The balancing act: Identity verification in an evolving fraud landscape

As the potential for an economic downturn increases, a heightened focus on identity verification is becoming crucial due to the escalating risk of fraud. Whether the expected economic slowdown materializes globally, 2023 and the years beyond are set to present serious challenges for businesses worldwide.

Constant regulatory shifts, rising inflation, disruptions in emerging technologies, and a recent Juniper Research study projecting cumulative merchant losses to online payment fraud exceeding US$343 billion between 2023 and 2027 all emphasize the need for business leaders to remain vigilant in the coming years.

Identity verification in an evolving fraud landscape

Organizations across all sectors must pinpoint and counter new threats like money laundering, account takeovers, and identity theft. With an intricate, diverse, and ever-changing threat landscape, businesses will likely seek collaboration with identity verification companies capable of addressing the broadest possible array of fraud risks.

Recent reports indicate a growing trend of digital fraud attacks worldwide, mainly through mobile channels. Global attack volumes on mobile experienced a 94% increase year-on-year, rising from 260 million to 505 million compared to the same period in the previous year.

In light of the recent surge in fraud and scam incidents, Tech Wire Asia had the chance to discuss the increasingly prevalent types of scams and emerging technologies for fraud mitigation with Vyacheslav Zholudev, CTO at Sumsub, who provided insights on enhancing the verification process.

Balancing user experience, compliance and fraud prevention

Businesses in the verification field grapple with a range of intricate issues that extend beyond mere operational concerns. Zholudev revealed that one common issue in the verification process is the reliance on external databases, which don’t have complete coverage and aren’t accessible in every country. Companies must find creative ways to onboard users and efficiently combat fraud. According to Zholudev, “it’s about solving an equation with three variables: user experience, compliance, and fraud prevention.” One of the key challenges that companies face is maintaining high pass rates while staying secure from fraud and compliant with regulations. Failure to strike the right balance could result in fines and even revocation of licenses for operation. This necessitates continuous improvement and the development of innovative solutions.

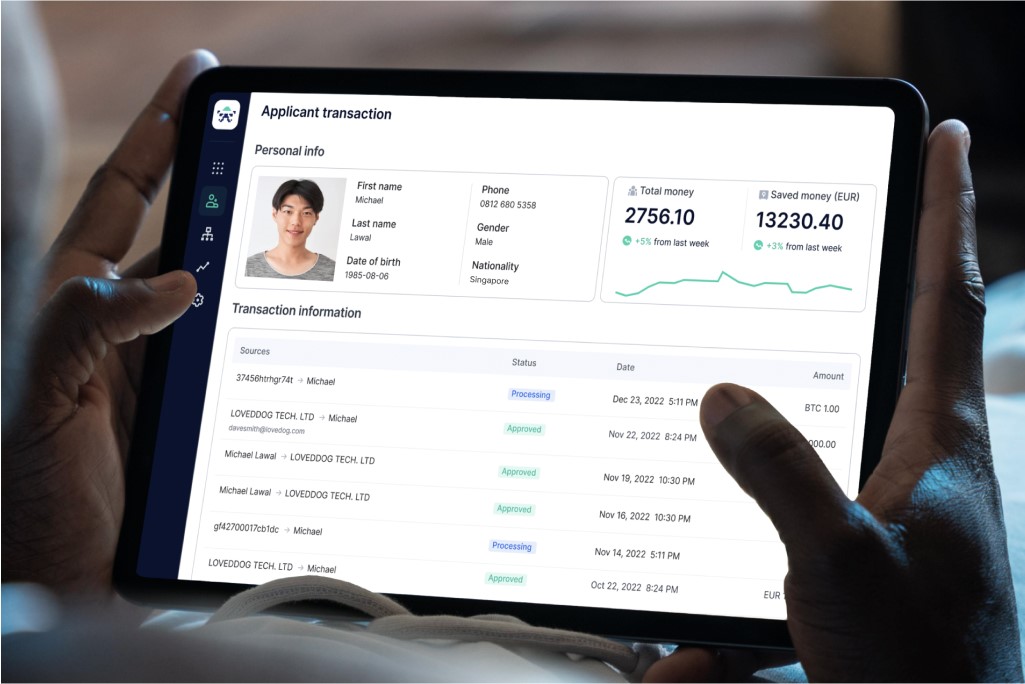

The importance of ongoing monitoring and transaction analysis

Source: Sumsub

Zholudev emphasized the crucial role of ongoing monitoring in the identity verification process. He pointed out that companies must account for the entire lifecycle of a user, acknowledging that fraudulent activity can often surface after the initial onboarding phase. This is backed by Sumsub’s internal data, which reveals that 70% of fraud activity happens past the KYC stage. Zholudev notes, “While KYC is crucial during onboarding, monitoring user behavior and transactions throughout their time on the platform is equally essential for identifying and preventing subsequent fraudulent activities.”

Transaction monitoring holds particular significance for the Asian market, a dynamic region characterized by its booming fintech, cryptocurrency, and superapp industries. Here, businesses must remain particularly vigilant against money laundering and other forms of financial fraud, given the region’s stringent regulations. For instance, in Singapore, the Monetary Authority of Singapore (MAS) has introduced robust Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) regulations that demand strict adherence from businesses.

Advanced AI-driven systems play an instrumental role in this landscape, analyzing and cross-referencing vast volumes of data to detect suspicious behavior and preventing financial crimes. One example of AI in the arena is Sumsub’s Travel Rule solution for the cryptocurrency industry. This solution helps businesses meet regulatory requirements by identifying and reporting suspicious transactions.

Emphasizing transaction monitoring enables businesses not only to secure their operations but also to protect their customers from fraud, fostering trust and promoting growth in growing industries.

Zholudev highlighted the importance of network analysis and anomaly detection in addressing fraud, an area where AI’s ability to ingest at scale yields good results. “We are noticing more organized networks where people use the same wall or table to take selfies and photos of documents in the same location. To address this, it’s crucial to pay more attention to network analysis and anomaly detection, such as identifying shared IP [addresses], device fingerprints, or even the same backgrounds.”

The growing challenge of deepfakes and AI-generated fraud

Deepfakes have become sophisticated, leading to a constant cat-and-mouse game between technology and fraudsters. Deepfakes in Asia have been utilized for political motives, with a notable example occurring during the 2020 Legislative Assembly elections in India. Altered videos of BJP President Manoj Tiwari reached around 15 million people through 5,700 WhatsApp groups in Delhi and surrounding areas.

Zholudev highlighted the challenges posed by more sophisticated deepfakes. “Previously, users would submit a passport and a selfie with their document, but these images were often leaked on the dark web, making it easier for malicious individuals to pass verification,” he said.

In response, liveness checks were introduced to ensure that a real person was sitting in front of the camera. However, AI-generated faces and face-swapping videos have emerged as new challenges. AI-driven face search, document or face ‘fingerprinting,’ and monitoring user behavior throughout their time on a platform, are crucial in identifying and preventing fraudulent activities.

Zholudev mentioned the challenges arising from the need for better public education on the risks of sharing personal information like passport details with strangers. He also emphasized that deepfakes and convincing counterfeit documents are significant concerns. Stricter regulations require cross-checking with databases, making generative models a considerable obstacle in combating fraud.

To address these challenges, businesses must use technology with caution to avoid adding noise to data or producing false positives. This careful approach is essential for overcoming the difficulties posed by generative models and mitigating the risks associated with social engineering and money mules.

Adapting to the future of identity verification and fraud mitigation

Source: Sumsub

In the changing landscape of identity verification and fraud mitigation, agility, adaptability, and vigilance are the watchwords. Businesses must respond to new challenges and embrace technological innovations. Aligning with forward-thinking identity verification companies, such as Sumsub, becomes a strategic imperative for organizations seeking to secure their operations in a digital world.

Sumsub excels at handling local documents and is well-versed in the nuances of different countries. In regions like India or Indonesia, which are embracing key digitalization trends, the verification process can be further simplified with a 1-click or document-free solution. The 1-click verification is remarkably user-friendly, requiring only the entry of a document number, rather than any document images. This method significantly reduces the number of steps and overall verification time, taking just 4.5 seconds compared to a standard 50-second KYC flow.

Highlighting the evolving nature of the verification industry, Zholudev noted, “The future of verification lies in providers that can guarantee oversight of the entire user journey, including transaction monitoring and KYC/KYB checks, within a single platform. This approach cuts costs for clients while keeping them 100% compliant and secure from fraud.” This statement underscores the importance of a balanced approach to managing user experience, compliance, and fraud prevention.

By leveraging innovative technologies like the 1-click verification and maintaining a strong focus on continuous improvement, businesses can ensure that they are well-equipped to address the challenges of today’s complex fraud landscape. Click here to try Sumsub, a comprehensive solution that meets organizations’ evolving needs.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach