIs.

Centralization and data analytics features

While some other countries have introduced arrangements for information sharing among FIs, the COSMIC platform will be the first centralized platform where information is shared in a structured format that allows for seamless integration with data analytics tools.

This will help FIs collaborate productively and at scale. COSMIC’s regulatory framework will also be unique in clearly specifying the types of information to be shared, and the circumstances under which information sharing will be permitted or mandated. MAS will use the information from COSMIC in its risk surveillance to detect illicit networks operating in the financial system and to target these activities for timely supervisory intervention.

MAS plans to launch the COSMIC platform in the first half of 2023. COSMIC will initially focus on three key financial crime risks in commercial banking, namely, abuse of shell companies, misuse of trade finance for illicit purposes, and proliferation financing (PF).

The six banks involved in COSMIC’s development, which are leading players in commercial banking, will participate and be permitted to share information in COSMIC during this initial phase. MAS plans to progressively extend COSMIC’s coverage to more FIs and focus areas and make some aspects of sharing mandatory.

Loo Siew Yee, Assistant Managing Director (Policy, Payments & Financial Crime), said “COSMIC will significantly enhance our financial institutions’ ability to detect and curb suspicious activity while minimizing the impact on legitimate actors.

“The information-sharing framework is designed to target serious criminal behaviors and allow FIs to more quickly detect the bad actors to purge and deter them. It will strengthen Singapore’s position as a trusted financial center and place to do business, where FIs can better serve the vast majority of legitimate customers.”

MAS seeks feedback on the proposed legislative framework for COSMIC, as well as the platform’s features.

MAS invites interested parties to submit their comments on the proposals and legislative amendments by 1 November 2021.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach