From left to right: Daniel Cheong, Head of Consumer Banking, CIMB Bank; Tee Chui Chee, General Manager – PB Card Services & Support, Public Bank; Hanif Yaakob, Director of Business Development, Mastercard Malaysia; Nick Drew, Head of Finance and Travel, Google Malaysia; Ong Shi Jie, Head of Payments, Hong Leong Bank; Clarice Yao, Head of Business Development, Visa Malaysia; and, Mohamed Galal, Deputy CTO, AirAsia (Source – Google)

Three reasons why Google Wallet will be a game changer in Malaysia

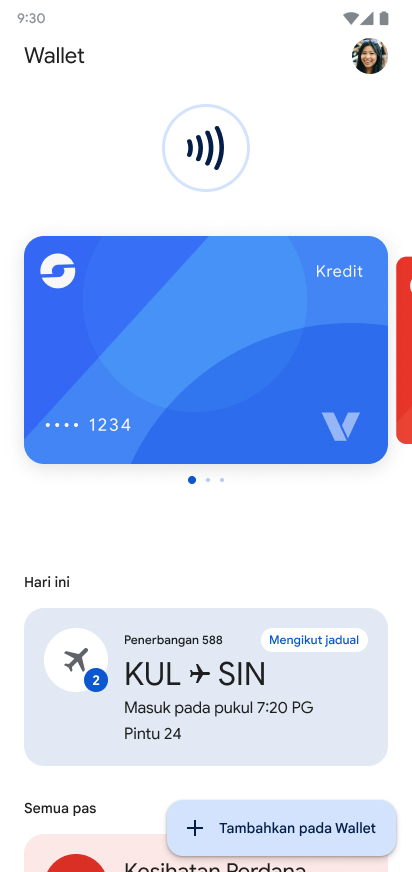

- Accessing necessities from Android and Wear OS devices, such as credit cards and boarding permits, is safer, easier, and more convenient with Google Wallet

- Google Wallet users can now upload AirAsia boarding passes, and Malaysia Airlines will follow soon

The use of mobile wallets, in particular, has grown significantly due to attractive incentives like cashback offers, discounts, and loyalty points, to name a few. The situation has been improved by the expanding use of cashless and contactless payment methods. Malaysia is just one of several nations worldwide that has seen a significant increase in the use of e-wallets for purchasing products and services.

With Google Wallet making its debut in Malaysia, Tech Wire Asia highlights three reasons why this e-wallet might just be a gamechanger for the crowded e-wallet market in the country. They include:

- One tap for all – As Google Wallet can be connected to Android and Wear OS devices unlike most e-wallets, users can easily tap their devices for payment and even airline boarding passes.

- Enhanced security features – Google Wallet’s privacy and security features include industry-standard tokenization, providing consumers access to all the security features of their Android phones.

- Simplicity to use – Users with cards connected to their Google accounts just need to link them and they cause their wallets already.

The state of e-wallets in Malaysia

E-wallets are widely used nationwide, and if you visit any Malaysian mall, you’ll almost certainly find them at every store. Most people use them to pay for their purchases, so it’s clear they’re here to stay.

53 e-wallets are already available in Malaysia and the sector takes up 19% of the nation’s fintech landscape. Such e-wallets include GrabPay, Touch’ n Go eWallet, MAE, BigPay, etc. are among them. According to an Ipsos study, among these e-wallets, Touch’ n Go eWallet is said to be the most popular in Malaysia. Google Wallet will be the 54th e-wallet in the country.

With the use of digital items like boarding passes, Google Wallet offers customers a safer, easier, and more beneficial payment experience. Digital payments are on the rise and are anticipated to reach over $200 billion in gross transaction value in Malaysia by 2025.

“With millions of Malaysians now using their phones everyday to make payment, Google is excited to bring Google Wallet to Malaysia,” said Marc Woo, Managing Director of Google Malaysia. “With Google Wallet, Malaysians can tap to pay in stores or checkout seamlessly online. They can also easily access their boarding passes when they jet off for their year-end holidays. Google Wallet helps keep everything protected in one place, no matter where you go.”

Screenshot of Google Wallet (Source – Google)

How to use Google Wallet?

You only need to set up your eligible credit or debit card for contactless payments by following the instructions if you already have one saved to your Google account. If you don’t already have one saved, the issuer terms and conditions must be read and accepted before usage if you want to add a new card to Wallet. To do this, touch “Add a card” in the carousel at the top of the screen. Cards will be tokenized and available in Google Wallet as soon as you accept and verify your card details.

Furthermore, Google places security as a top priority. When using Google Wallet, purchases are performed using a different card number (a token), which is device-specific and linked to a dynamic security code that is altered with each transaction.

Before a user can add a card to their phone, banks will also require the cardholder’s identification, so they can activate a screen lock to prevent unauthorized access to their device’s contents. Suppose their phone is ever stolen or lost; in that case, they can efficiently use the “Find My Device” tool to remotely lock it, create a new password, or even completely delete all of their personal data and credit card information from it.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach